The Bank of Canada announced a full 1% increase in the overnight lending rate on July 13th, 2022. This brought the policy rate up from 1.5% to 2.5% in just one day. While we were expecting a rate increase, a full 1% was a bit of a shock. A hike of this magnitude has not been seen since 1998.

The Governor of the BOC said he expects the overnight rate to hit 3% or slightly higher before the end of the year, leaving room for another 0.5% rate increase. The next time the BOC meets will be in September.

Who Does This Impact?

I want to go back and really talk about who this increase is affecting because this can be scary news to hear, especially for someone who has recently bough in the last 2 years when rates were a lot lower and price points higher.

Full disclosure, I am NOT a Mortgage Broker and advise you consult with your mortgage broker prior to making any assumptions or changes, however, this is a mini-break down from your favourite Realtor:

Does not Impact: People who were pre-approved with a fixed rate and secured a rate hold. Most rate holds are 90 days long, meaning a buyer would have to complete on a purchase within 90 days, not just remove conditions.

People who are currently in a fixed rate term.

Does Impact: People who are in an adjustable variable rate: your mortgage floats, or adjusts with the prime rate.

People who are in a static variable rate. The amount you pay per month doesn’t change, but the amount you pay to interest or principal each month does change. For example when rates go up, more of the monthly payment goes towards interest. When rates go down, more goes towards principal.

What is the Math on a 1% Increase?

This works out to roughly a $52 increase per every $100,000 borrowed on your mortgage. So, on a $500,000 mortgage, you can expect to pay an additional $260/ month (assuming you have an adjusted variable rate).

Overall, rates are still considerably low when looking at history. However, to have that 1% change happen all within a day is pretty big. I think in the short term this will hurt, but long-term it’s likely needed. The BOC waited too long to do anything and then raised things too fast causing some fear in the market.

History of the Bank of Canada Interest Rate:

My Thoughts

Prices will go down over the next few months. Purchasing power has been taken away and people who are purchasing now are pre-approved for less.

The Big Question: Does this Make Housing More Affordable?

Yes, prices are going down now, but are homes becoming more affordable?Housing prices have declined, but monthly payments are becoming higher. We are still not building enough homes for the demand we have. Immigration is not slowing down. The alternative of renting is not very attractive at the moment either because rents are at an all time high. Vancouver is officially the most expensive Canadian city to rent in.

Enough Negativity, There is Some Opportunity in all of This

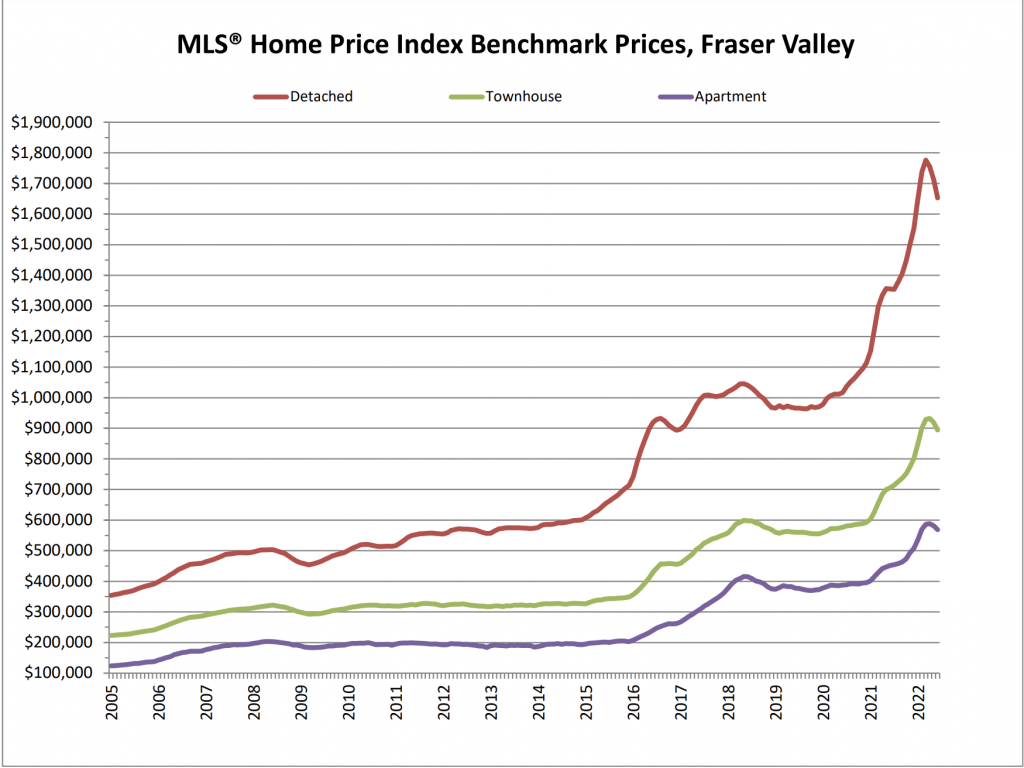

For people who want to upsize from a condo to a townhome or a townhome to a detached home, there is opportunity. We saw a lot of inflated sale prices over the last couple of years and in a transitional market like the one we are in, detached prices are affected the most, followed by townhomes & finally condos are affected at the smallest scale.

So, for an upsizer, you are selling something that percentage wise did not drop as much as the larger asset class you would be purchasing into.

Market Snapshot

For the 3rd strait consecutive month, we saw both the number of sales and sale price points decline across the valley. The number of sales for all asset classes across the FVREB is down 5.8% in one month. The number of sales are down 43% from year over year. To put that into context, this is the lowest sales volume for the month of June in over 20 years.

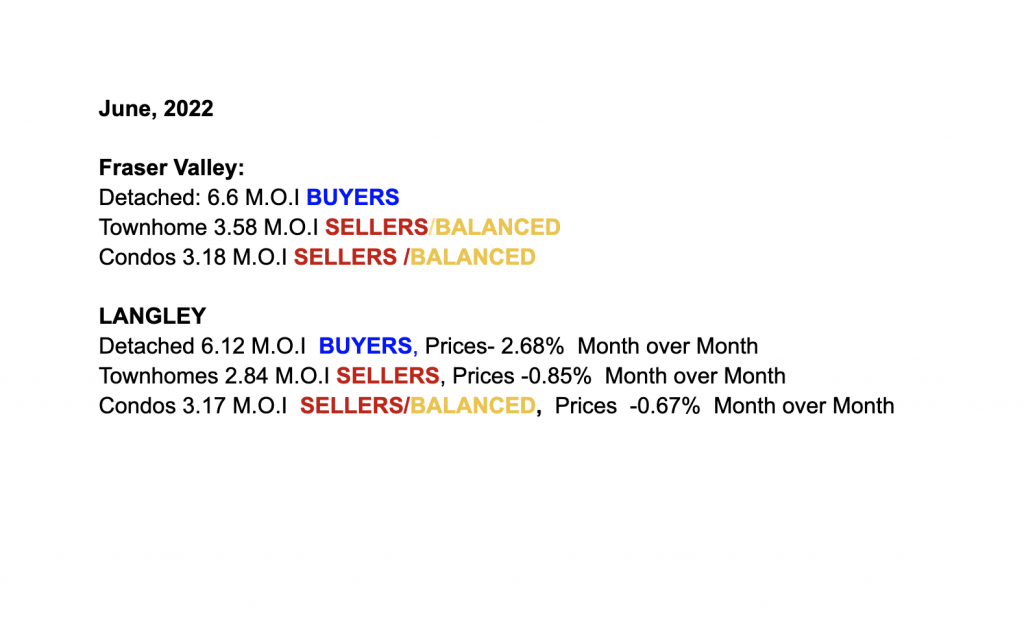

Months of Inventory (M.O.I) for the Fraser Valley & Langley area:

We have shifted from a strong sellers market into more of a balanced – and in some cases a buyers – market. This has all happened in a short period of time. I expect months of inventory to continue to rise for the next several months.

Remember, really think about the reason you are buying or selling. If you plan to be living in the home you are planning to purchase for 3+ years, looking at history, you should be fine. If you are looking for a quick flip or more of a short term investment, I would caution you at this time.