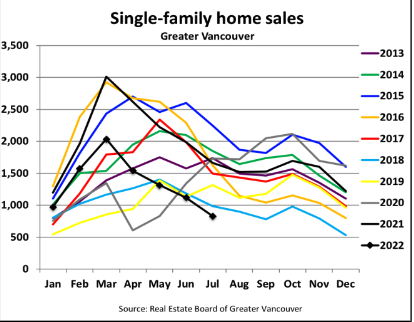

Sales in Vancouver for the month of July have not been this low since the 1990’s.

Inflation & real estate prices have spiked, and now the Bank of Canada (BOC) is trying to halt the inflation they created; which, you guessed it, has caused real estate sales and sale prices to decline over the past several months.

Housing markets across Canada are now retuning to a Balanced, and in some cases, a Buyers market. Although this has been the case since March, 2022 and it isn’t new news; I wanted to show you just how much real estate sales and sale prices have changed when comparing the peak of the market to today.

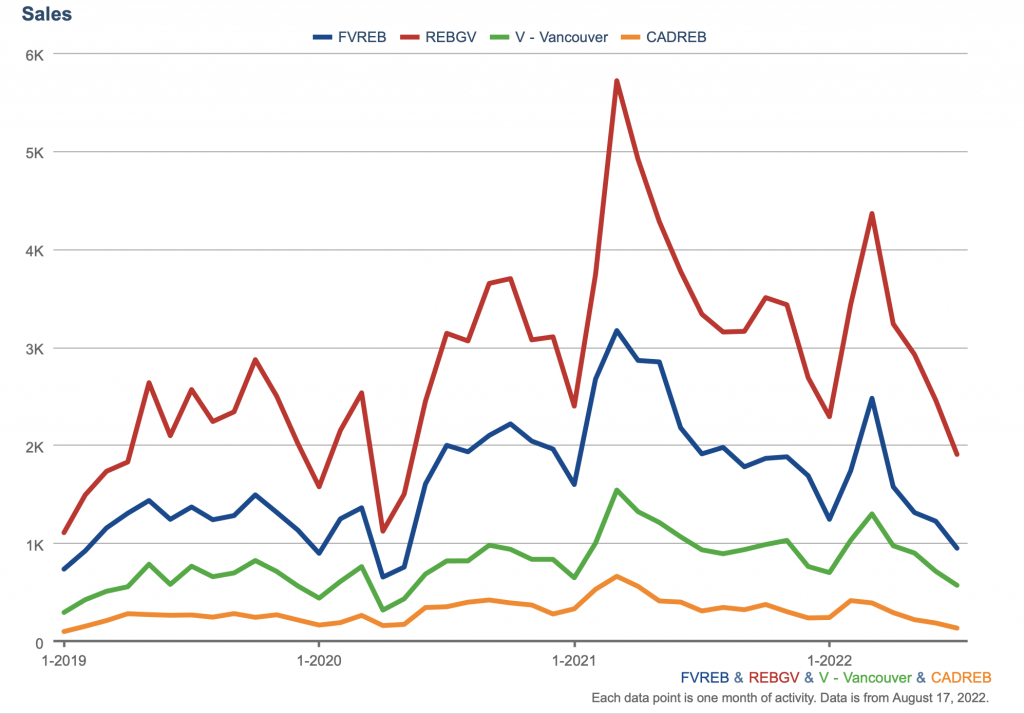

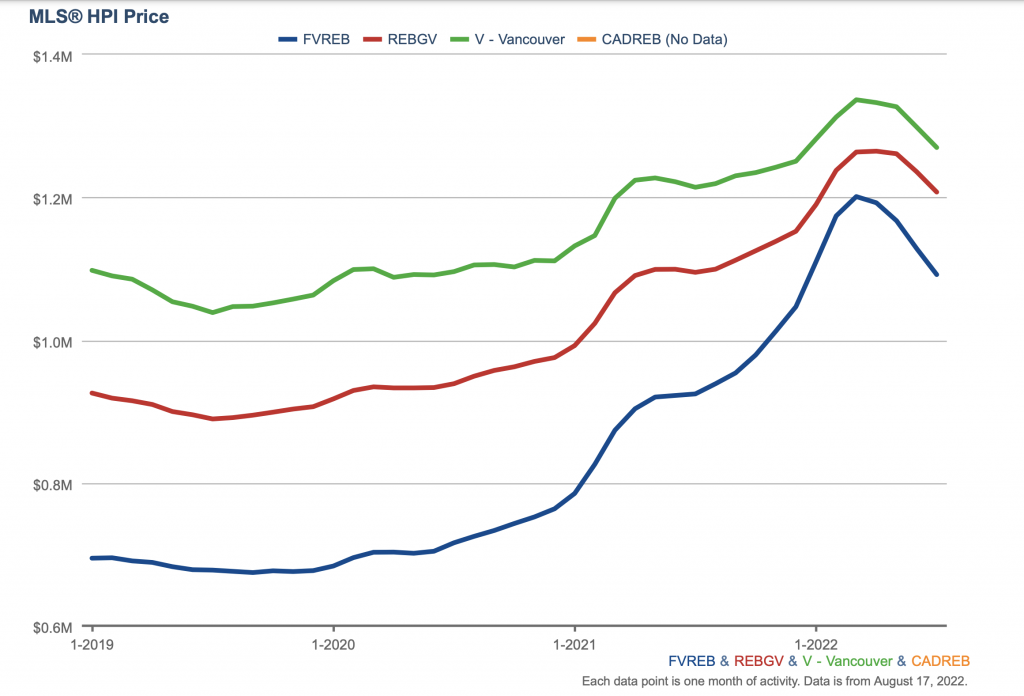

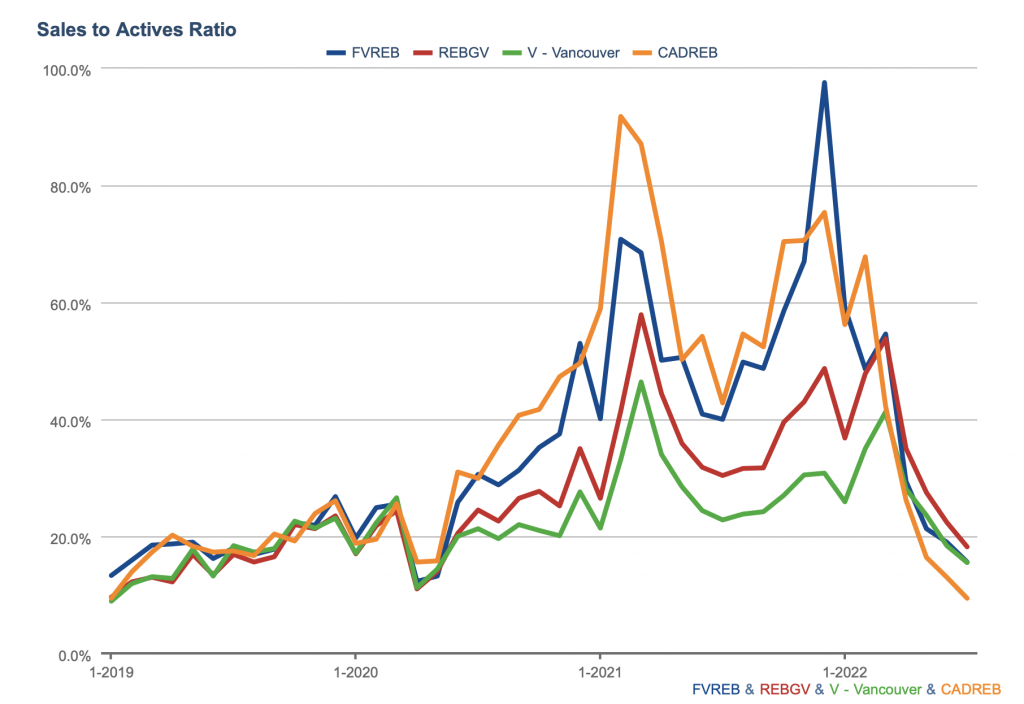

Fraser Valley Board: BLUE Greater Vancouver Board: RED Vancouver Board: GREEN Chilliwack Board: ORANGE

Sales, All Property Types:

Benchmark Pricing, All Property Types:

Sales to Actives Ratio:

If you have been following my updates, you have heard me talk about Months of Inventory (MOI). This is a way to measure absorption rate and also determine which type of a market we are in (Balanced, Buyers or a Sellers market). Sales-to-Actives Ratio is another way to measure this.

The graph below outlines which type of market we are in. Currently, all Real Estate Boards are in a Balanced market, with the exception of Chilliwack, which is sitting in a Buyers Market. Chilliwack saw such a massive spike in demand during the pandemic and is now the seeing the most aggressive cool off. It seems cities that are closest to the Vancouver core are more stable again, whereas during the pandemic, cities further east such as Abbotsford and Chilliwack saw the most demand.

Rates

The cost of living keeps soaring, inflation hit a nearly 40 year high in May, 2022. We are expected to see another increase in variable rates next month but I am hearing that there’s a decent chance that we have already seen the highs of fixed rates unless inflation re-accelerates from here. Fixed rates sit at anywhere between 5-7% depending on your terms and if you have a high ratio mortgage or not. Inflation just decreased from 7.8% to 7.6% mid August, 2022 which is great news.

Investors

It’s becoming difficult to generate positive cash flow in the local Fraser Valley & Greater Vancouver markets. Local investors who are carrying variable rates could be going from -$200 cash flow to -$400+ cash flows with the dramatic rate increases we have seen this year. It makes me wonder if these investors going to unload their local rental properties and move elsewhere.

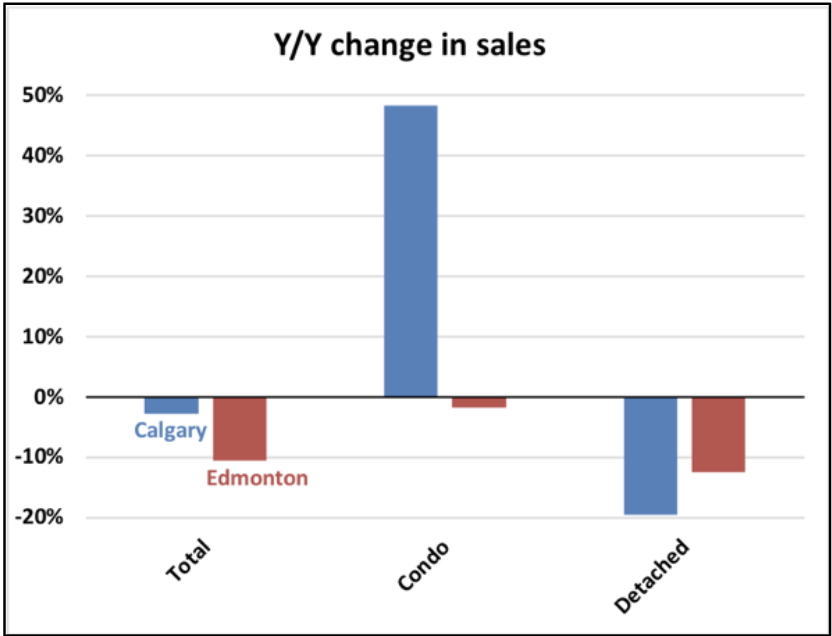

I wanted to turn your attention to Alberta. Below is a graph that shows year-over-year sales change in Edmonton and Calgary for condos and detached homes. I was astounded to see that Calgary condos saw nearly a 50% increase in sales over the past year. I am curious to know if these were BC and Toronto investors who are re examining their portfolios in search of cash flow over long term appreciation (which is the game in BC & Ontario).

Summary

Are homes more affordable today in terms of a down payment, Yes. Are homes more affordable today on a month-to-month basis? Depends on what rate you are getting.

We have seen the biggest correction in the detached market since the peak. However, they are still expensive. There currently 11 homes in Aldergove, Langley that are listed under 1M. If you had asked me if I would have thought we would see detached homes in Langley drop below 1M again over the next couple of years, I would have said, no way!

Canada has now admitted 406,000 new permanent residents in the past year, source stats Canada. Home supply remains very low in Canada and Immigration into Canada continues to set records. There is no question that the energy surrounding the local real estate market has changed, however, I think come 2023 when rates stabilize, we will remain in a strong housing market.