Is This the End of the Red Hot Real Estate Market?

The Fraser Valley Real Estate Board received 75.3% more listings in February compared to January of last month. This is something that we desperately needed in order to ease buyer demand in the valley – which is something that has been on the rise since the pandemic.

It doesn’t take a genius to understand that when supply levels rise, demand eases – but what is happening to sale prices?

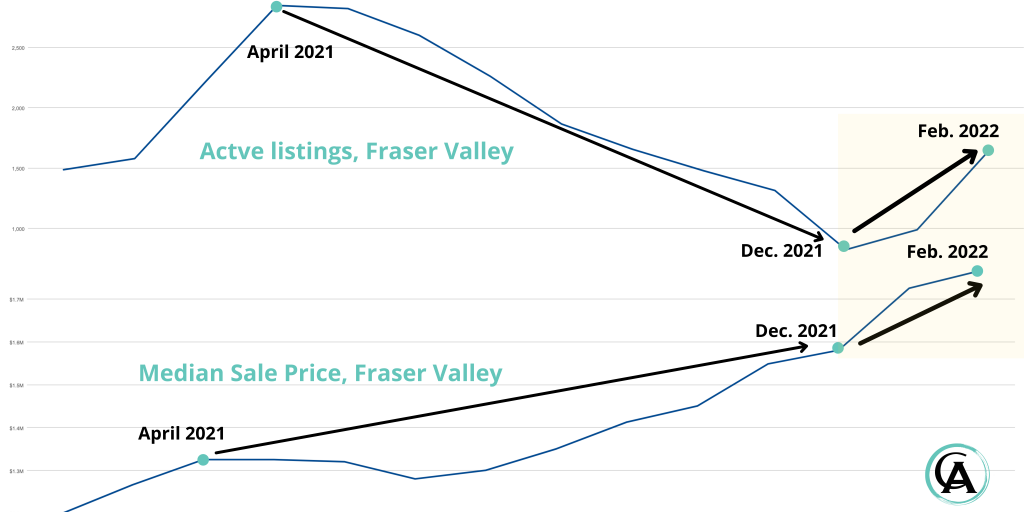

I have outlined a graph below that demonstrates the correlation between active listings (shown on the top) and median sale prices (shown on the bottom).

Active listings saw its highest levels in April, 2021 and its lowest levels in December, 2021. If we look at the sale prices below, we can see that as supply decreased, sale prices increased. This makes sense. What I find interesting is the correlation between number of active listings and sale prices.

You can see that active listings have increased this year & prices have followed suite. Whereas, I would have expected prices not to necessarily decline, but to have seen more of a plateau, given the recent surge in supply levels.

With spring coming, supply levels are expected to continue to increase, and I wonder what price points will look like as we get further into the year. I for one, do not expect prices to fall, but they certainly cannot keep accelerating at the pace they have been since the pandemic. It is simply not sustainable.

Interest Rates

The Bank of Canada met on March 2, 2022 and announced the increase of the benchmark interest rate (also knows as the overnight lending rate). The BOC lending rate is now 0.50% – an increase of 0.25%.

But wait!!! Before anyone panics, I would also like to mention that prior to the pandemic, the overnight lending rate was 1.75%. There has not been a rate increase since October, 2018. This recent increase was something, in my opinion that needed to be done, especially considering that inflation is at a 30 year high.

This will only affect variable rate holders. Fixed rate holders are not affected until the end of their term. If you are currently getting pre-approved, you will also not be affected due to the Canadian stress test which pre-approves buyers at 5.25%.

You can watch my recent video on the rate increase below for more info 👇

The Inside Scoop

The word on the street (and by street I mean my Remax office) is that there is a slow in the air. Buyers have started to get reluctant to compete on “offer dates”. I have had several agents tell me that on their expected offer collection day, in some cases 1 or even no offers were collected, resulting in the sellers declining to accept the offer.

I expect that the “list low” strategy that has been used over the last couple of years – in hopes to boost up the number of offers received – will change, and that more and more Realtors will move towards listing at what the home’s fair market value actually is…wow that will be nice.

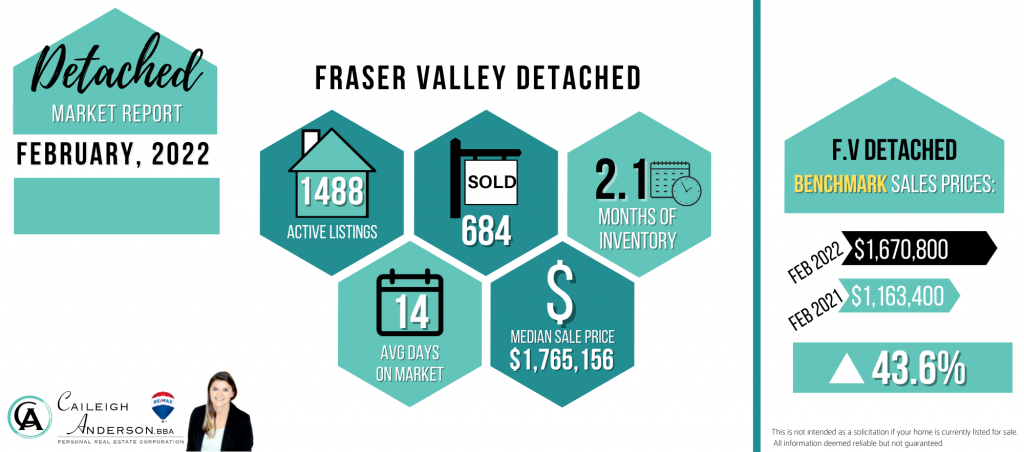

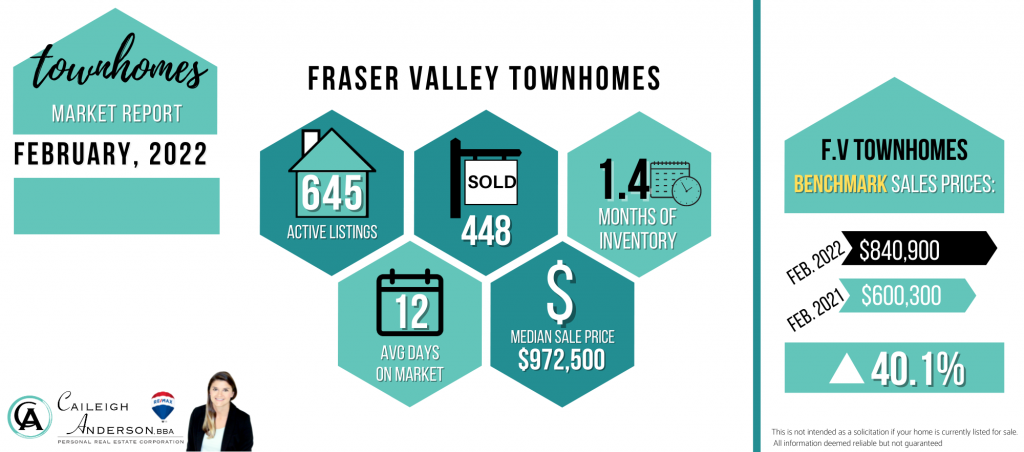

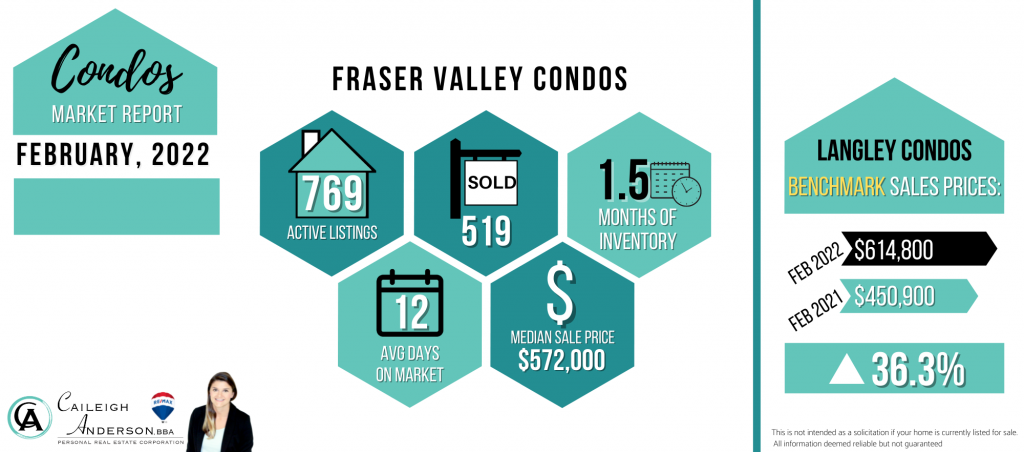

I am seeing the slow in demand more in the detached market. Condos and townhomes are still pretty strong in terms of the demand, however, once the media gets ahold of the fact that the market is “slowing” I am sure it will only be a matter of time before demand on those eases as well. Plus, the expected increase in supply as we get into the springtime months will help cool things off as well.