We are well into the fourth quarter of 2022 and what a year it’s been in the real estate world so far! From experiencing the height of the market in late February to early March, to now having witnessed five separate rate hikes this year – the first hike happening on March 1st; we have seen the red hot real estate market cool in a very short period of time. rates have not seen an increase of this magnitude in this short of a timeline since 1981.

The BOC has increased the overnight lending rate by 3% so far in 2022. At the start of the year, the key rate was 0.25%. At present, it sits at 3.25%. What is even more surprising is that The Bank of Canada said they aren’t quite done raising rates yet as inflation is still too high.

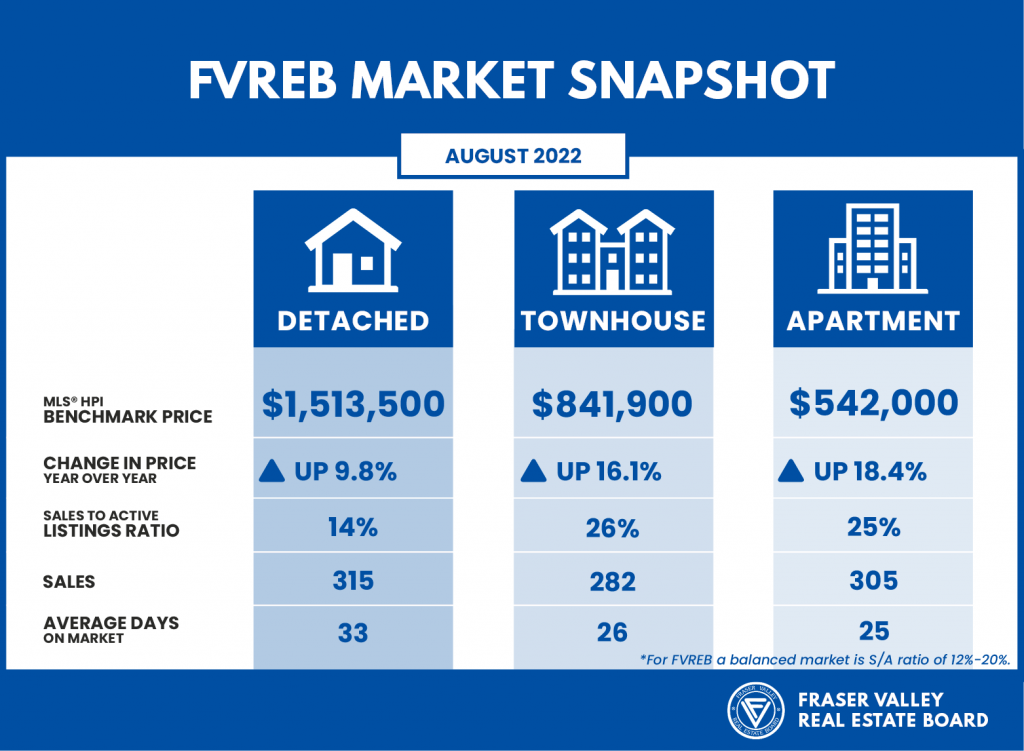

When looking at the price gains over the past year, we are still up in all asset classes across the Fraser Valley. Detached home are up 9.8% year over year, townhomes are up 16.1% and condos are up 18.4%.

Opportunity for Upsizing

Since rates started to increase back in March of this year, the detached market has been hit the hardest, followed by the townhome market and lastly condos have seen the smallest change in price. So, if you are in the market looking to upsize, there is good opportunity, granted you sell at a similar time that you will be buying at. For example, if you are in a townhome looking to get into a detached home, the percentage your townhome has fallen in price since the market shift is far less than the detached market.

Months of Inventory

Below I have outlined Months of Inventory for the entire Fraser Valley. Within the valley, I have pulled the data specifically for Langley, Abbotsford and Surrey and have included what type of market each asset class is in within these locations.

Sale Prices

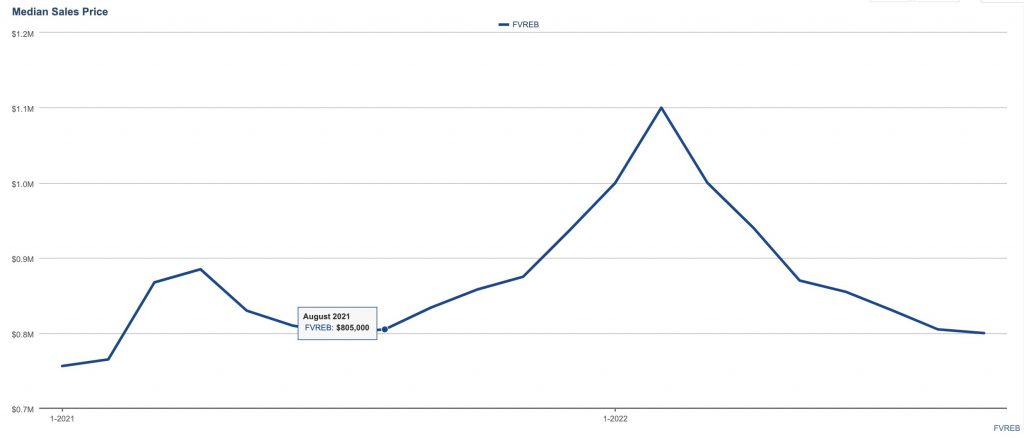

All the price gains made in 2022 are now gone and we are sitting at similar sale prices to August 2022. Coming up to the end of the year, December 2022 sales will not be higher than December 2021 sales.

Closing Thoughts

There is a feeling of uncertainty amongst Buyers right now. With rates having gone up as much as they have and further expectations that they will continue to rise, a lot of buyers are wanting to sit on the sidelines and wait for further price drops. No one wants to purchase a home and have it be worth less than what they paid for it when they get the keys. I will say it again, when rates go up, your pre-approval goes down and your monthly mortgage payments increase. It is really important to understand how rate increases affect your monthly payments and even more importantly, your pre-approval amount.

Money is more expensive to borrow now and I have seen this cause high demand specifically in detached homes priced under 1 million dollars. When you purchase a property that is under 1M, you do not need 20% down. Any homes priced over 1M have a minimum requirement of 20% down. Back at the beginning of 2022, detached homes were not selling under 1M and now in some areas of Langley and further out east in Abbotsford and Chilliwack, you can find homes selling under 1M.

I do expect prices to continue to fall over the next few months and into 2023. However, there will be a tipping point when rates level out and everyone who has been waiting on the sidelines jump back in at once.