It’s no secret that prices are falling. The question on everyone’s mind is, how much more will they fall by? Have we hit the bottom, or, will housing prices continue to decline as we head into the new year?

In this month’s report, I will show you where prices have fallen and where I think they will go over the new year on a micro and macro level.

Price Comparison

The current benchmark sale prices are in line with the price points we saw roughly one year ago. In other words, all the price gains made over the last year, have been wiped out. Of course, the monthly mortgage payments of someone who purchased at a similar price a year ago would be much less than they are today, however, I wanted to see how much prices have fallen since the market shifted and rates have increased.

The chart below outlines when the last time prices were aligned with what we are seeing today.

Price Comparison Chart, Fraser Valley:

| ALL PROPERTY TYPES | NOV. 2022 | OCT. 2021 |

| $975,400 | $979,300 | |

| DETACHED | NOV. 2022 | SEPT. 2021 |

| $1,404,900 | $1,404,000 | |

| TOWNHOMES | NOV. 2022 | DEC. 2021 |

| $799,400 | $800,500 | |

| CONDOS | NOV. 2022 | DEC. 2021 |

| $518,400 | $507,000 |

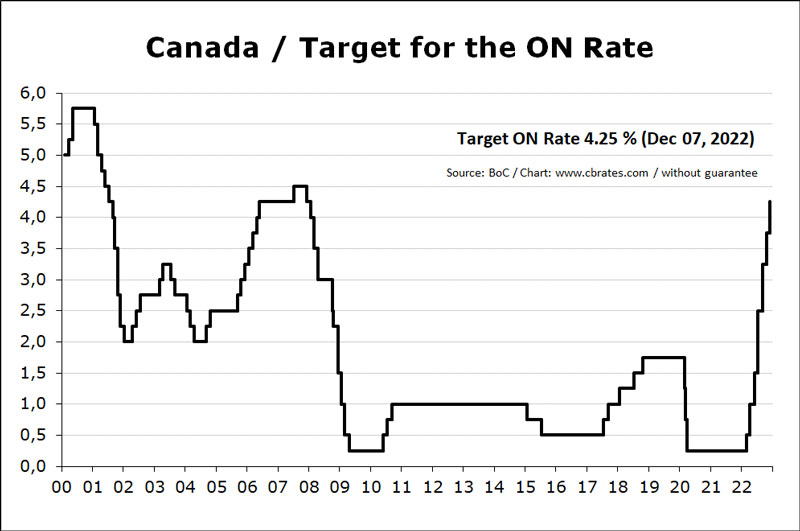

Interest Rates

The Bank of Canada hiked its overnight rate by 50bps (0.50%) on December 7th, 2022. The target rate is now sitting at 4.25%. Let’s not forget that we started the year at 0.25%. Rates have not gone up this much, this quickly since the late 1980s.

If you are a variable rate holder, check to see if you have static or adjustable payments. If you have static payments, the amount you pay each month stays the same, however, the portion of interest vs. principal paydown changes. When rates go up, you pay more interest, when rates go down, you pay less interest and more toward principal paydown.

To avoid paying too much interest, variable rate holders with static payments may want to consider increasing their payments or making a lump sum payment to avoid hitting their trigger point. This is the point at which someone is paying all interest and nothing towards principal. Fixed-rate holders are not affected.

It is suggested that we can expect rates to hold for a bit going forward. We may see one or two increases over the next year, but nothing like we saw in 2022. I think it would be foolish to raise them too much more anytime soon, as consumers don’t fully feel the effects of rate hikes right away. When consumers with fixed rates of 1.5-3% go to renew over the next year or so, they are really going to feel it.

Aside from interest rates, I want to talk about other factors that have an effect on the real estate market.

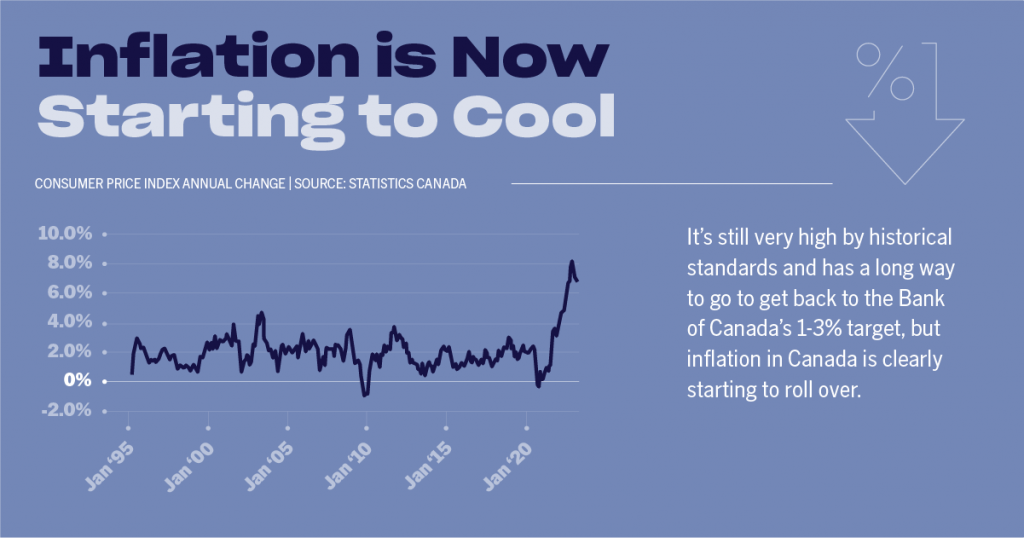

Inflation

As a result of the Bank of Canada rate increases, inflation has cooled. Canada’s annual inflation rate was at 6.9% in October of 2022, remaining unchanged from the prior month and in line with market expectations. This is down from just over 8.1% earlier in the year. The Bank of Canada has a target to get inflation to 1-3%, so, we still have a long way to go.

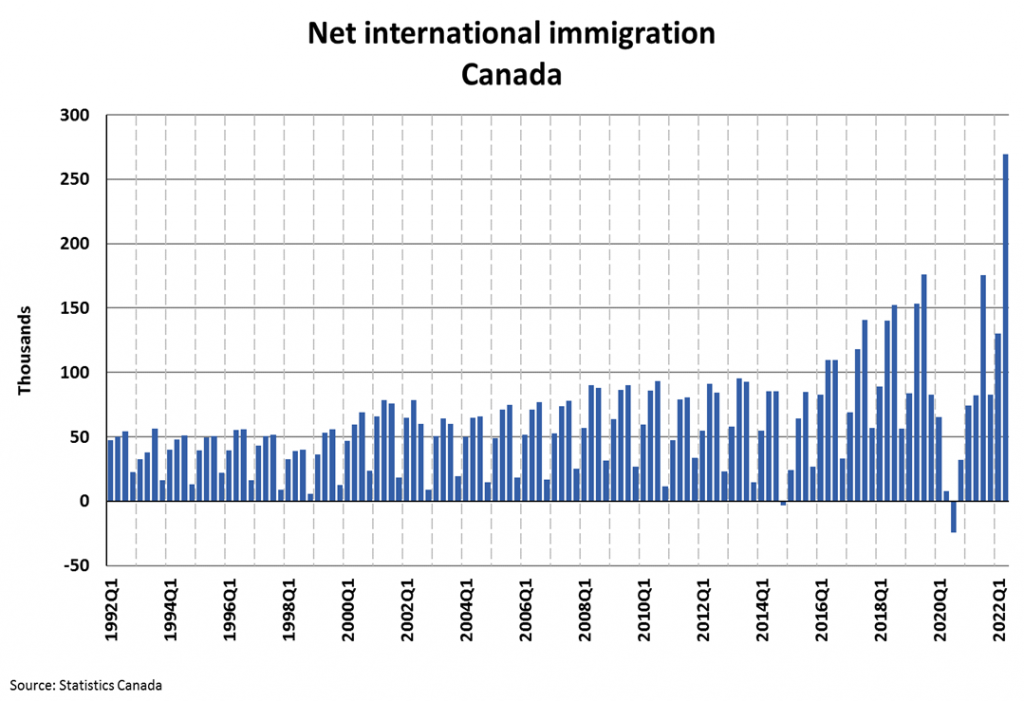

Immigration

Statistics Canada has recorded that Canada’s population grew by a record 285,000 in the third quarter alone. That has pushed the annual growth in population to just over 700,000. We can expect to see more immigrants over the fourth quarter of 2022.

Every immigrant coming to Canada will be competing for real estate, whether that’s in the rental market or whether that’s in the purchasing market. A lot of people immigrating to Canada are well-educated and employable. This will increase the housing demand.

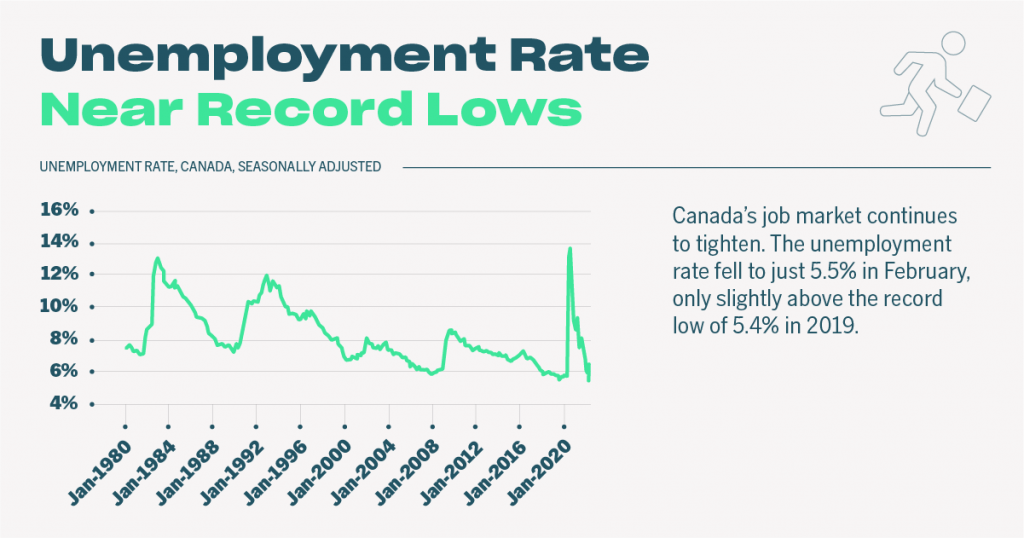

Employment

The labour market is still hot. The Canadian labour market added 10.1k positions in November, with full-time employment up 50.7k and part-time employment down 40.6k.

The unemployment rate fell by 0.1 percentage points, to 5.1%. The participation rate also fell to 64.8% (down 0.1 percentage points).

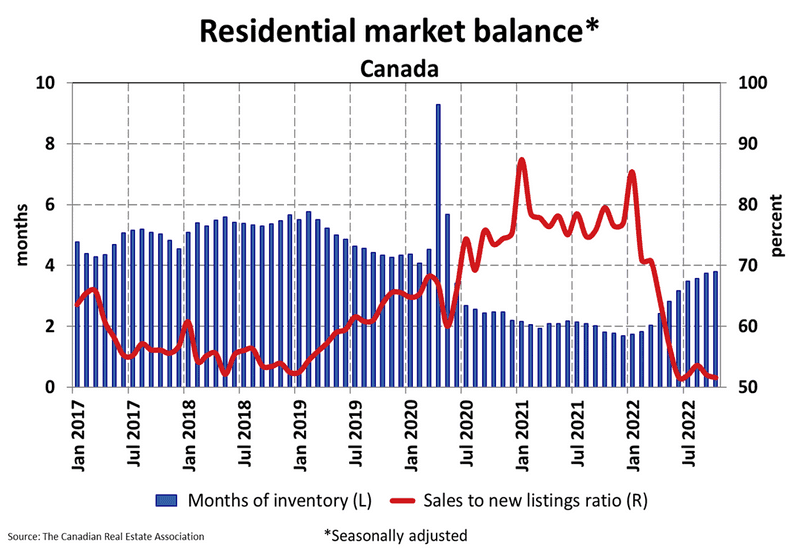

What Type of Market Are We In?

When we look at the Months of Inventory (MOI) which measures consumption and tells us what type of market we are in, we can see that all across Canada we are in a balanced market, sitting at roughly 3.8 MOI. If we take 2020 and 2021 out of the equation, we can see trends heading toward what we saw pre-pandemic.

I want to remind you that 2022 saw high volatility and in some senses, it can make the market we are in today seem worse than it actually is when we look at historical data.

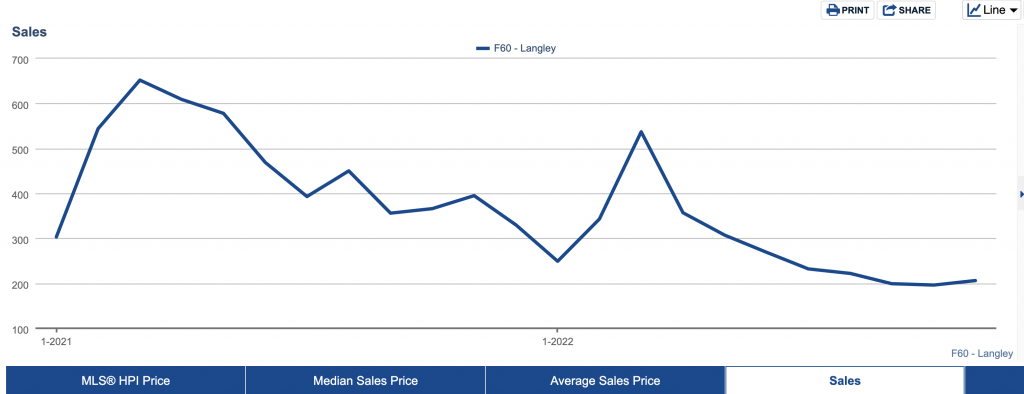

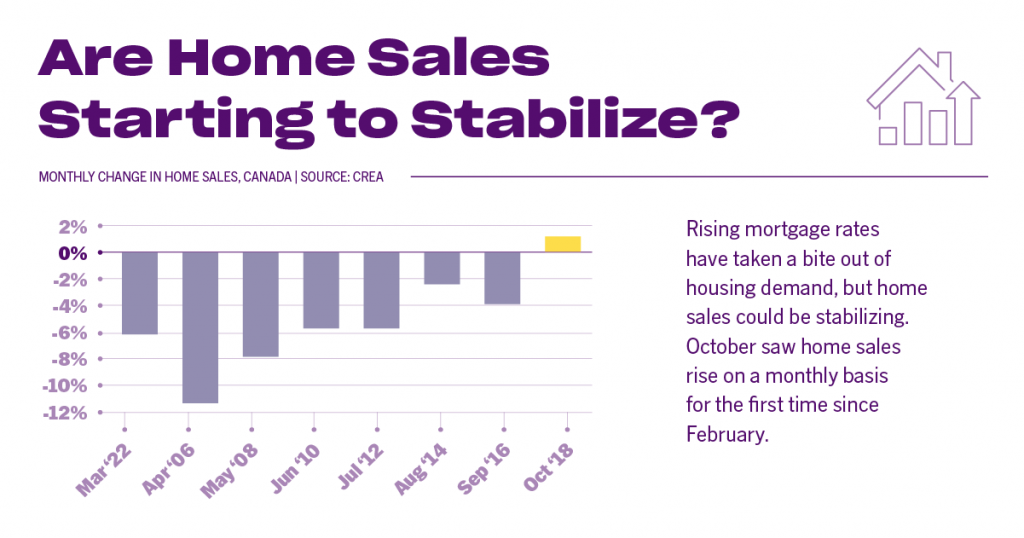

Housing Sales

We know sale prices have declined over the last few months, but what about sales? In my marketplace of Langley, BC, the last month saw an increase in sales from October 2022 to November 2022. This was the first time we saw an increase in sales since the peak of the market in February.

The number of new listings is down month-over-month. With sales up and new listings down, absorption rates will increase.