My Top 5 Predictions for 2023

Since nobody could have predicted the 2022 real estate market, I wanted to jump in and put together my top 5 real estate predictions for 2023! This way, we can all look back and see how right…or wrong I was in one year’s time!

Prediction 1: Rental Prices Remain High

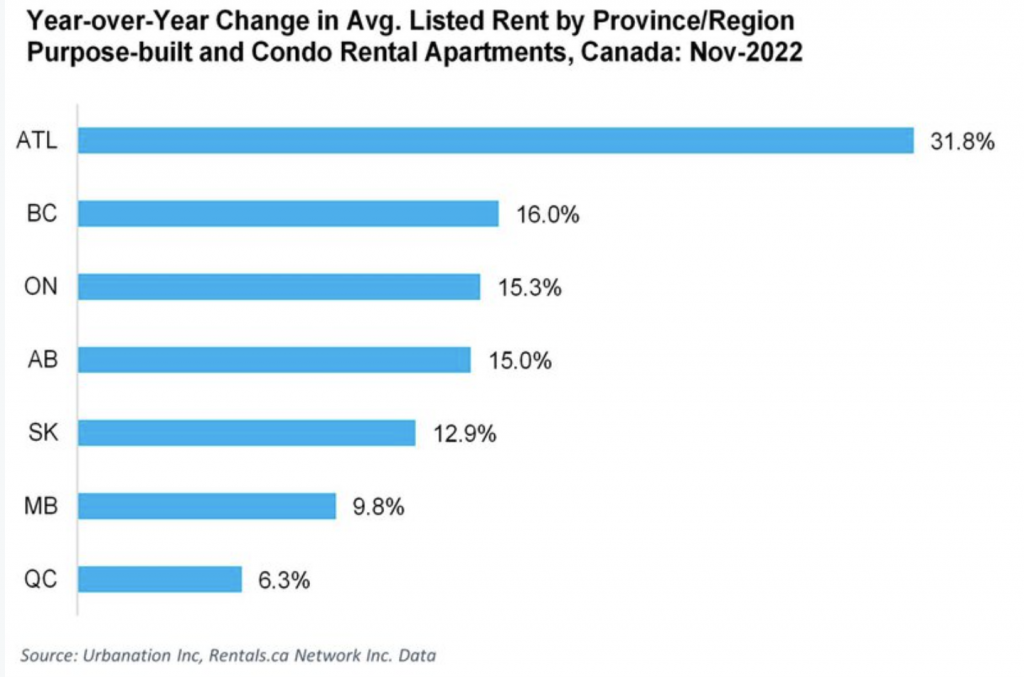

Rental prices have been steadily climbing across Canada throughout the last year. Rentals are up 24.3% in Vancouver year-over-year and up 16% overall in BC.

The two main catalysts behind high rental prices are interest and immigration rates.

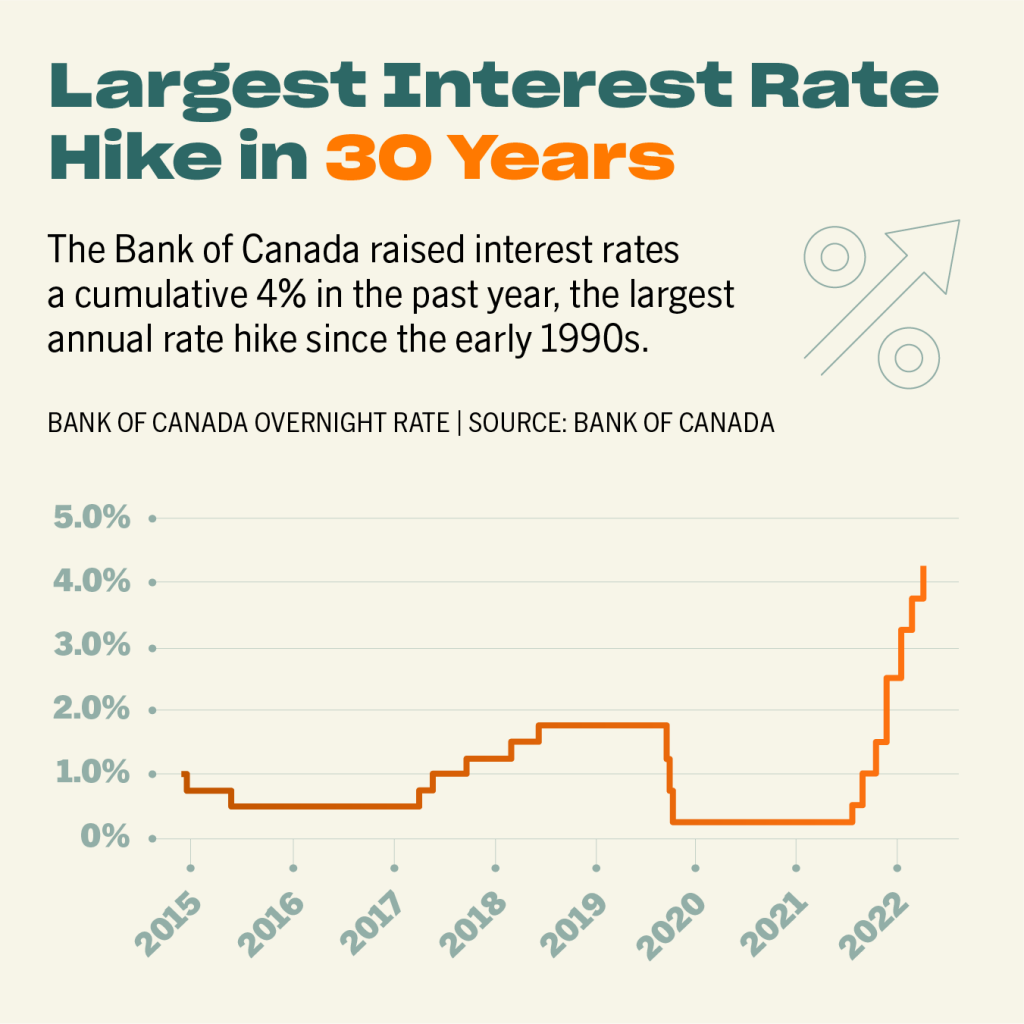

Interest Rates

The Bank of Canada continues to increase the overnight lending rate, making it more difficult for people to qualify for a mortgage. The overnight rate now sits at 4.25%; a 4% increase over one year. This increase has a massive effect on what someone will qualify for, and as a result, people who were not already in the market, are continuing to seek rentals.

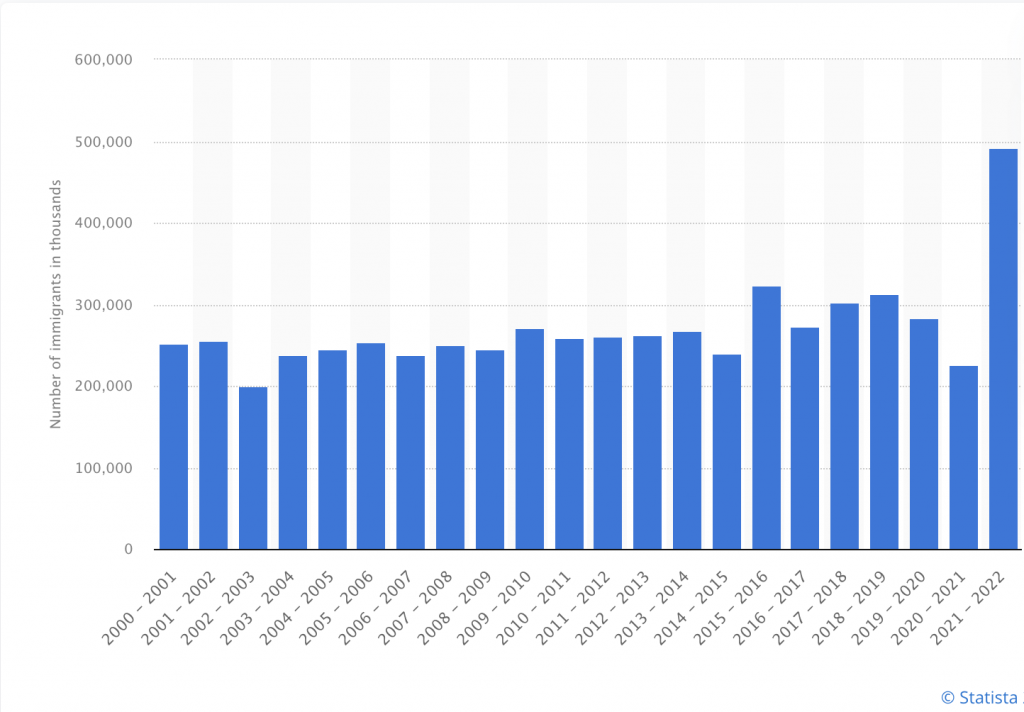

Immigration in Canada is high. Canada welcomed roughly 431,000 new immigrants in 2022, blowing out the previous record of 401,000 immigrants that were seen in 2021. Canada is aiming to welcome an additional 465,000 new immigrants in 2023. For these reasons, I think rental prices will remain historically higher than we are used to.

I do not foresee rental prices continuing to rise at this pace, however, I don’t believe they will come down as much as we have seen home sales decline over the past 9 months.

Prediction 2: Low Supply Levels

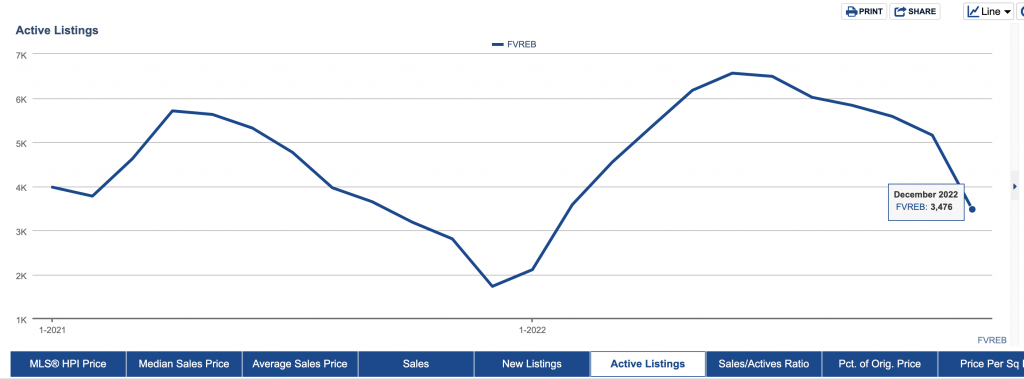

To have a balanced market in the Fraser Valley, we should be sitting at roughly 6,000 active listings. Currently (as of the end of Dec. 2022) there were just under 3,500 active listings on the market, which is below where we need to be in order to accommodate buyer demand in the Valley.

Three main causes I see attributing to lower supply levels in the marketplace are seller uncertainty, sellers having unrealistic expectations and high immigration levels.

Seller Uncertainty

When we have low supply levels, sellers are hesitant to list their home because there is not a lot of choice for them on the purchase side of things once their home sells. Subject-to-sale offers are being seen in the local marketplace depending on what asset class is being purchased, however, subject-to-sale offers – in most cases – result in the buyer having to pay more in order for the seller to accept this type of offer.

Sellers Having Unrealistic Expectations

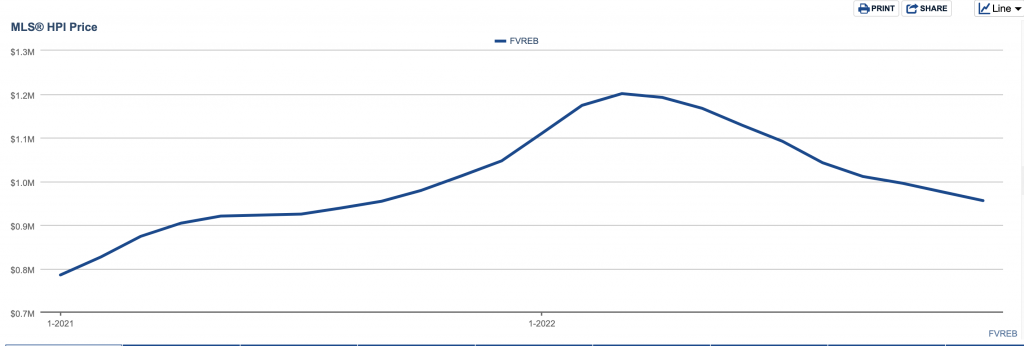

There are some sellers who still cannot accept that their home is worth in some cases 20- 30% less than it was at the beginning of 2022. If someone sold their home today, they will not get as much as their neighbour or someone in their neighbourhood who sold for at the peak of the market and as a result, those sellers want to hold off until they see prices rebound.

Record High Immigration

As we talked about above, Canada is welcoming new immigrants at record high levels. These immigrants will need a place to live. Yes, some will be renting, but, there are some that will be purchasing homes. We are already below healthy supply levels and with more people moving to Canada, it will be challenging to get ahead of the demand for supply.

Prediction 3: Interest Rates Increase

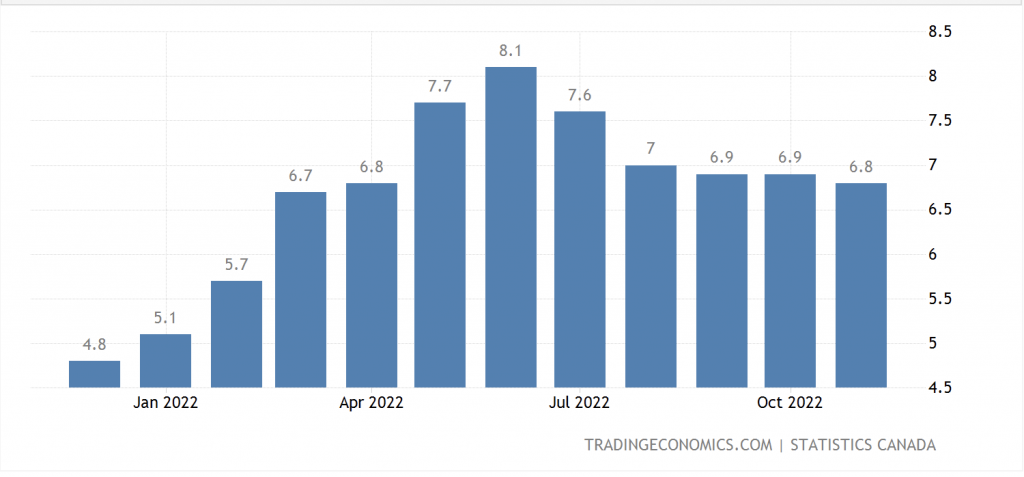

Don’t shoot the messenger, but I think we will see interest rates rise again in 2023. Let me be clear, I do not think we will see rates rise at the levels we saw in 2022, however, inflation is still high and if it does not correct, the BOC will continue to raise the overnight lending rate until inflation cools.

Currently, we are sitting at an inflation rate of 6.8%. The Bank of Canada has a target inflation rate between 1-3%, so, we still have a long way to go. On a positive note, inflation has come down from its peak in June of 8.1%.

Prediction 4: Sale Prices Slight Decline

I believe sale prices will remain steady overall in 2023. Supply levels will remain under where we need to be, and, I think interest rates will stop increasing in the latter half of the year. The detached market still has room to decrease from where we currently are, however, townhomes & condos are seeing a lot of demand, and I cannot see price points falling much more.

To make this prediction less fluffy, I will associate a percentage to the decrease I think we will see in 2023. I do not think prices in the detached market will fall more than 10%. I think condos and townhomes will fall roughly 5-8% over 2023 and then rebound in Q4.

Prediction 5: Balanced Market Overall

Due to low supply levels and the increase in immigration, even though it feels like a Buyers market, I think we will be in a Balanced market for the majority of 2023. Looking at all asset classes in the Fraser Valley region, we are currently sitting at 5.2 MOI which represents a Balanced market. Although the news may have you thinking it is a Buyer’s market and that a market crash is coming, the stats tell a different story.

Keep in mind, when you are looking for a home, take into account each asset class and each sub-neighbourhood to really understand what type of market you are buying or selling in. For example, detached homes in Mission will be in a totally different market than Langley City condos.

Visit my website for more information, or to see my latest listings.