Should I buy Now or Wait for Prices to Come Down Further? Read on as I Go Over the newly released Real Estate Pricing Forecast

This seems to be on everyone’s mind and is a question I’m getting daily. The overall trend in the real estate space when reading the news is doom and gloom. But, is that actually the case?

In this update, I am going to go over the BC Real Estate Pricing Forecast in Canada, BC and the Fraser Valley for 2023 and 2024. I will also summarize the first month of data we now have for 2023. Although no one really knows what the future holds, I will do my best to provide you with a well-rounded idea of where I believe the market is headed.

“With the shock from the Bank of Canada’s efforts to control inflation fading, and uncertainty about the path for housing markets and where borrowing costs will ultimately land also likely to wind down over the next few months, the theme of our 2023 forecast is not recovery, but the start of a turnaround. “

CREA, January, 2023

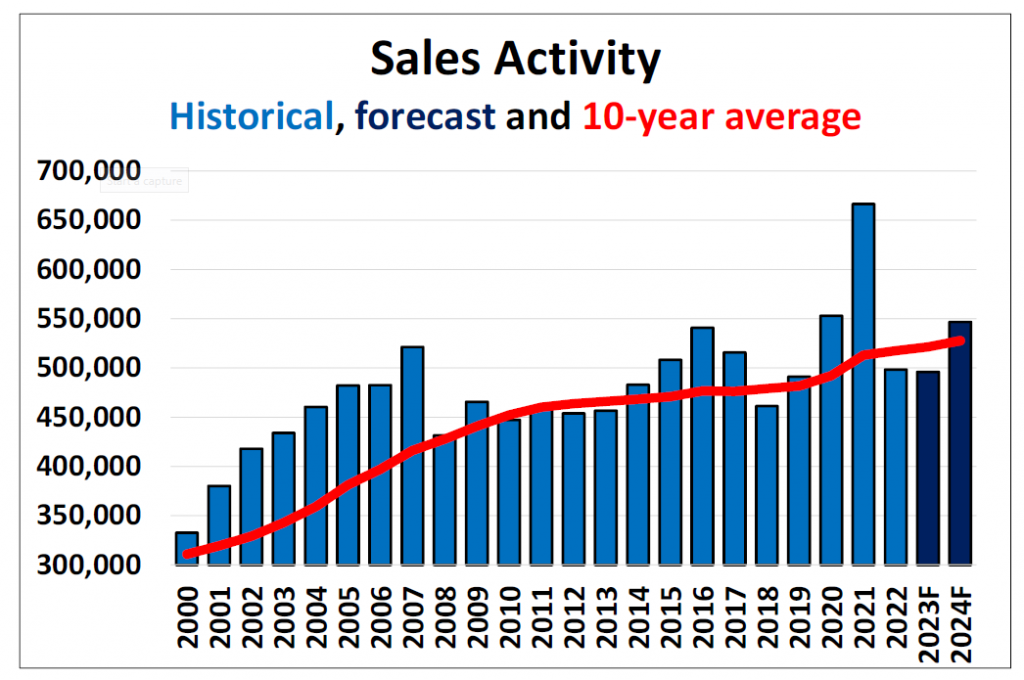

See the below chart outlining historical sales in light blue, forecasted sales in dark blue and the 10-year sales average in red.

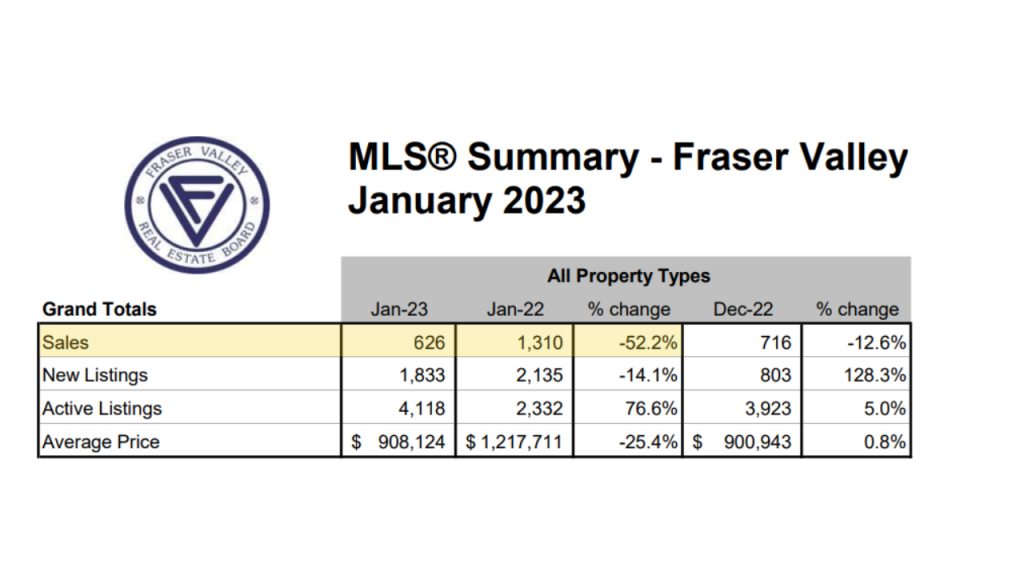

CREA is suggesting that real estate sales in 2023 are going to be similar in volume to those of 2022. This forecast is pretty bold, considering Q1 of 2022 was the peak of the Canadian Real Estate market. Also, when comparing January 2022 sales to January 2023 sales, we are behind 52.2%…so, we better get caught up!!

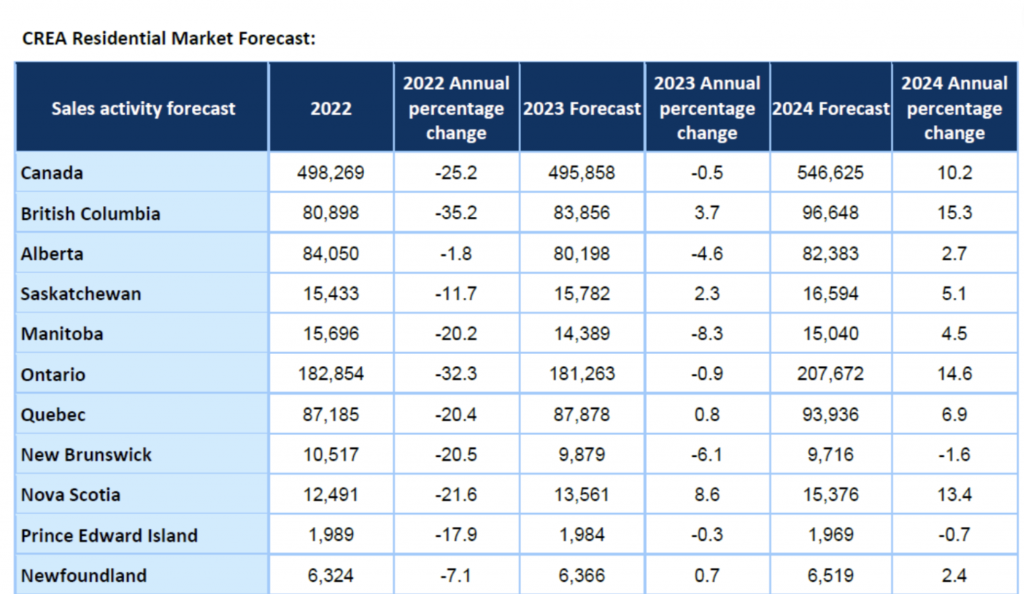

Sales Activity Forecast:

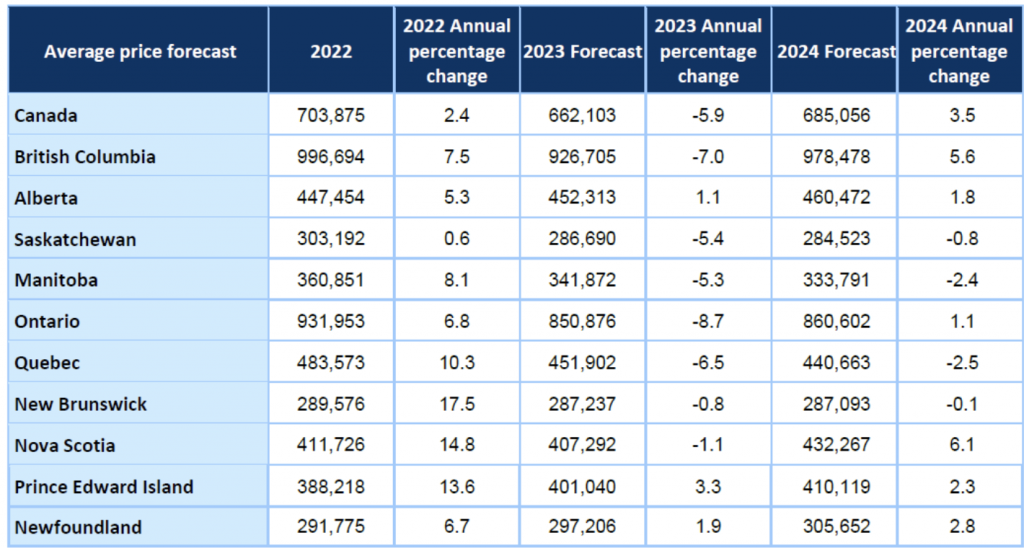

Average Price Forcast:

CREA expects 2023 to decline in both sales and prices, however, they project a rebound in 2024 to a level that surpasses the 10-year rolling average.

These projections translate to the fact that CREA feels consumer uncertainty with interest rates is in the rearview mirror. They do not foresee the BOC raising rates much – if any- over the year or two at the least.

Personal Findings & Local Deep-Dive

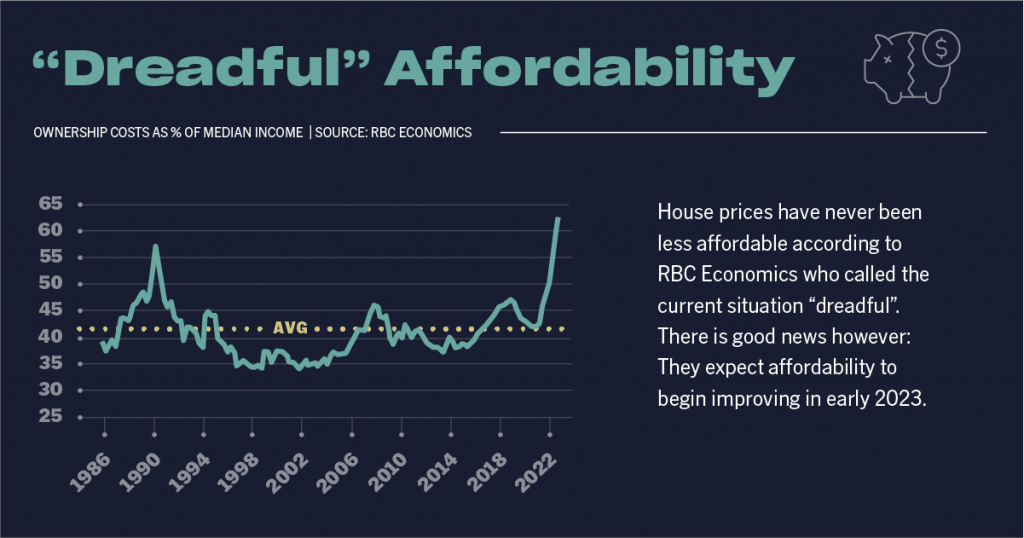

Buyers today have come to terms with the fact that they are getting an interest rate somewhere in the ballpark of 5-7%, depending on what term and type of rate they choose. They are looking at homes at today’s prices that allow them to stay within their monthly budget. That said, housing affordability is still an issue. Prices have still not come down enough to make up for the increase in rates. A 1% increase in mortgage rates accounts for a decrease in affordability by roughly 10%.

There has been pent-up demand building since the last quarter of 2022, attributed by a record number of interest rate hikes. I expect buyer demand to cause a sales uptick, especially if rate hikes subside, which I expect will be the case moving forward. As we move towards the spring market, we should start to see more homes come to market.

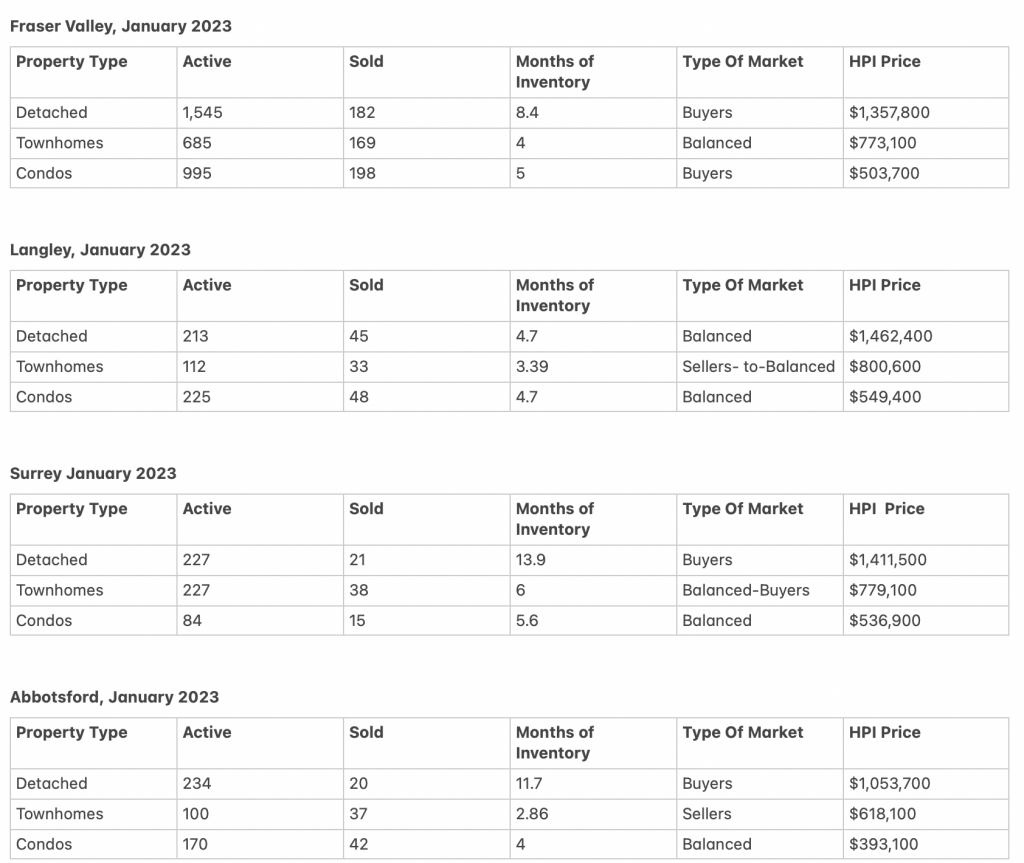

Summary of 2023 in the Fraser Valley:

Click here for past Anderson Report’s and latest market updates for the Fraser Valley.