Prices Are Heating Up in the Fraser Valley & Greater Vancouver Area

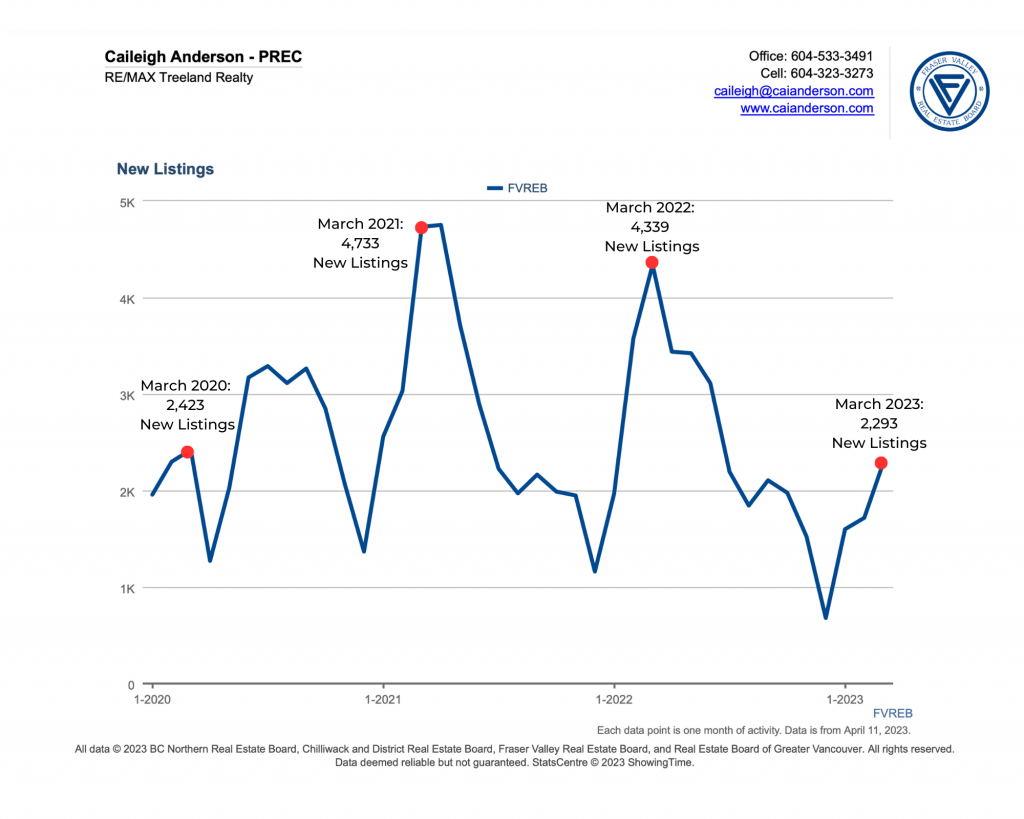

Looking at the year-over-year difference in the number of new listings across the Fraser Valley, we can see new listings are down -44.1% from last year. When we compare new listings to historical March months, we are at similar levels to March 2020, the start of the pandemic.

Until more listings hit the market and people start to sell, we will continue to move towards more of a seller’s market and, as a result, see an increase in sale prices across the Valley.

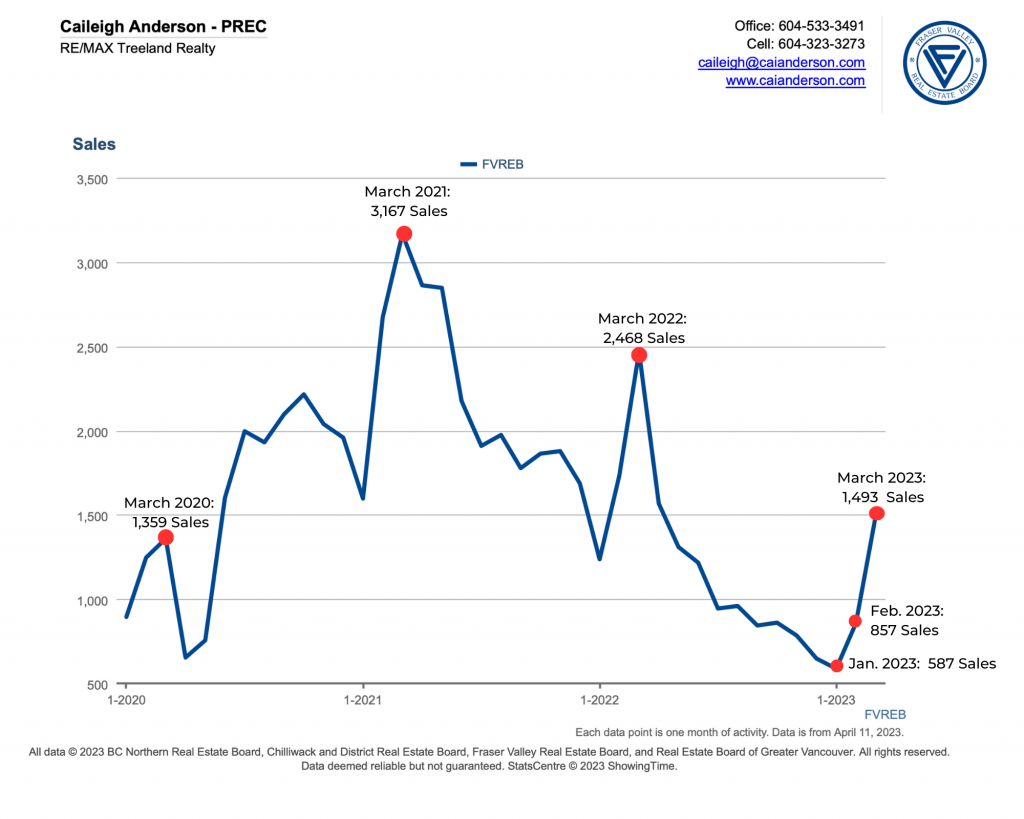

Below I have compared this March to historical March months to provide insight into how low sales are. We are well below the 10-year sales average.

New Listings:

Year-over-year sales are down -39.9%. We are up from last month, although February is historically a much slower month than March and not a great indication of where we should expect to be at this time in the year.

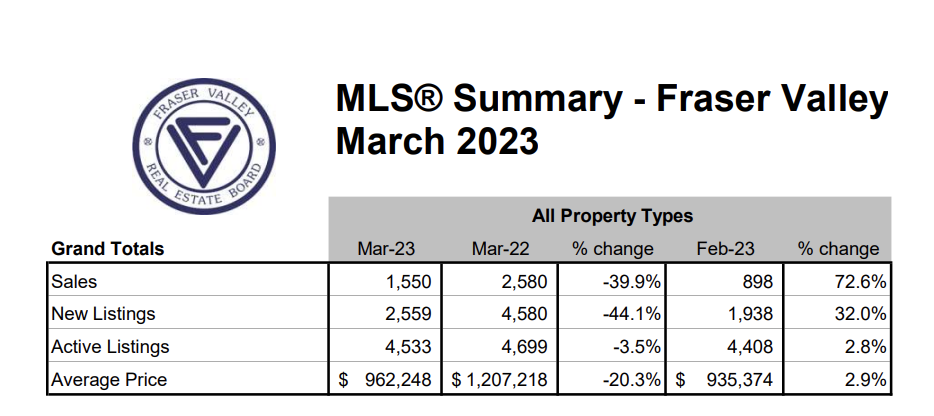

Summary of New Listings, Sales, Active Listings, and Average Price:

I have outlined the recorded sales for 2023 and previous years’ March sales to show seasonally what is expected for March.

March 2023 sales are well off the ten-year average and among the lowest March listings recorded in a decade.

Sales

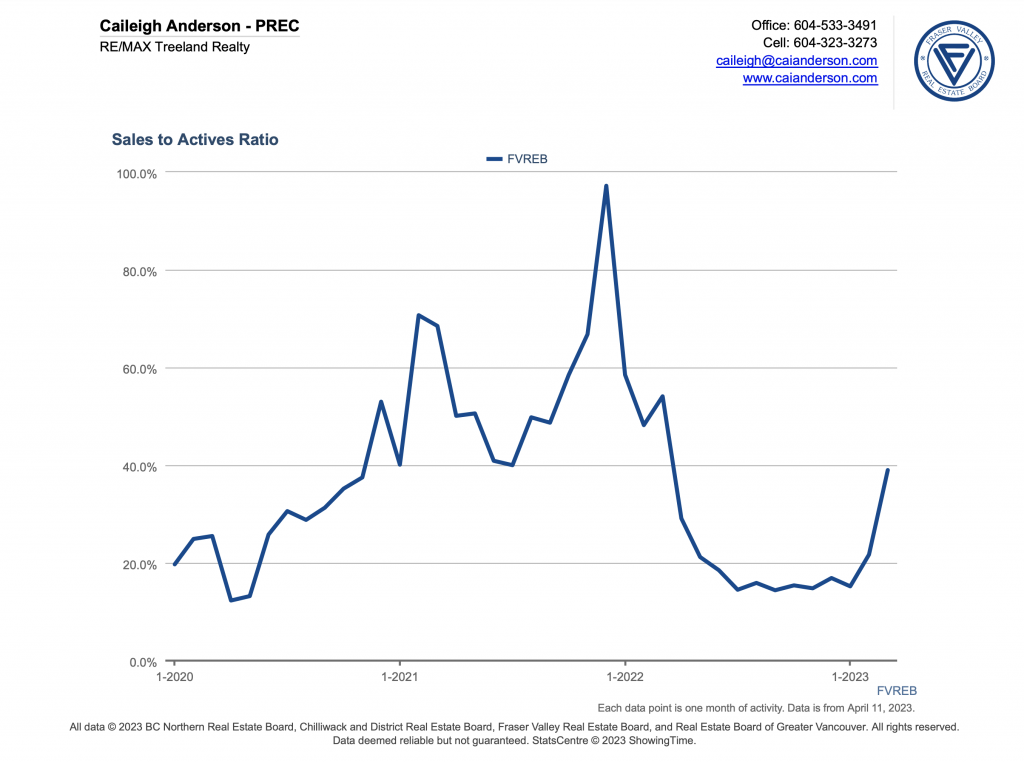

Sales-to-Active Ratio

Due to the lack of new listings coming to the market, the sales-to-active ratio continues to move deeper into a seller’s market, currently sitting at 36%. This means that 1 out of every 36 homes is selling in a given month. 12-20% is considered balanced, below that is a buyer’s market and anything above 20% is a Sellers’ market.

We can see that since the start of the year, we have really seen a sharp shift from Buyers’ to Sellers’ market in a short period of time. This is again, due to the lack of inventory levels throughout the Fraser Valley, with demand for townhomes even more pronounced, at a 62% ratio.

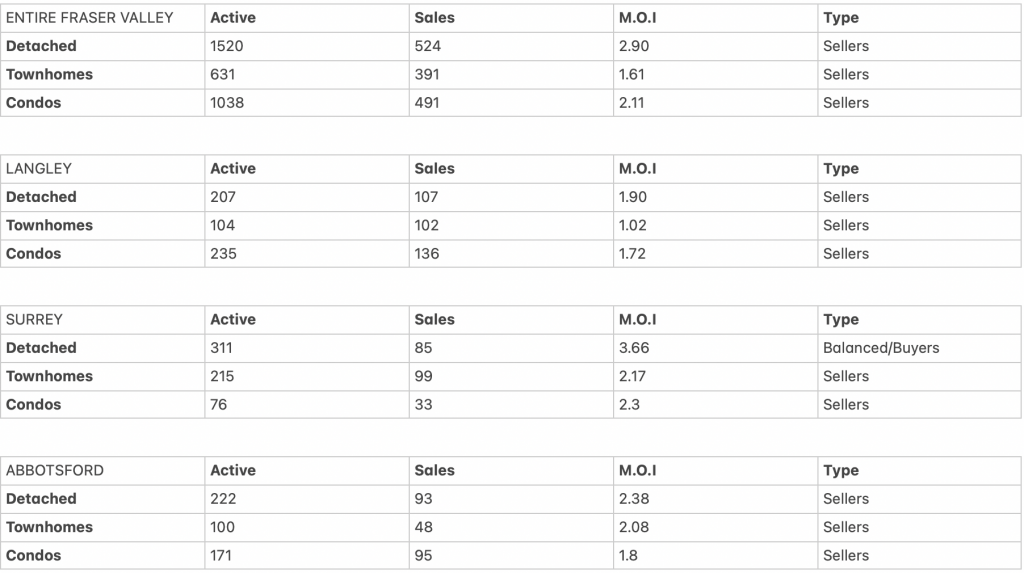

Months of Inventory

I have gathered the data for Months of Inventory which is another method aside from the sales-to-active ratio used to measure the absorption rate of the market. It helps us understand if we are in a Sellers, Buyers or Balanced market.

All across the board with the exception of Surrey detached homes are in a Seller’s market.

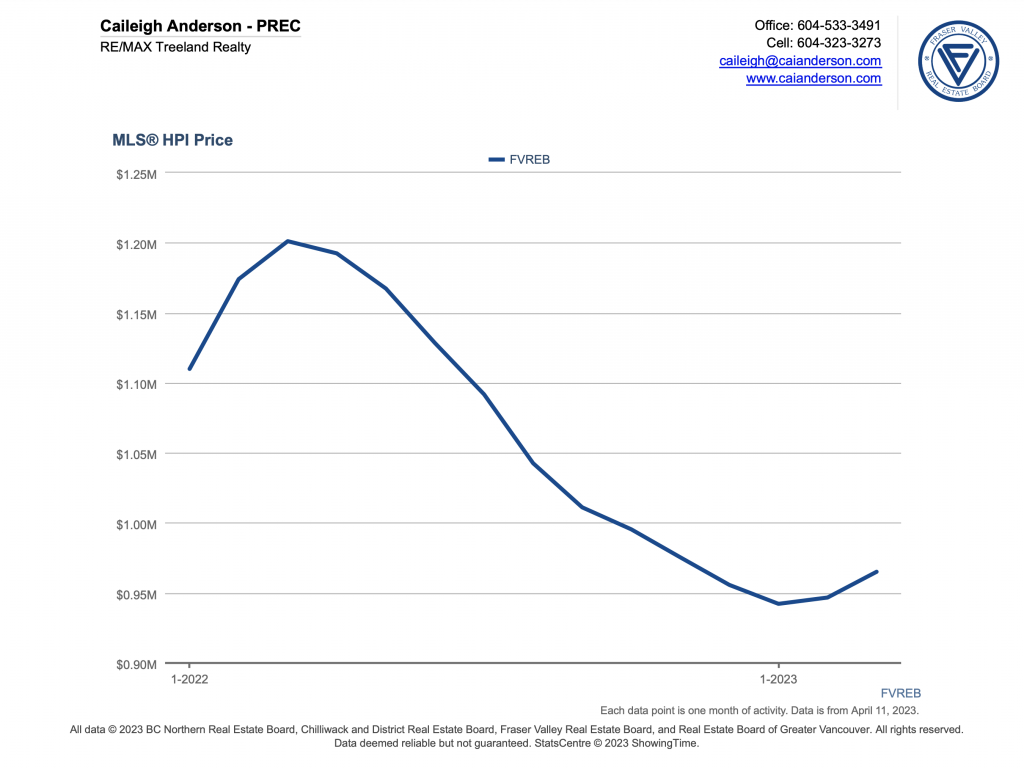

Benchmark Prices

For the last 2 consecutive months, we have seen sale prices increase in the Valley. The Bank of Canada holding rates last month and the lack of supply surely play factors in this increase.

What I am Seeing

The townhome market is on fire right now. In Langley, out of the 104 active townhome listings in March, 102 sold. These are extreme Seller market conditions. People are still trying to get into the market, but the lack of supply is really turning the pressure up on Buyers once again and we are seeing multiple offers occur and Sellers holding off on offers. That said, the multiple offers we are seeing today are not as intensive as they were during the peak of the market in 2021/2022.

There are some subject-free offers being presented to Sellers, that said, with the newly implemented buyer rescission period, the Buyer has 72 hours to “cool off” before they have to formally submit their deposit.