Can the Fraser Valley Survive More Rate Hikes?

Bank of Canada Increases the Overnight Lending Rate

On June 7, the Bank of Canada raised its policy rate by 0.25% to 4.75%. This came as quite a shock to most as Tiff Macklin indicated there wouldn’t be a rate hike until the July 12 rate announcement meeting.

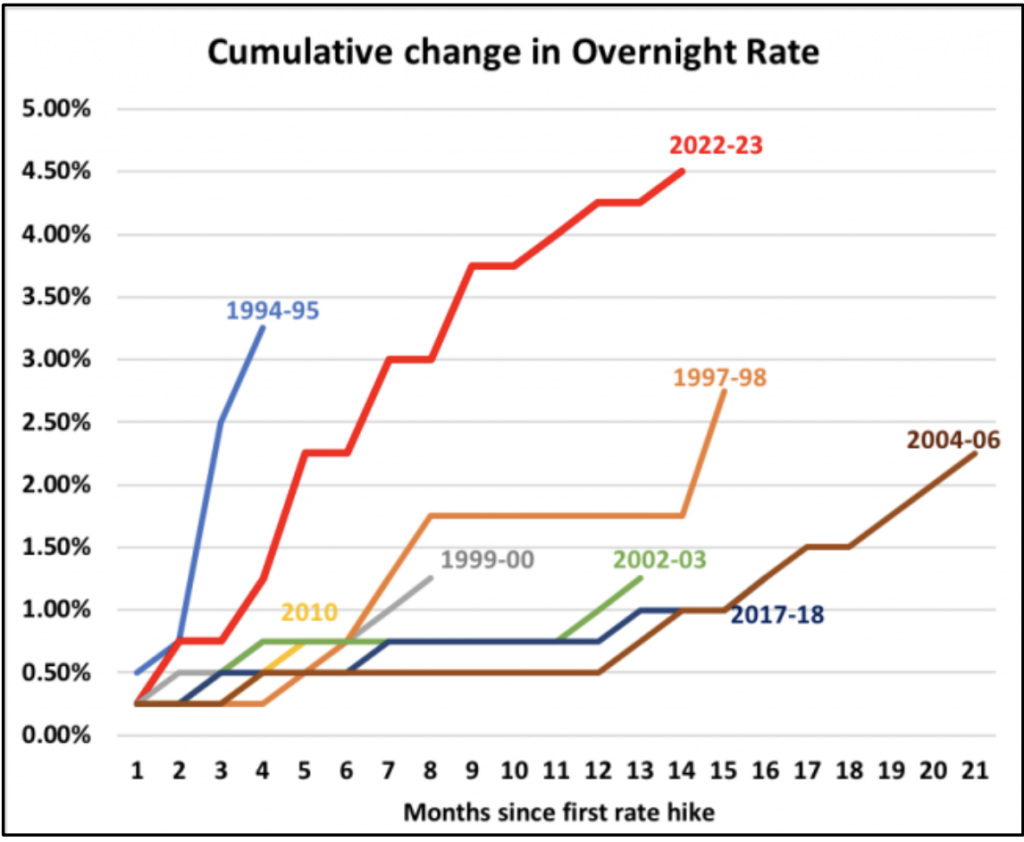

This most recent announcement is the ninth time the BOC has raised rates since March 2022. Overall, this is the largest cumulative interest rate hiking cycle since the 1980s, and there may be more to come. Markets are pricing in a 100% chance of another rate hike in July. The prime rate now sits at 6.95%.

Who is Impacted by The Rate Increase?

For every $100,000 borrowed, you will notice an increase of approx. $15 / month. So, for example, if your mortgage is $500,000 and you have an adjustable variable rate, you can expect your payments to increase by $75.

If you are a variable rate holer, you will be affected by this increase. Fixed payment variable holders; your monthly payments will stay the same, but the portion going towards interest will increase and the portion paying off the principal will decrease. You may be closer to your trigger rate and may wish to increase your monthly payments or put forward a lump sum in order to avoid paying interest only.

Fixed-rate holders are not affected, but you might want to look into when your term is up for renewal. Depending on when you purchased your mortgage, you may be in for sticker shock when you have to renew. Here is my latest video on how much you can be affected by today’s rates vs. rates a few years ago. Click here to watch.

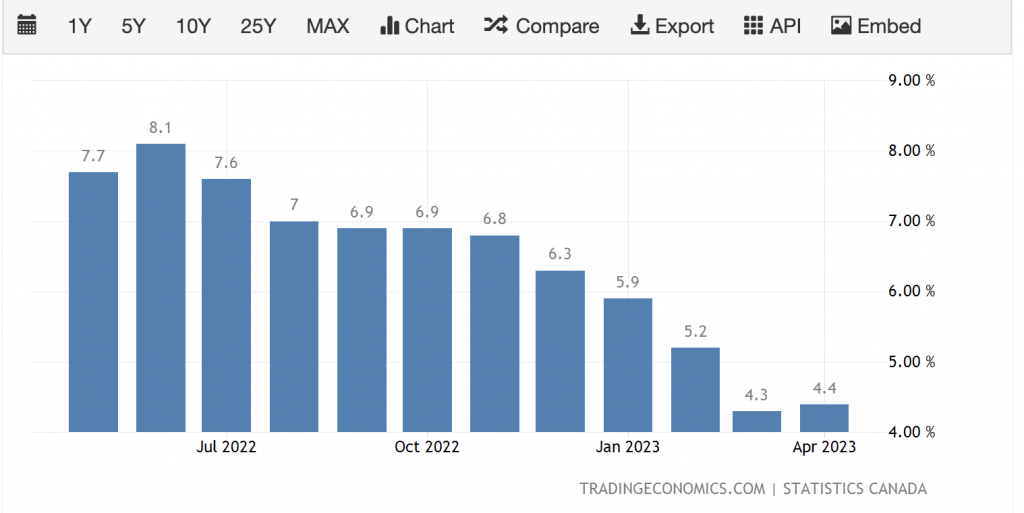

Inflation

Inflation remains high and even increased last month despite higher costs. I believe this played a factor in the BOC’s decision to raise rates in June.

Sales, New Listings & Supply Levels

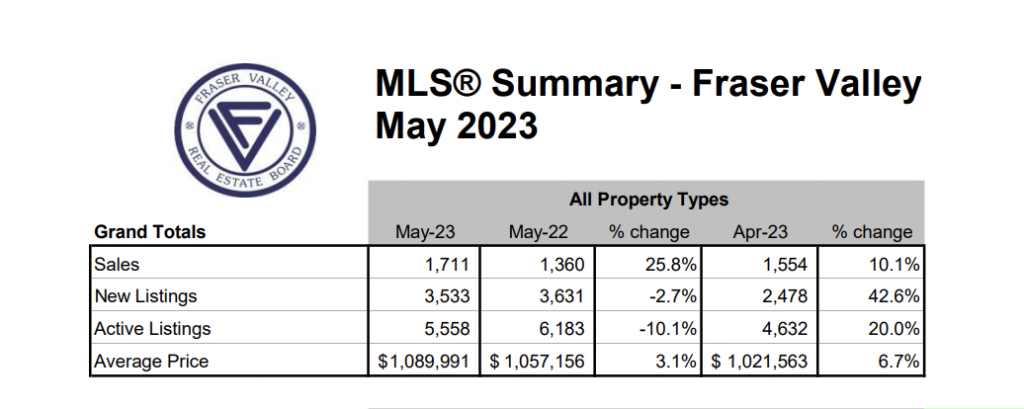

For the first time in months, we saw a solid increase in new supply which is great news given that inventory levels have been concerningly low. New listings increased by 42.6% from April 2023 to May 2023.

Active listings in May 2023 were also up 20% compared to April 2023. With inventory growing, we should see things shift away from a seller’s market to a more balanced market.

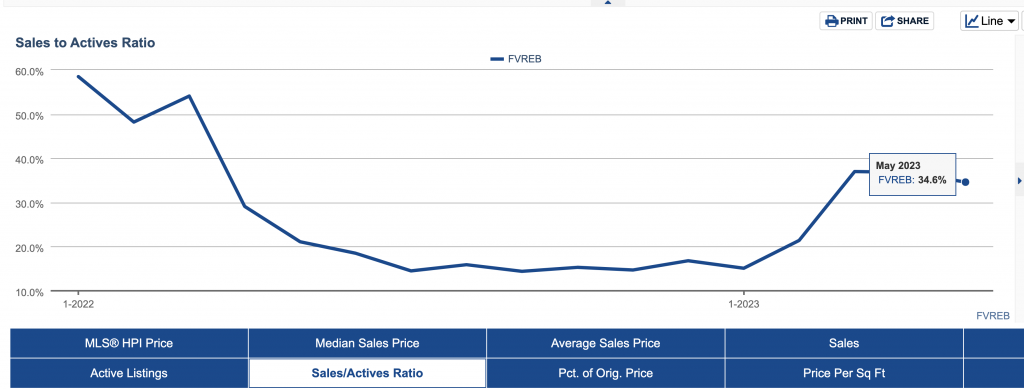

Currently, the Fraser Valley Sales-to-Active ratio for all property types sits at 34.6%. Anything above 20% sales-to-active is a seller’s market. This is used to measure the absorption rate of homes (how long it takes for them to sell).

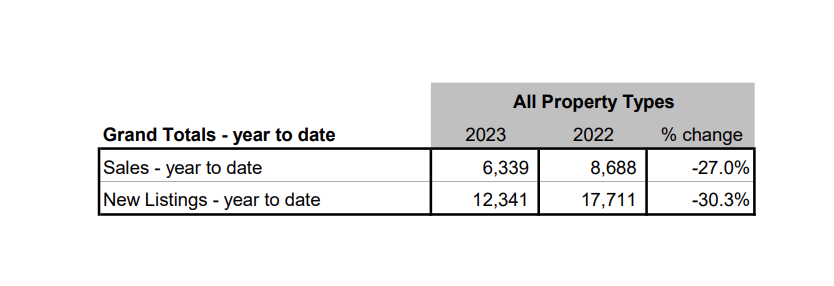

Sales and New listings are both down for the year. Sales are down 27% from this same time last year, and, new listings are down by 30.3% from this same time last year.

Benchmark Sales

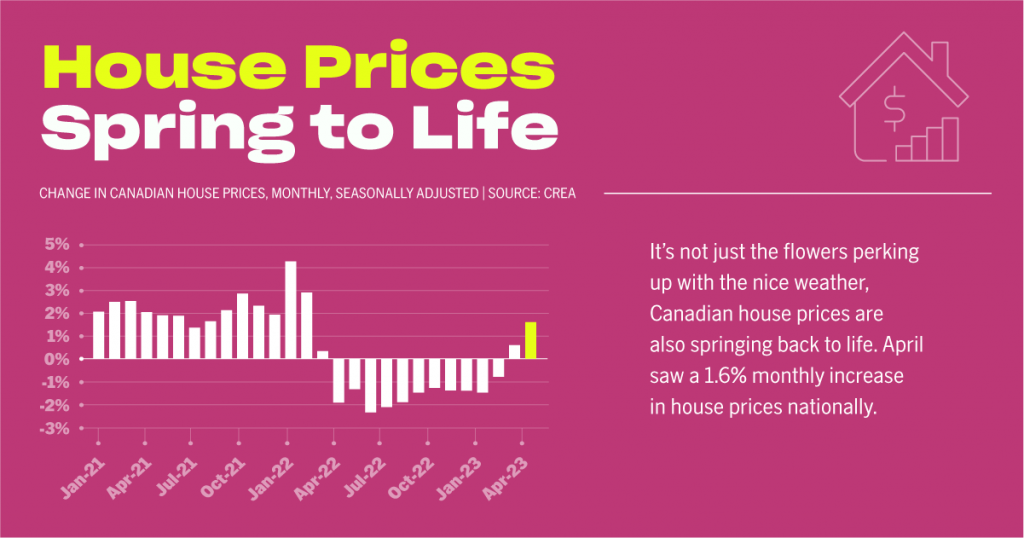

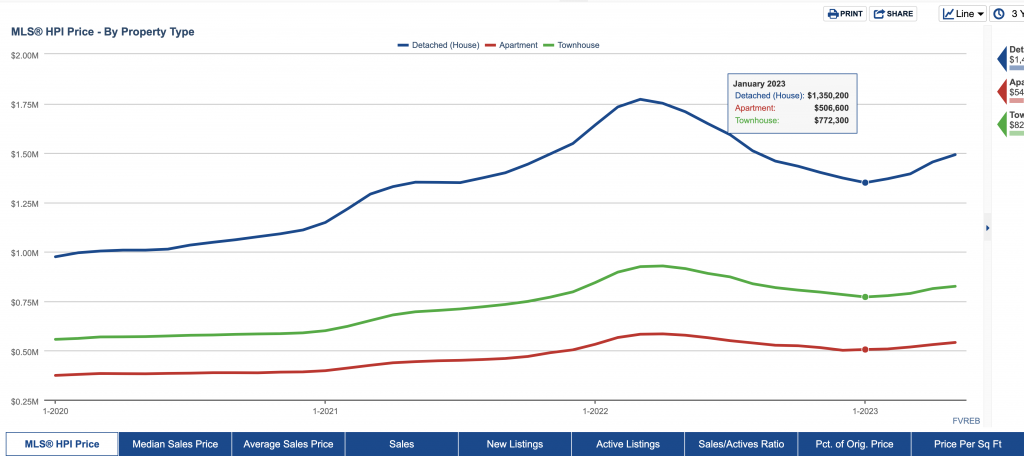

Fraser Valley Benchmark sales price increased for the 5th consecutive month. Despite the Bank of Canada’s decision to increase rates in January and June, we have seen consistent price increases.

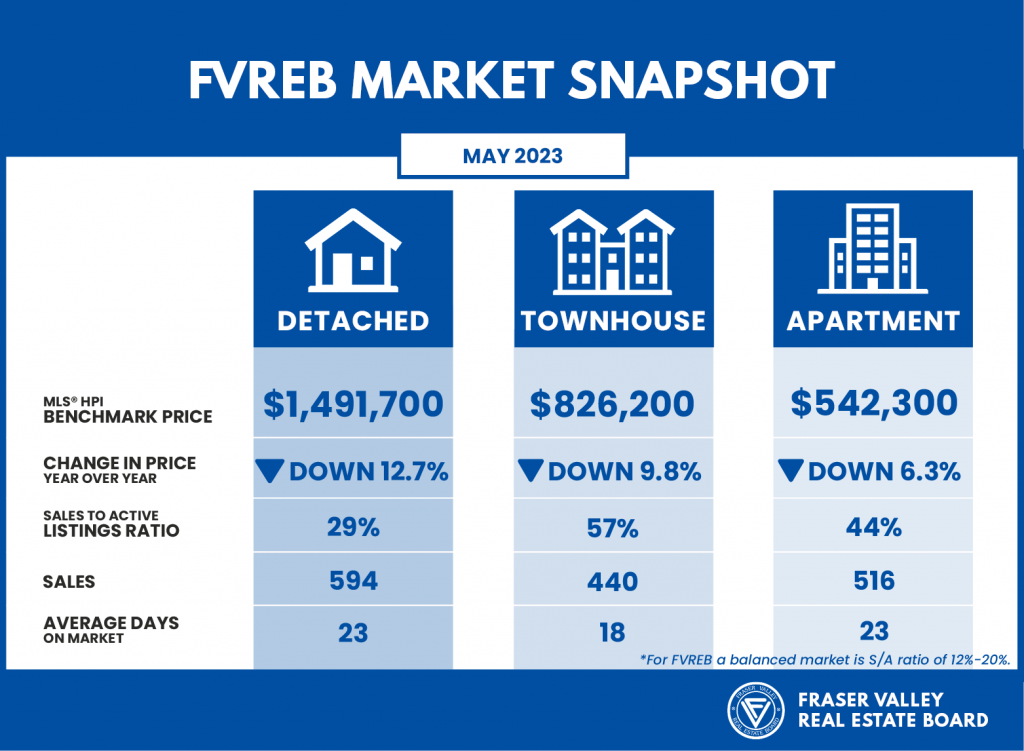

Fraser Valley Housing Snapshot

National Housing Snapshot