How Much Do You Need to Earn To Afford a $500,000 House?

I was recently interviewed by CTV on an article by Point2Homes that highlighted: Renters in the majority of Canada’s major cities cannot afford to purchase a starter home. I wanted to point out that this is not isolated to being a Vancouver and Toronto problem and that renters living in 36 of Canada’s 50 largest cities can’t afford a $500,000 house in their city.

To be clear, the article says starter homes – also referred to as entry level homes- used to be smaller dwellings, hovering around $200,000. The article written by Point2Homes recognizes that that is not realistic these days. To level the field, they considered starter homes to be valued at half the city’s benchmark price.

Income Needed to Afford a $500,000 House

To better help people understand the costs and qualifications involved in purchasing a started home in the Fraser Valley, I made a video! In this video, I break down the benchmark price of a Fraser Valley and Langley condo and cost out how much someone needs to make / year in order to qualify for a mortgage.

To see the full interview by CTV, click here

The Numbers

The benchmark price of a condo in the Fraser Valley is currently $552,200. Keep in mind this includes 1, 2, & 3-bedroom condos. As a first-time home buyer, if you are open to a 1 bedroom condo, the benchmark price decreases. Currently, the median price for a 1 bedroom condo in the Fraser Valley is $449,000, and the median sales price in Langley is $455,000.

For simplicity, I will use the example of $500,000 as a starter home price.

Income Needed:

If you are NOT putting down 20%, you need to earn $115,000/ year in order to qualify for and afford a $500,000 house. If you are putting down 20% or more (mortgage insurance not required), you would need to earn $105,000/ year to afford a $500,000 house.

Down Payment:

On a $500,000 home is $25,000. The structure in BC is 5% up to $500,000 with an additional 10% required for any amount between $500,000 and $999,999

No Property Transfer Tax is needed if the home is $500,000 or less. There are additional closing costs involved. If you would like a full list, you can email me at caileigh@caianderson.com and I will send it over.

Monthly Payments Required on a $500,000 Home

At an interest rate of approx. 5.2% amortized over 25 years with less than 20% down, the monthly mortgage payments come out to $2,962. Please consider adding strata fees, hydro, fortis (if there is gas), and property taxes on top of this amount.

Now, let’s compare the cost of home ownership to the cost of renting in the Fraser Valley.

Rental Prices

According to Rentals.ca, currently, the average rent for a 1 bedroom condo in Langley is $2,000/month + utilities. The average rent for a 2-bedroom condo ranges between $2,200 – $2,500 + utilities.

In short, on a monthly basis, renting is cheaper. That said, when you own a home, you are earning appreciation and paying down the principal of your mortgage. When you rent, you are paying 100% interest.

Considering the ongoing market trends, it is crucial to determine whether your income level allows you to qualify for and afford a $500,000 house. Based on the current benchmark price of $552,200 in the Fraser Valley, you need to evaluate your financial capabilities and make informed decisions.

Market Update

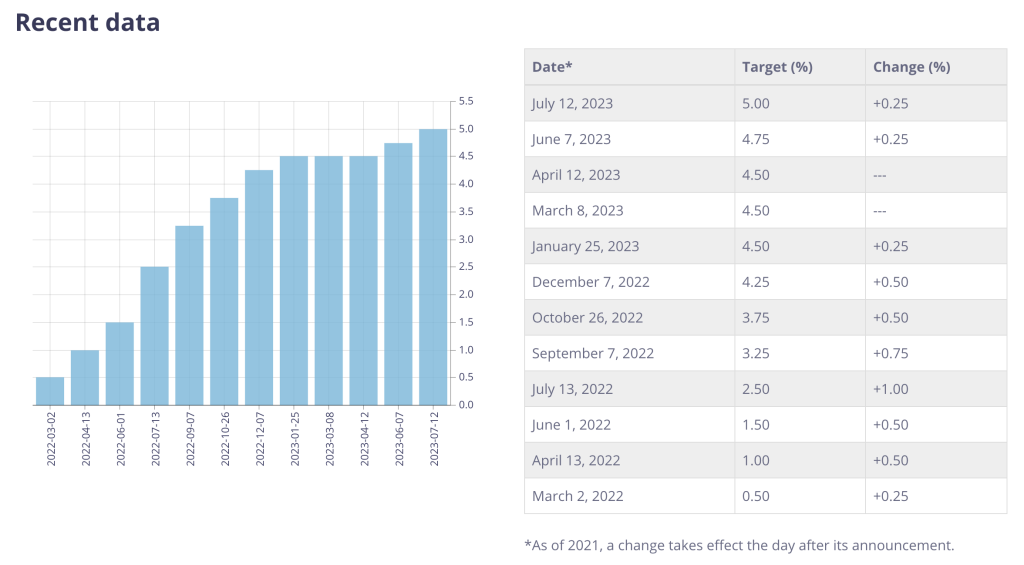

Prices across all asset classes in the Fraser Valley increased yet again this month despite the policy rate being the highest we have seen in over 20 years. The overnight lending rate now sits at 5%. To put this into context, it will cost someone roughly $600 for every $100,000 a person borrows. For example, if someone’s mortgage is $500,000, they can expect their mortgage payments to be roughly $3,000 per month.

Sales, Listings, and Prices Across the Fraser Valley:

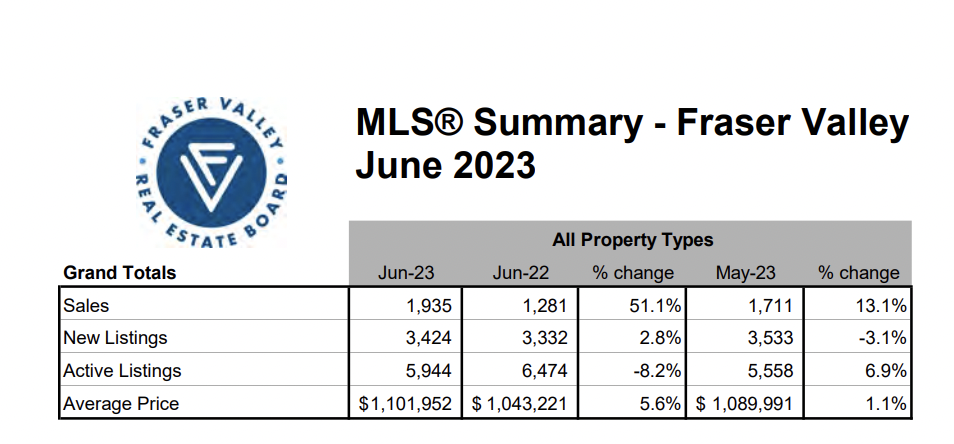

Looking at the chart below, we can see that sales are up quite dramatically on an annual and monthly basis. New listings have increased compared to one year ago, however, the number of new listings has decreased compared to last month. When we have an increase in sales and a decrease in new listings like we experienced over the last month, we can expect sale prices to increase as the absorption rate increases.

Days on Market:

Across Fraser Valley in June, the average number of days to sell a single-family detached home was 21

and a townhome was 16 days. Apartments took, on average, 22 days to sell.

To view the latest stats package, click here