Real Estate Sales & Sale Prices Fall for the First Time in 2023

The Fraser Valley and Langley real estate market has seen five consecutive months of rising sale prices, followed by the first recorded decline in both sale prices and sales volume as of July 2023. Below, I have provided a market update for the Fraser Valley and Langley regions. I’ll also go into broader trends within the Canadian real estate landscape with topics like Canadian debt, immigration patterns, and housing markets across the nation.

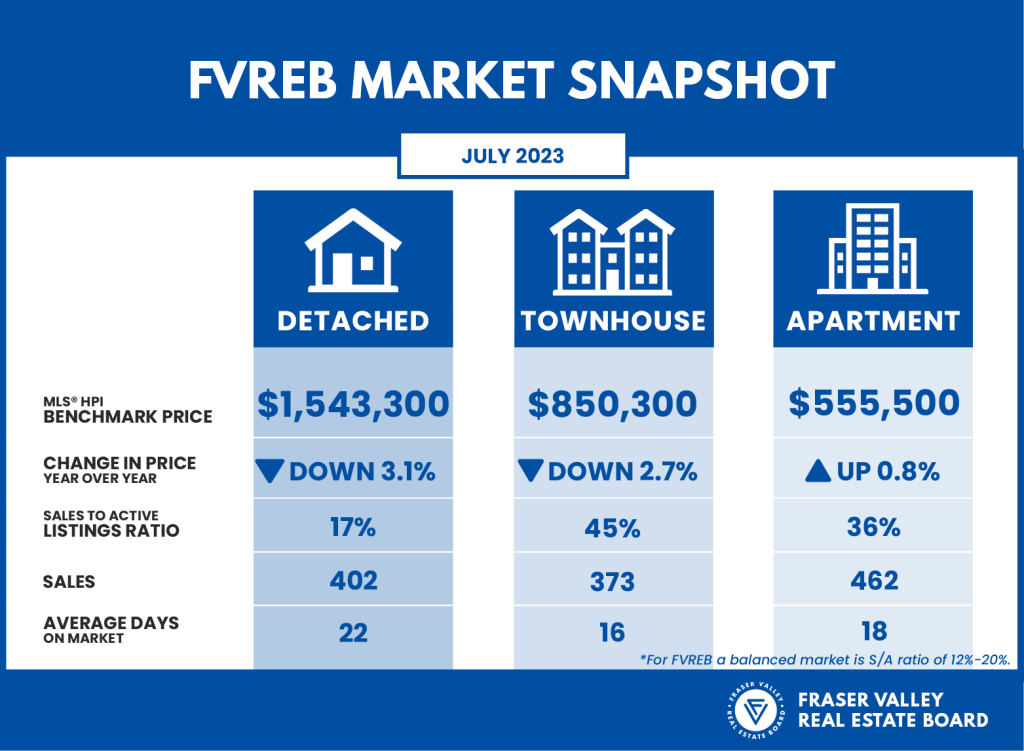

Market Snapshot

The decline in sales volume and sale prices in the most recent month is partly due to seasonality. The summer months usually see reduced activity. This can be due to many people taking summer vacations, leading to fewer property searches, and sellers opting to wait for the fall market. The slower summer months are important to take think about when breaking down the data from last month’s stats.

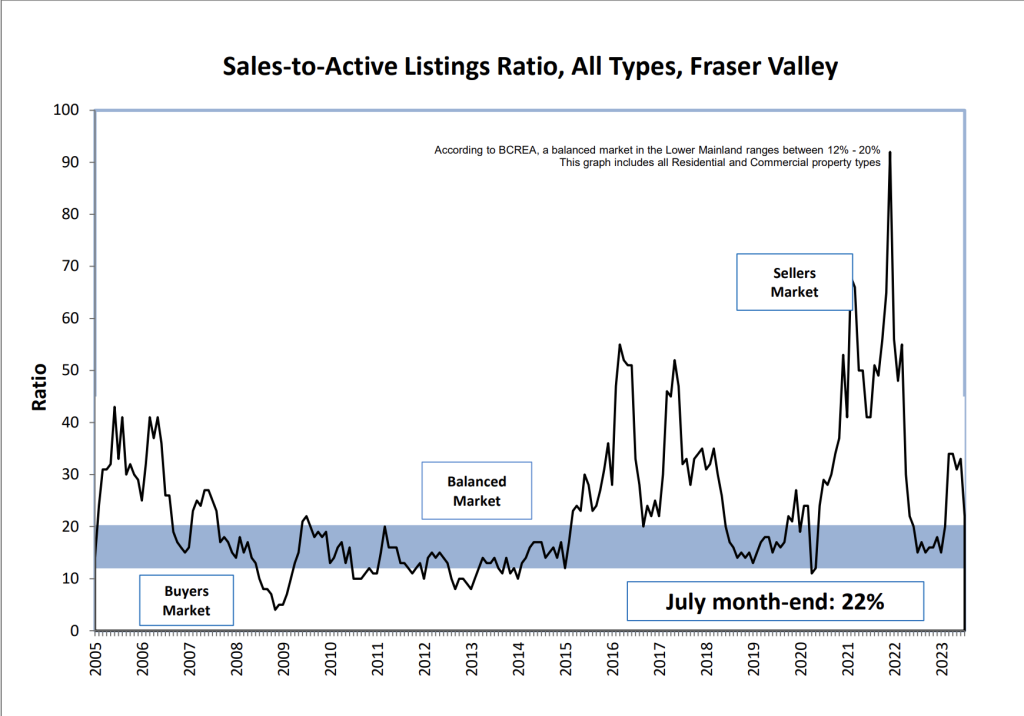

September and October are anticipated to provide crucial insights into the market’s trajectory for the remainder of 2023. Despite the recent downturn, the Fraser Valley retains its status as a seller’s market, with a sales-to-active ratio of 22%. Any sales-to-active ratio exceeding 20%, favours sellers and is classified as a “sellers market”.

Year Over Year

Comparing year-over-year data, we can see we have almost caught back up to last year’s higher real estate sale price trends. Detached home sale prices have experienced a decline of 3.1%. Townhome sale prices have reduced by 2.7%. And condo prices have risen by 0.8%. This is noteworthy, particularly considering the backdrop of 10 interest rate hikes since the market’s peak. This underscores the strong demand from buyers in the local market.

The Valley has been on a consistent increase in sale numbers for the entire year of 2023. An exception is the decline between March and April, with a noteworthy downturn in July. The trajectory of median sale prices from January to June shows a steady ascent. However, this patter was disrupted in the past month with the first decline in sale prices in 2023.

The two interest rate hikes in June and July, with another anticipated in September, give context to this decline. Economists and bankers predict an additional 0.25% increase, positioning the current rates at their highest levels in over two decades. Variable rate holders may experience interest rates ranging from 6.5% to 7%. Fixed rates vary between 5.5% to 6%, contingent upon the term selected.

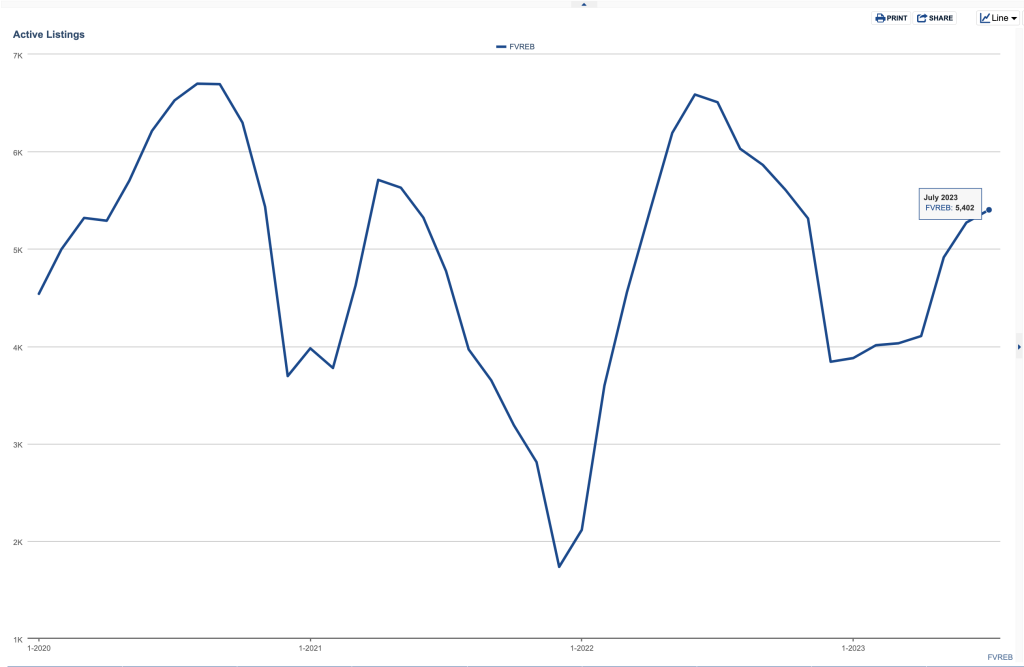

Active Listings in the Fraser Valley

Let’s turn our attention to active listings in the Fraser Valley for various asset classes. We have seen a consistent rise in inventory since December 2022. This rise in inventory benefits buyers with increased options but potentially challenges sellers due to heightened competition. The Fraser Valley presently holds just over 5,400 active listings. Remember, an ideal balanced market requires around 6,000 listings to be “balanced”. This meeaning one seller for each buyer.

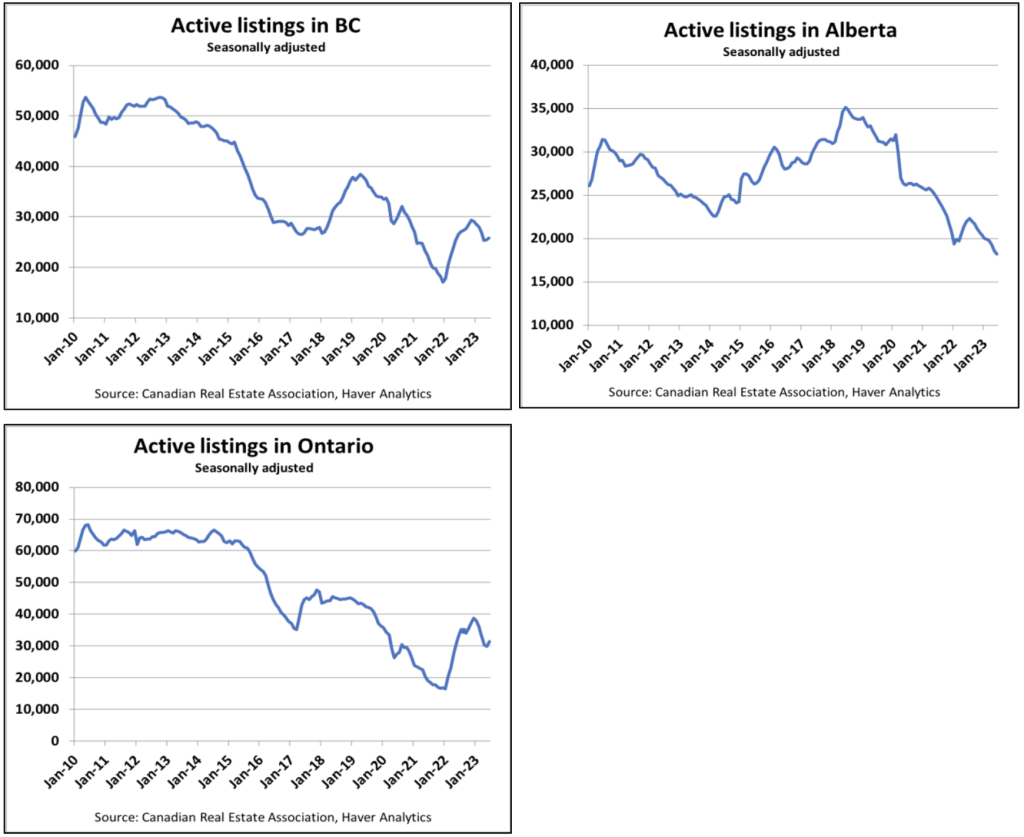

A comparative overview of active listings across different regions in Canada reveals an upward trend, reflecting the increase in inventory. BC and Ontario share similar patterns while Alberta sees an overall decline in inventory. This is due to the recent popularity of the Alberta market due to its comparatively discounted property prices.

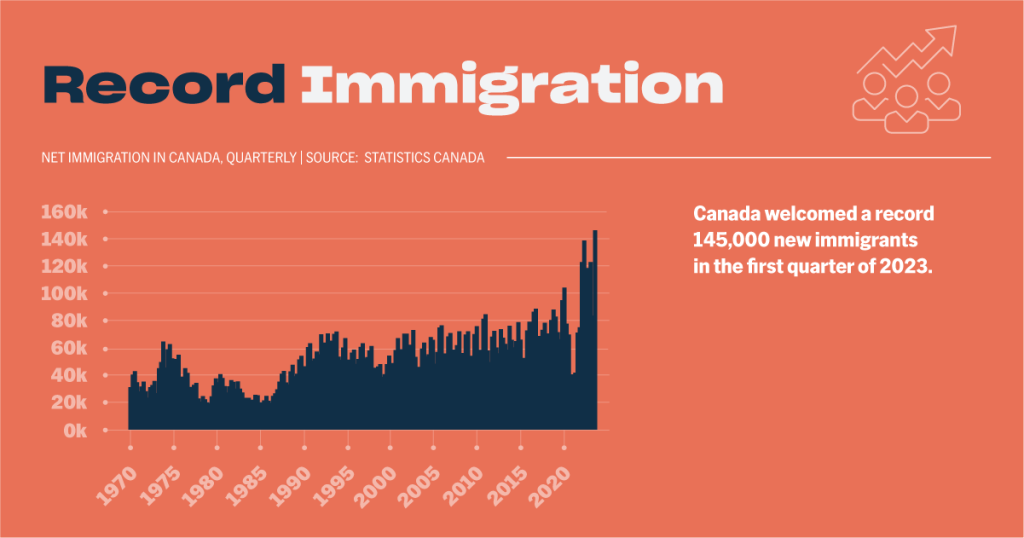

Immigration

High levels of immigration contribute to housing demand, while developers’ cautious approach due to rising interest rates adds to the shortage, sparking discussions about the need to manage immigration influx. Simultaneously, the Canadian household debt situation raises concerns, with credit card debt escalating by 13% from the previous year.

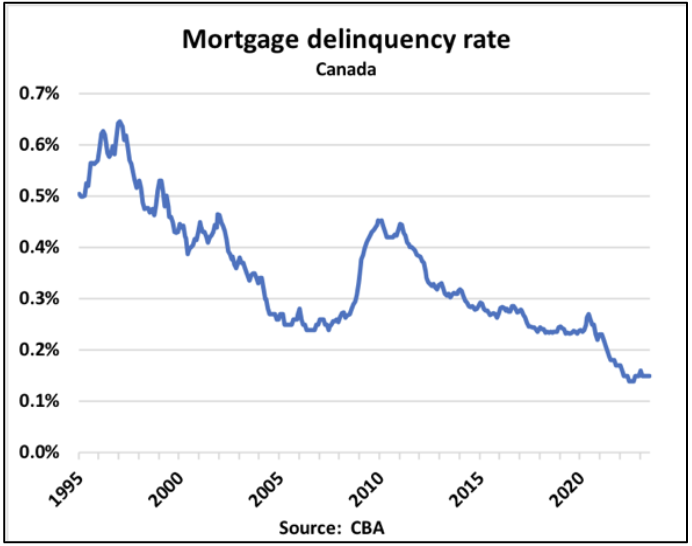

Mortgage Delinquency Rates

Mortgage delinquency rates remain remarkably low at 0.15%, but economists caution that rising interest rates may lead to an increase in defaults as renewal terms become challenging to manage.

As we look forward to the next Bank of Canada rate announcement on September 6th, we could potentially see another 0.25% increase. As the months of July and August are historically quieter, they may not offer a precise reflection of the market’s actual state. September and October are poised to provide a more accurate depiction of what can be expected for the Fraser Valley’s housing market in the remaining months of 2023.

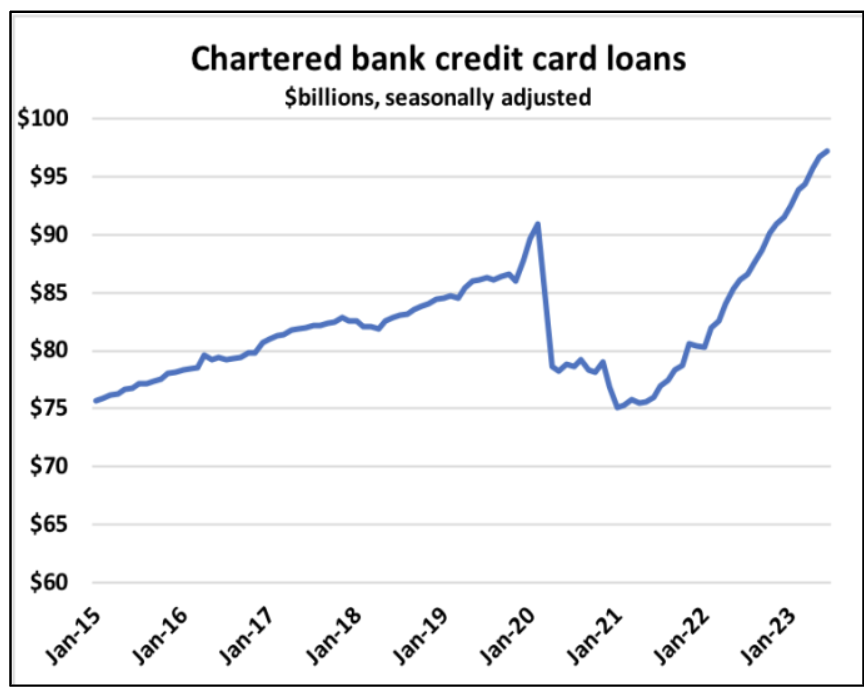

Canadian Household Debt

Canadian households see credit card debt jump with balances up 13% over the past year, suggesting some households have used up their savings and are now staying afloat by using high-interest credit card debt. If there is one thing about Canadians, it is that they do not like to miss a mortgage payment, resulting in higher credit card debts. We are expected to see these debts continue to rise due to the higher interest rates and overall cost of living.

Click to see more info and to see my latest listings.