September, 2023

Prices in the Valley started to fall in 2022 after the peak – and first-rate hike announcement- occurred in March 2022. However, when we look at the sale prices in 2023, it is interesting to see an increase in sale prices. Rates have increased 3 times in 2023 alone, with another expected rate increase to occur before the end of the year.

This trend of increasing sales prices is also surprising to see because, over the past year, we have seen a rise in the number of active listings. When more listings come onto the market, it can usually be expected that sale prices remain steady, or, decrease, which hasn’t been the case. This tells us that there is buyer demand in the Fraser Valley area.

We are heading towards more of a balanced market, whereas we have been in a seller’s market over the past few months. This is partly driven by the increase in new and active listings being brought onto the market.

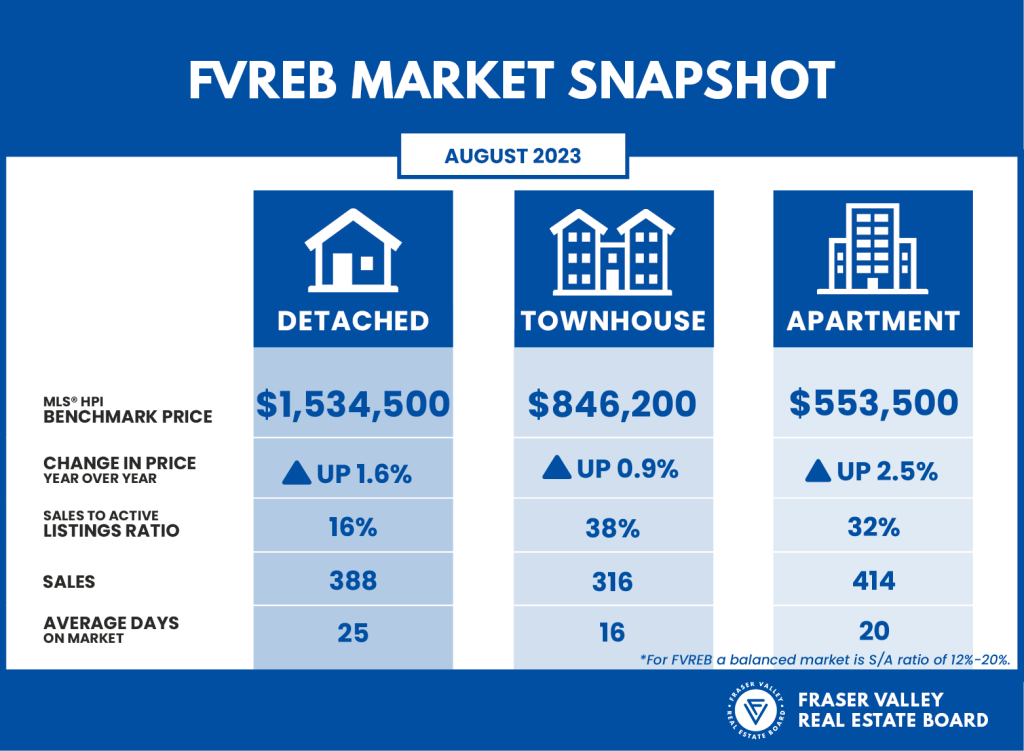

While demand for detached homes remains fairly balanced according to the board’s report, the demand for townhomes and apartments stood significantly higher in August. With a sales-to-active-listings ratio of 16%, the market for detached homes was balanced between supply and demand. Demand for townhomes and apartments remained stronger (38% and 32%, respectively). The market is considered balanced when the sales-to-active-listings ratio is between 12% and 20%.

Looking at Fraser Valley sale prices over the last year, all three asset classes have increased:

Over the next few months, I believe we may experience a lack of people wanting to move due to financial strain. Of course, people may have to downsize to put themselves in a better position financially, however, I do not feel it will be too common to see people upsize for the following reasons:

- With housing prices going up again over the past year, people’s net worths are also going up on paper. Therefore, it doesn’t make sense to sell and buy another property if the sale price of the repurchase is at a high price as well. People who own property now don’t want to move sideways or upsize at higher prices and high-interest rates.

- A significant amount of people who bought homes at low interest rates back in 2021 and 2022, don’t want to give up their low rates. Royal Bank of Canada, the country’s largest lender, disclosed that 43% t of its Canadian residential mortgages had an amortization period of longer than 25 years, as of July. That’s up from 40% year earlier, and just 26% in January 2022. https://financialpost.com/real-estate/mortgages/homeowners-extend-amortization-banks-mortgage-data.