Anderson Report: October, 2023

There are a lot of different opinions circulating around the Fraser Valley real estate market right now.

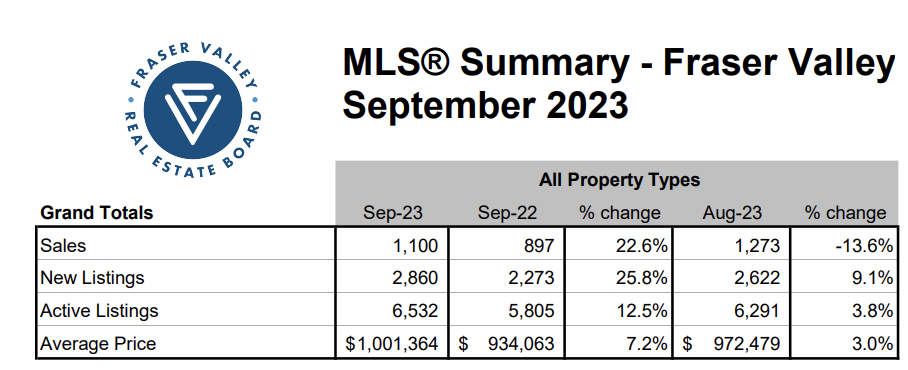

With sales down and listings up, the market balance tipped decidedly toward buyers in September, with the sales-to-active listing ratio sitting at 18% for all property types across the Valley.

Below I have broken down the Fraser Valley real estate Stats to bring you up to speed with what is happening in our local market.

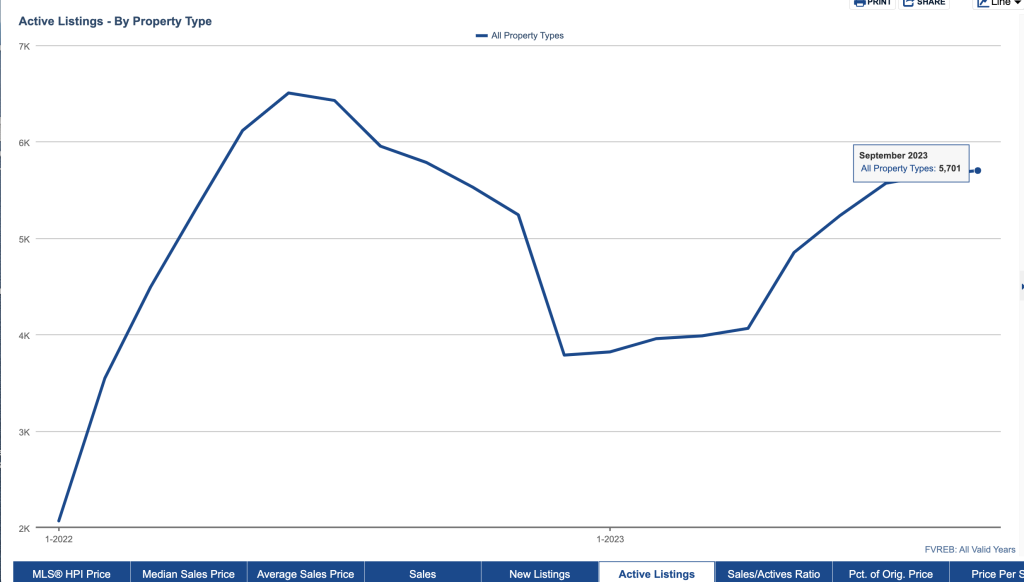

Active Fraser Valley Real Estate Listings

As of September, there are just over 5,700 active listings in the Fraser Valley. When looking at all property types in the Valley, we saw an increase in active listings over the last month. That said, condos attributed to the increase, moving from 1,398 in September to 1,432 in September. Detached and townhomes saw a dip in active listings between August and September.

With over 5,700 active residential listings on the market, overall, we are in balanced market territory. However, there are signals that we will continue to build up supply and head into an official Buyer’s market. In the chart below there is a visible inventory increase from the beginning of this year.

New Fraser Valley Real Estate Listings:

Looking month-over-month, new listings jumped almost 9% from 2,377 in August 2023, to 2,577 in September 2023 for all property types in the Fraser Valley.

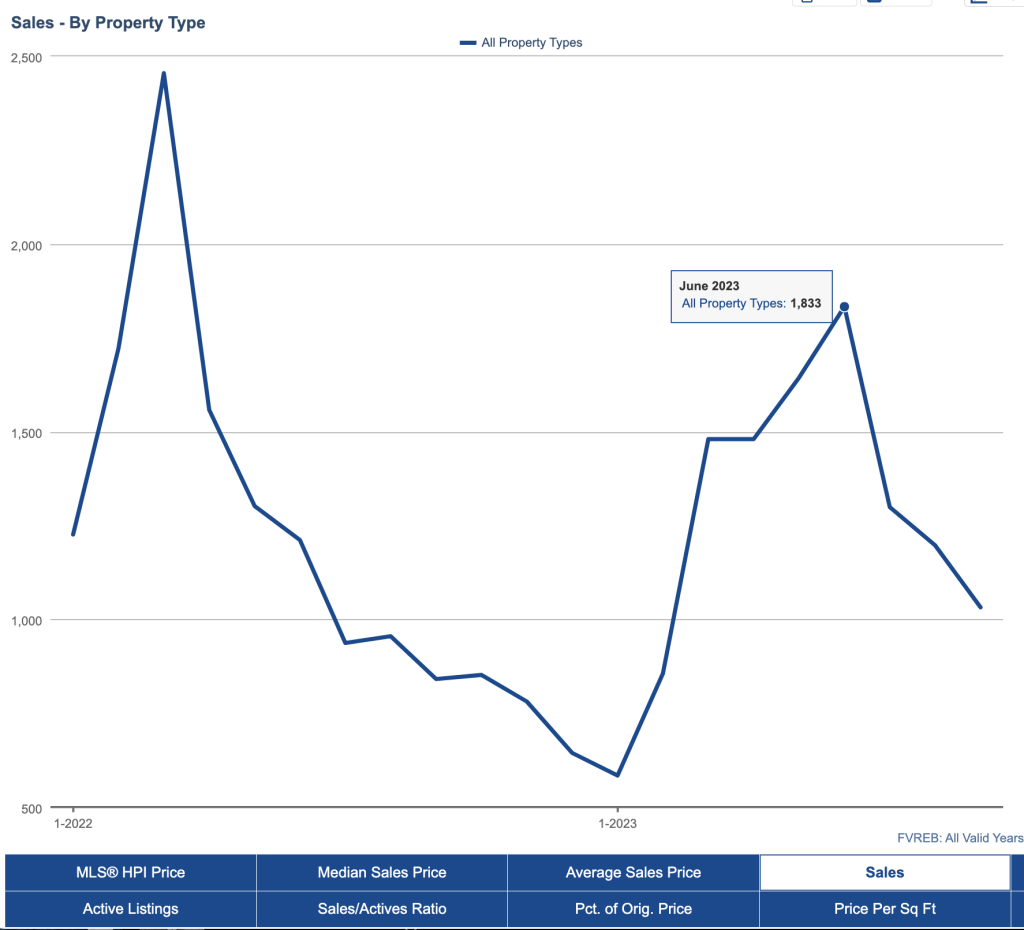

Fraser Valley Real Estate Sales

The number of Fraser Valley real estate sales have been on a downward trend since June, 2023.

We saw 1,100 sales in September 2023, down from 1,273 in August 2023. When we compare September 2022 to September 2023, the number of sales has increased 22.6%.

Sale Prices

Sales prices in the Fraser Valley real estate market fell month over month between September and August 2023 which rarely happens. Historically, August is the slowest month in terms of sales and sale prices. September is usually the start of the fall market where we see more activity.

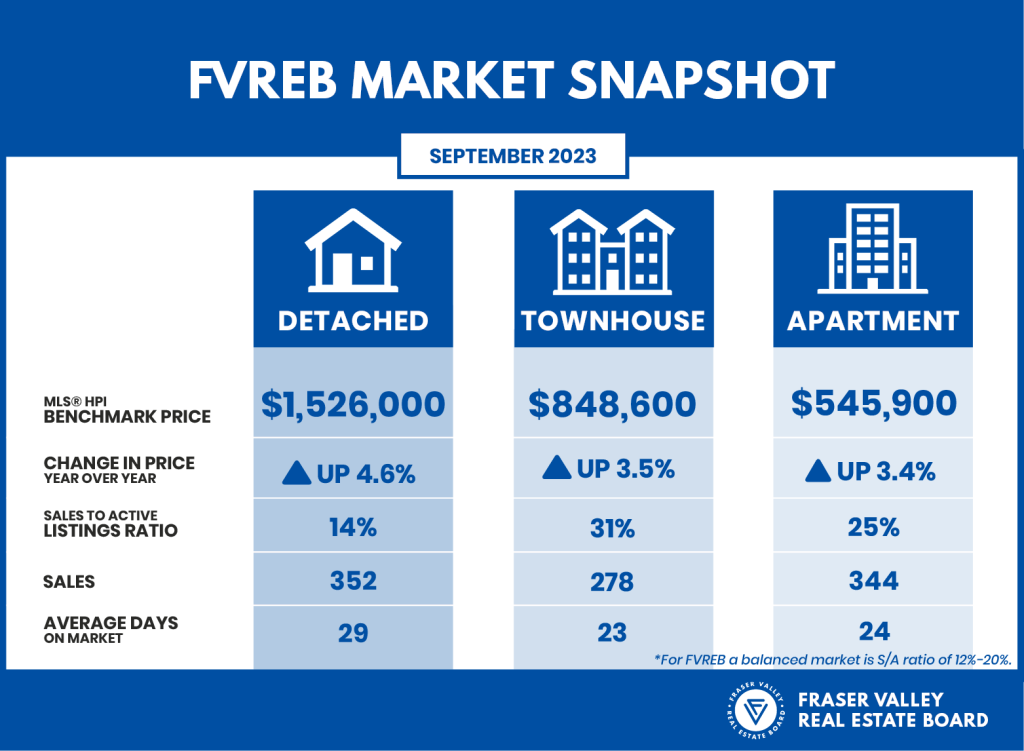

Despite more interest rate hikes this year, benchmark Sale Prices for detached, townhomes and condo are all up year-over-year. Month-to-month, the benchmark sales price for detached and condos have decreased, while townhomes increased.

| Single Family Detached: At $1,526,000, the Benchmark price for an FVREB single-family detached home decreased 0.6% compared to August 2023 and increased 4.6% compared to September 2022. Townhomes: At $848,600, the Benchmark price for an FVREB townhome increased 0.3% compared to August 2023 and increased 3.5% compared to September 2022. Apartments: At $545,900, the Benchmark price for an FVREB apartment/condo decreased 1.4% compared to August 2023 and increased 3.4% compared to September 2022. |

Sales-to-Active Listing Ratio

The single-family detached market is coming in with the lowest level of absorption, sitting at 12.6%. Remember, anything below 12% is a Buyer’s market. Townhomes are the hottest right now in terms of absorption. These sit at over 30% in both the Fraser Valley and Langley.

Here is a breakdown below: Ratios sitting between 12-20% indicate a balanced market

Fraser Valley:

- Detached: 12.6% (Balanced – Buyers Market)

- Townhomes: 30.3% (Sellers Market)

- Condos: 24% (Sellers Market)

Langley

- Detached: 17% (Balanced Market)

- Townhome 36% (Sellers Market)

- Condos: 30% (Sellers Market)

The detached market is getting hit the hardest. This makes sense because it is the most volatile of the three asset classes. The townhome and condo markets are still in sellers’ market territory, however, I think that will change over the next couple of months. Townhomes remain the second strongest, followed by condos.

My Thoughts

Over the next year or so, I believe there will be a lot of people who will be feeling the impact of re-financing. For example, those who purchased a home with a fixed rate term in 2020, and even 2021, at a rate of roughly 1.5% will be renewing at roughly 6-7% over the next year or so. The dollar value difference that comes with the increased rate is substantial.

Personal Real Estate Experiences

I want to share some inside insight with y’all about what has happened with my own personal clients in recent experiences to help shine some light!

I listed a Langley townhome at the beginning of October 2023 over the Thanksgiving weekend. We had three showings. Two of the three parties wanted to write an offer. We ended up getting both offers in at once, and the home sold for $15,000 over the list price. We were also able to achieve long closing dates. This was something important to my sellers as they have not yet found their next home. We even got the flexibility to change them 45 days back or forward if need be. The point being, that even in a market with increasing inventory and slowing of sales, homes that show well and are priced at market value are still attracting high demand.

I am working with a first-time home buyer looking to purchase in Fraser Valley real estate market. Their budget is $450,000. We have been looking for about one month steadily. So far, we have offered on three properties. We have managed to get one accepted offer but had to bail out due to a pending litigation on the building. The other two offers did not come together because the seller wanted way over the list price and we were the only offer. In one case, the seller countered us $48,000 over the listed price. In another case, it was $20,000 over the list price. On both occasions, we were the only ones competing. This is really frustrating when the Realtors on the other end do not educate their clients on the market conditions and recommend a dated pricing strategy.

Some Last Quick Notes

- I have a condo in Walnut Grove hitting the market today. It will be interesting to see what the action is on that. We priced it similarly to the last sales.

- We didn’t really get the fall push we normally see. I’m seeing buyers be very cautious and hesitant.

- Subject-to-sale offers are being seen, not necessarily in the townhome and condo market, but in the detached for sure.

- The next rate announcement for the Bank of Canada will be on October 25, 2023. The overall industry feeling is that rates will increase again by 25 basis points as they did not increase as previously expected in the rate announcement in September 2023.

- Inflation is sitting at 4%, down from the 8% high in July 2022.

- A new BC legislation implemented no short-term rentals with the exclusion of 14 resort towns and municipalities where the population sits below 10,000 people. Read the full article here.

Click here or more updates from me.