Have Interest Rates Peaked?

Interest rates

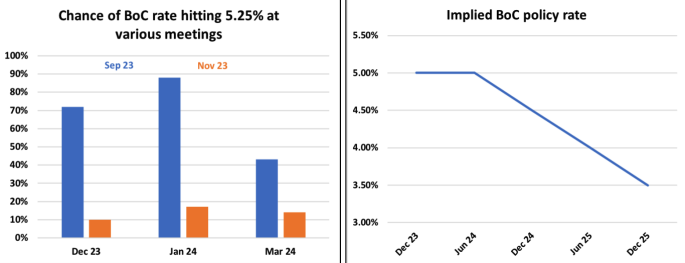

A lot of people had the feeling that rates would go up another 25 basis points, however, that was not the case and the Bank of Canada held the overnight lending rate at 5% at the last meeting, on October 25. The bond market finally started pricing in the reality that we may already be at the peak for the Bank of Canada this cycle. The odds of a hike in the overnight rate to 5.25% has collapsed from 90% in September to less than 20% today. Markets are now betting that the Bank will hold until Q2 next year before cutting and ending up in the 3.5% range in late 2025:

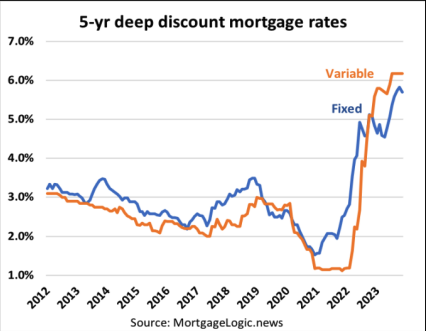

We’re now seeing fixed mortgage rates react, with deep discount rates down 13bps recently and that trend will likely continue.

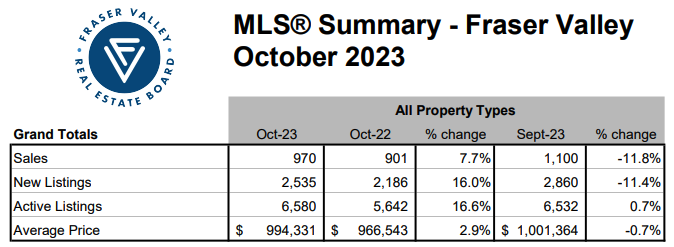

Sales

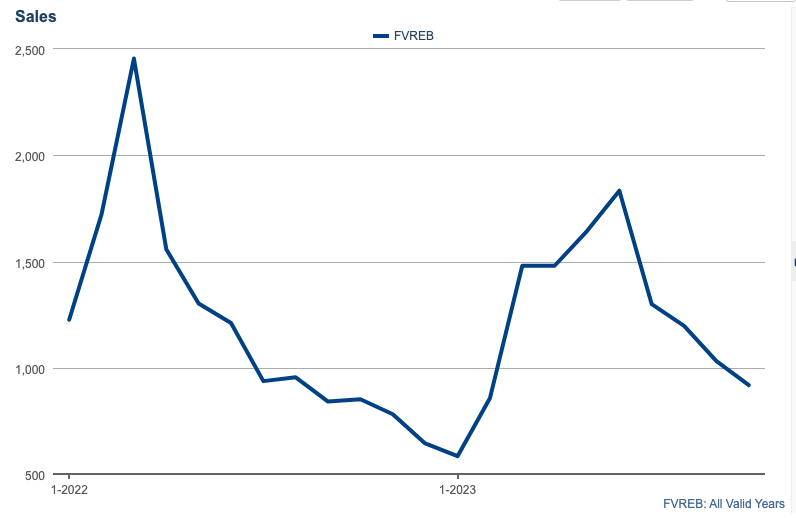

The number of sales last month in the Fraser Valley sat just below 1,000 at 970 sales in October, this is the fourth consecutive decline in sales since the peak in June, when 1,935 sales were recorded.

Sales fell 11.8% month over month, but they are up 7.7% year over year.

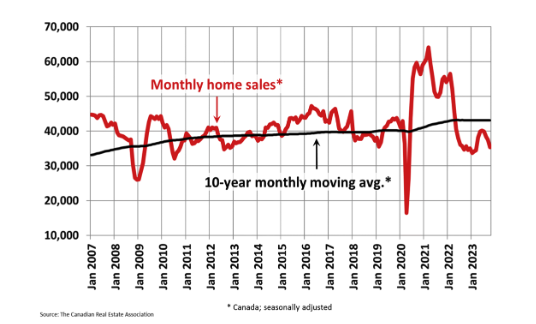

Looking at sales on a national level, they are still below the 10-year average. National home sales fell 5.6% month-over-month in October.

Housing sales across Canada, seasonally adjusted:

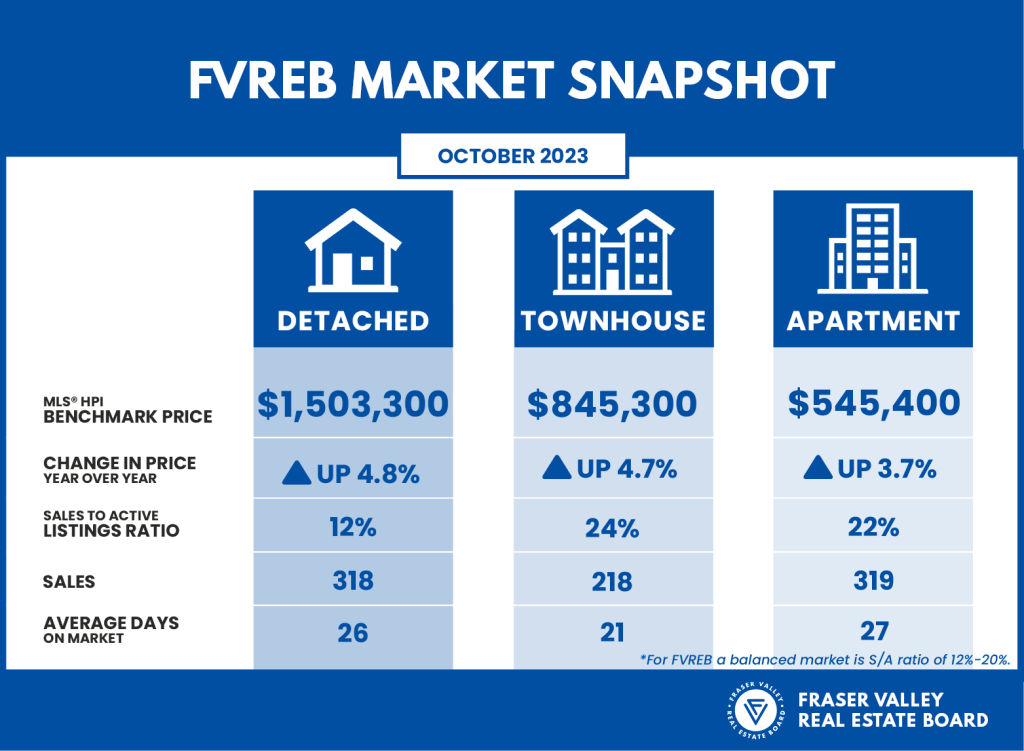

Market Type

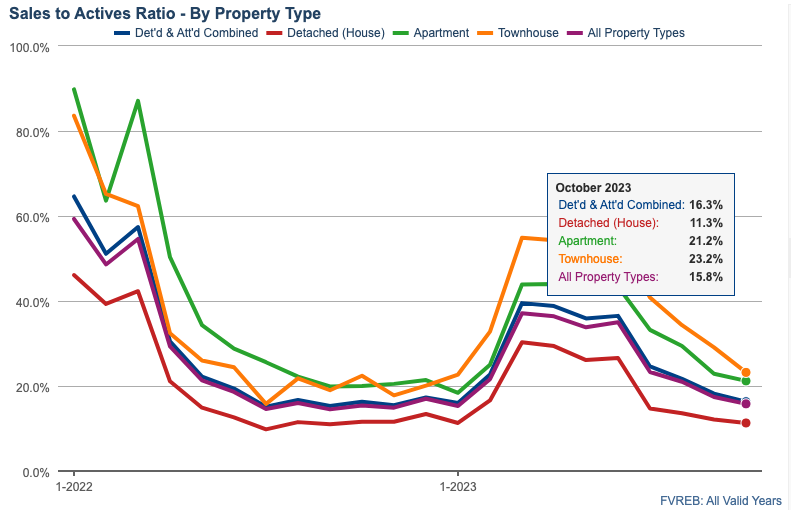

We are officially in a Balanced Market across the valley for all asset classes. The sales-to-active ratio sits at 5% as of October 2023, with detached houses dipping into buyers’ market territory at 11.3%. Condos and townhomes are hovering around the 20% mark. The market is considered balanced when the ratio is between 12 percent and 20 percent. Anything above 20% indicates a seller’s market. Anything below 12% is a buyer’s market.

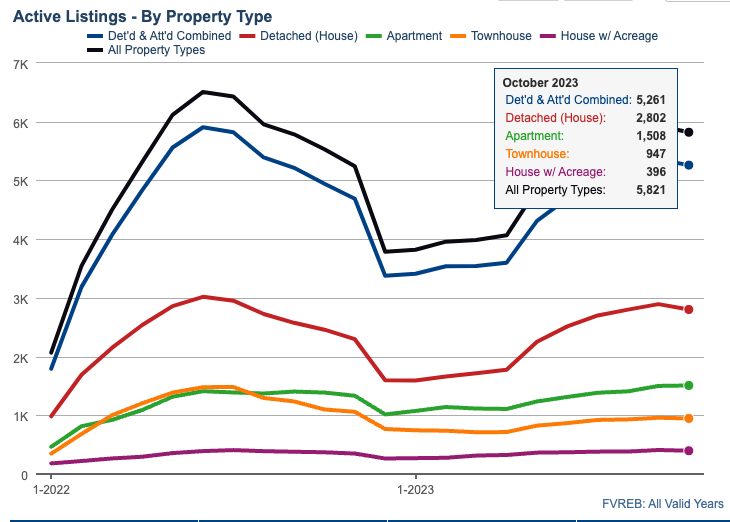

Fraser Valley: Active listings

The number of listings on the market is up 0.7% month over month. Active listings are up 16.6% year over year.

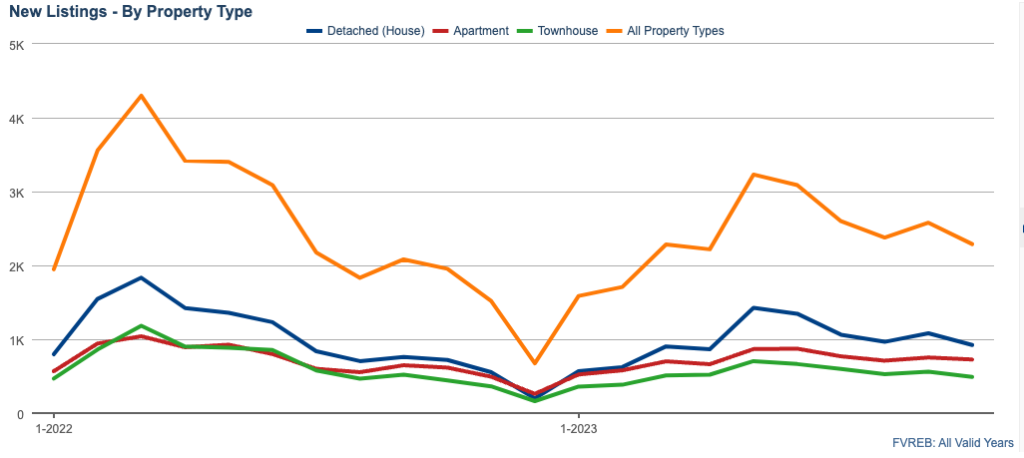

New Listings

In the Valley, new listings were down 11.3% month-over-month. It seems like people are winding down for the year and that most sellers are going to wait until the new year before listing their home.

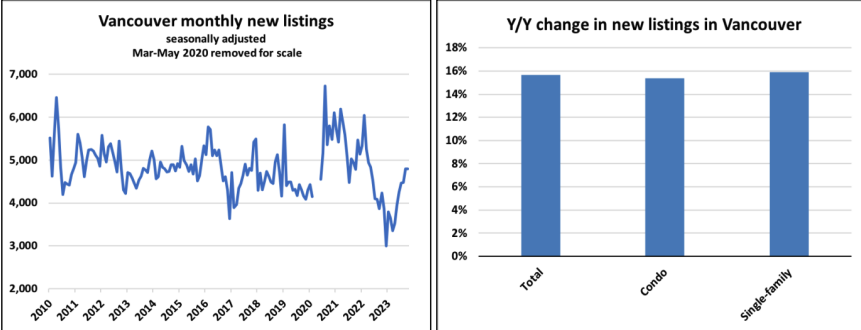

In Vancouver, seasonally adjusted new listings were unchanged in October but were up nearly 16% compared to last year at this time.

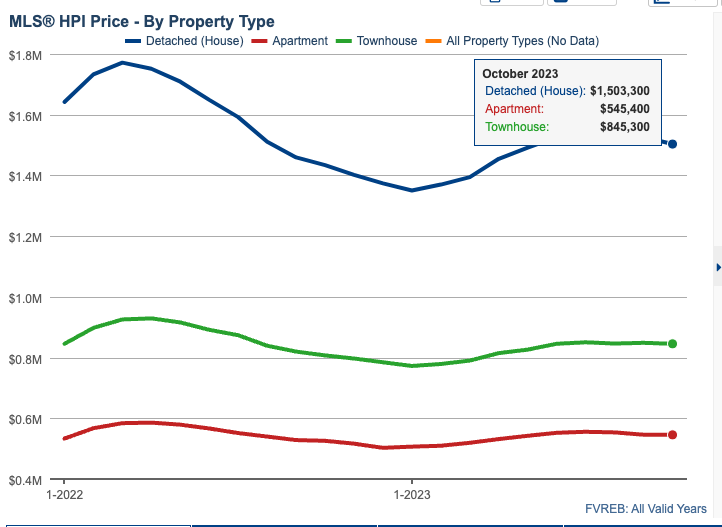

Benchmark Prices

Benchmark Prices continued to slide for the third month in a row. With fewer sales and more listings coming up, we should expect sale prices to continue to soften across the Valley.

Below I have summarized the Benchmark price for each asset class:

Detached: $1,503,300. Townhomes: $845,300. Condos: $545,400

My Thoughts

It’s important to remember that we don’t need rates to return to zero for this market to stabilize. Fixed rates were in the mid-4s this past spring and the market was just fine. We have another 120bps or so to go to get back to those levels, but at least the fears of a return to double-digit interest rates of the early 90s look likes it’s off the table. Sales have weakened but population growth has not. Demand is not gone, its affordability that is the challenge.

Right now, it is pretty difficult to put a deal together. Buyers are cautious about affordability and sellers are hesitant to put their homes on the market right now because rates are likely to hold and decrease and with that, more buyers will come forward.