In this Report, I go over my Top 5 Fraser Valley Real Estate Predictions for 2024. I’ll also share a bonus prediction to help you better prepare for the 2024 real estate market.

Prediction 1 – Interest Rates to be Cut Three Times

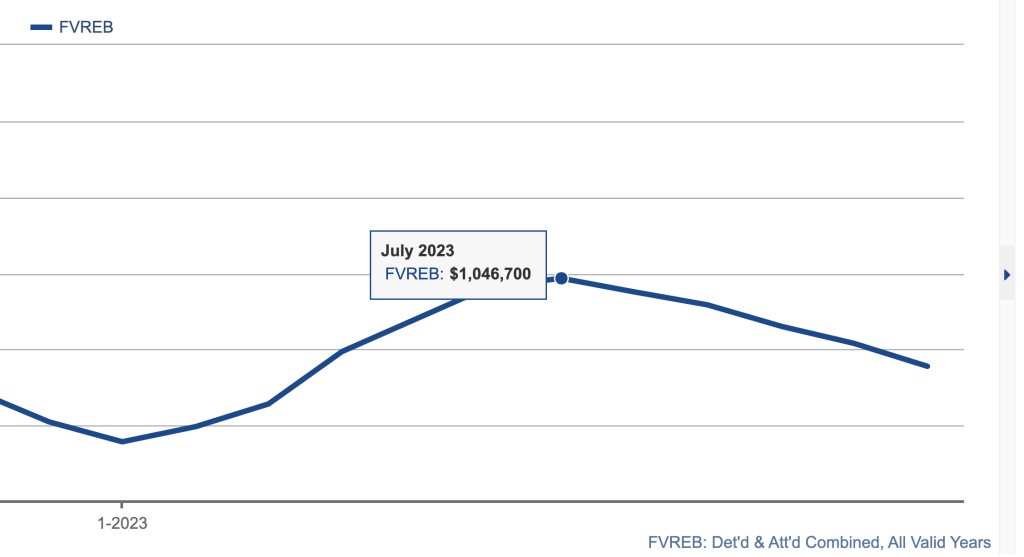

The Bank of Canada raised the overnight rate three times in 2023, for a total increase of 0.75% or, 75 basis points. The most recent rate increase was effective July 2023. Although this is not as intense as the rate increases seen in 2022, it has still affected consumer confidence and sale prices. After the last rate increase of 25 basis points in July, sale prices have been on a steady decrease.

In 2024, I believe the BOC will cut rates three times, each time by 0.25%, for a total of 0.75%. This brings the total overnight lending rate to 4.25% down from the current posted rate of 5%.

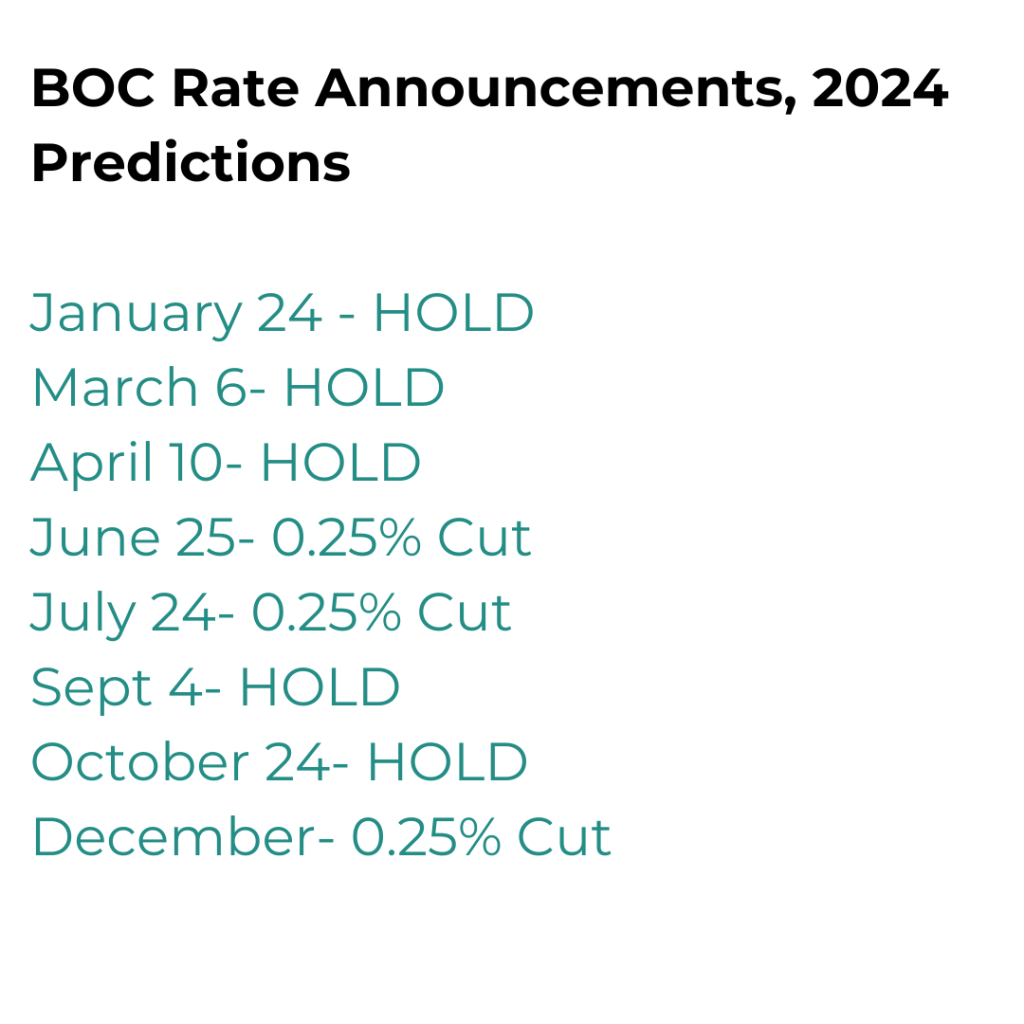

The BOC meets eight times per year to address rates. Here is the schedule below with my predictions:

I don’t think the BOC will reduce rates before the spring market because it may act as too large of a catalyst. The spring is the busiest time of year and rates have already been held for the last three meetings. This in itself caused an uptick in buyer demand. In some cases, we are seeing multiple offers again in the Langley and Fraser Valley real estate markets.

Finally, I predict a final rate cut in December 2024. Historically December is a slow month in terms of sales volume.

The chart below shows that fixed rates have already started to come down. Based on the 5-year bond yield, which correlates with the 5-year fixed rate, it can be expected that fixed rates will continue to decrease throughout 2024, and, not to get ahead of myself, but in 2025 as well.

Prediction 2 – Sale Volume Increase

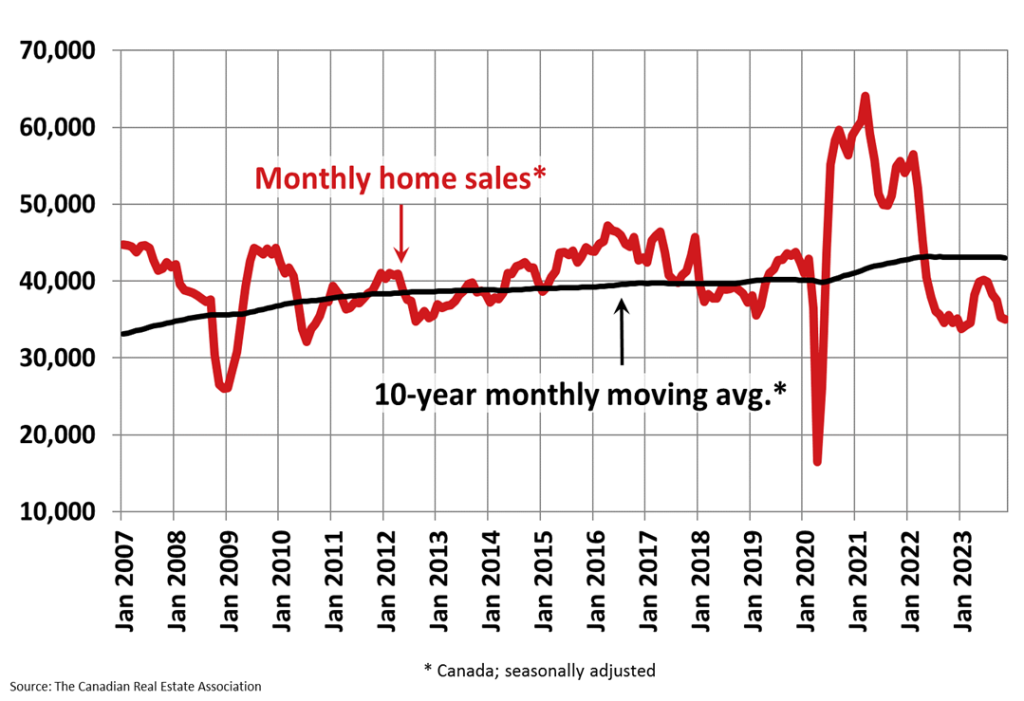

I think we will see an increase in sales activity in Fraser Valley Real Estate and Canada on the whole. In 2023, the number of sales recorded was the lowest it has been in over a decade, sitting 23% lower than the 10-year rolling average.

The main causes for this were increased interest rates, decreased consumer confidence, and high inflation. There wasn’t a lot of motivation for people to move due to affordability challenges. Not only are people less willing to take on more mortgage debt, but they are also hesitant to break their current mortgage and refinance at today’s high rates.

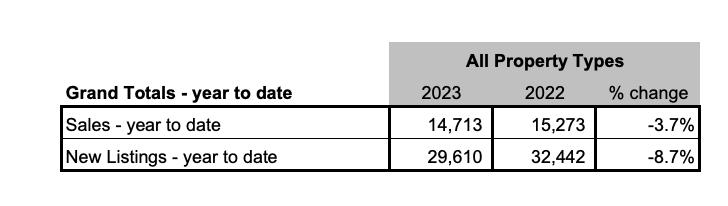

Sales year to date across the valley are down almost 4%. Sales volume peaked in June 2023. Usually, we see an uptick in sales in the Fall, but that wasn’t the case this past year. When rates continue to hold and eventually fall, more people will come off the sidelines and look to purchase again.

Prediction 3- Fraser Valley Real Estate Sale Prices Increase 8-10%

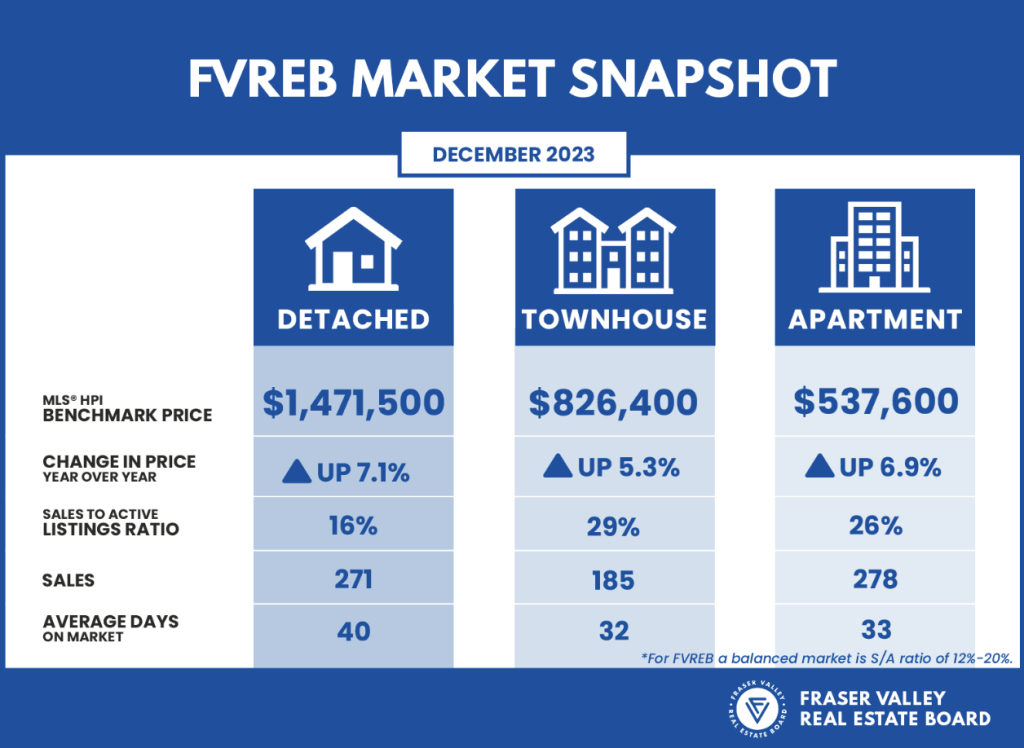

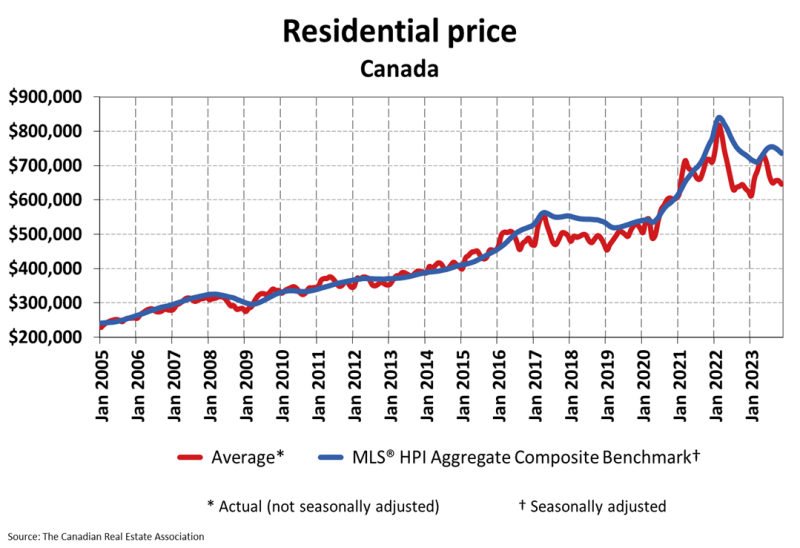

Looking back at 2023, sale prices peaked in June and July and have been on a steady decline ever since. Overall, sale prices are still up for each asset class year-over-year.

Detached prices are up 7.1%, Townhome prices are up 5.3% and Condo prices are up 6.9%.

The detached market saw the lowest increase in sale price over 2023, followed by condos and then townhomes.

Where We Will See Biggest Price Increases

This year we see a 3.8% increase in sale price increase. With projected rate decreases projected on the horizon, I believe an increase of 8-10% is reasonable. I believe we will see the biggest price increases being seen in the detached market. I have already seen people jump in to get ahead of the projected rate decreases expected in 2024.

Not only did sale prices see a decline over the past few months in Fraser Valley real estate, but overall on a National level as well, with the exception of Alberta, which has really seen pricing growth over 2022 and 2023.

Prediction 4: Active & New Listings Increase

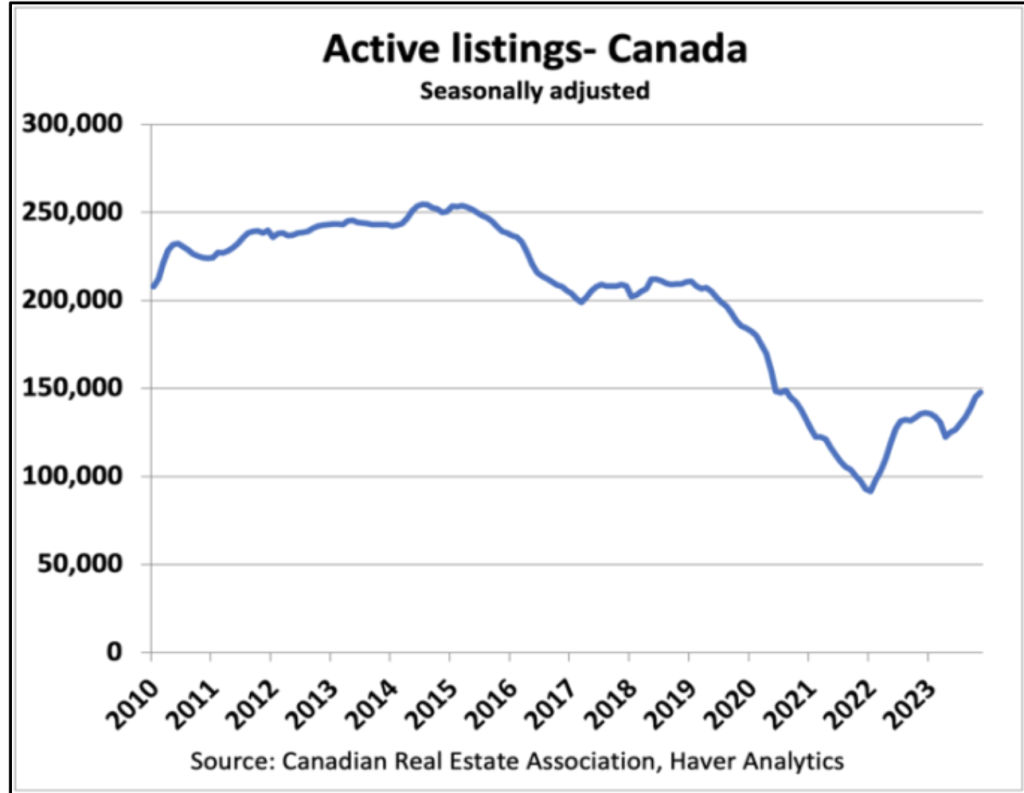

With recent sales activity down, we have seen a replenishment in the number of active and new listings coming onto the market in the Fraser Valley. With lower rates coming up, people can be more likely to make a move and therefore be able to list their properties for sale. In the past year and a half, breaking one’s current mortgage and taking today’s high rates, wasn’t very appealing. This resulted in fewer active listings on the marker.

Looking at a national level, active listings hit an all-time low in 2022, the peak of the market.

As we move towards a balanced market territory, generally this means a healthy number of listings are active on the market.

Prediction 5: Type of Fraser Valley Real Estate Market (Buyer, Balanced or Seller)

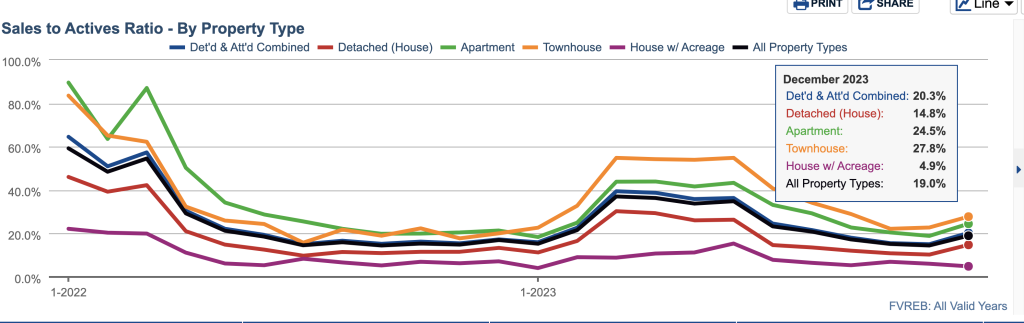

Currently, the summary of all property types as of the most recent sales data (December 2023), sits at a 19% sales-to-active ratio. This indicates a balanced market territory. To recap, 0-12% is a buyer’s market, 12-20% is balanced and anything above a 20% sales-to-active is a seller’s market.

Detached homes are sitting at the lowest absorption rate of 14.8%. Condos and townhomes are in seller’s markets.

Considering rates are going to go down, the condo and townhome market which are already in a seller’s market, could become quite competitive again for buyers.

Townhomes were the hottest asset class throughout 2023.

I predict the detached market will rise to 20-25%. Detached homes with a suite could be in demand.

Townhomes with a suite can be more on a month-to-month basis.

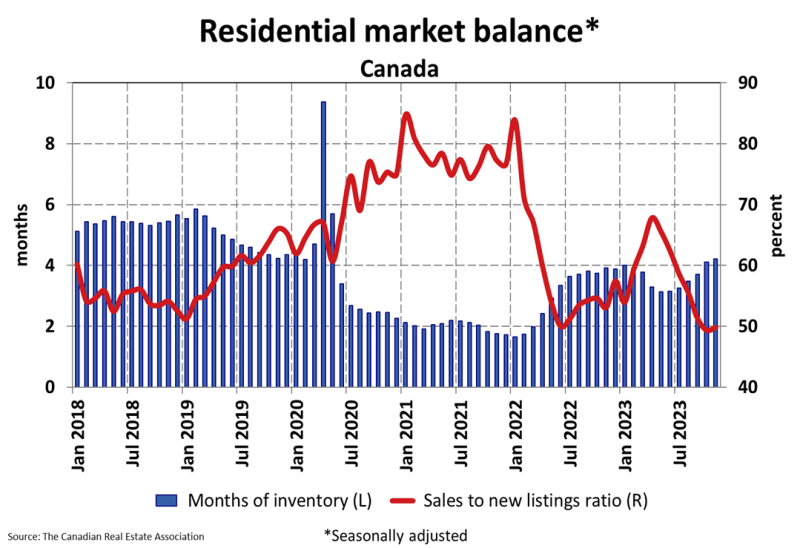

Months of Inventory (MOI) Canada

Absorption rates are measured in two ways; sales-to-active and months of inventory. Regarding months of inventory, Canada is sitting at just over the 4-month mark, indicating a balanced market. This is at healthy levels. Personally, I like to see it a bit higher, but I don’t think that can be the case as rates are expected to decline.

Investors coming back into the Fraser Valley Real Estate Market

I think locally, there are some more incentive for investors to come back into the market. There will be more on the market and rates will lower. To achieve monthly cash flow in the Fraser Valley, an investor will require approximately a 40% downpayment. However, in BC, the name of the game is long-term appreciation. Be prepared to hold your property for at least 5 years before. If you are an investor looking at cash flow only, and not necessarily appreciation, Alberta should be on your radar.

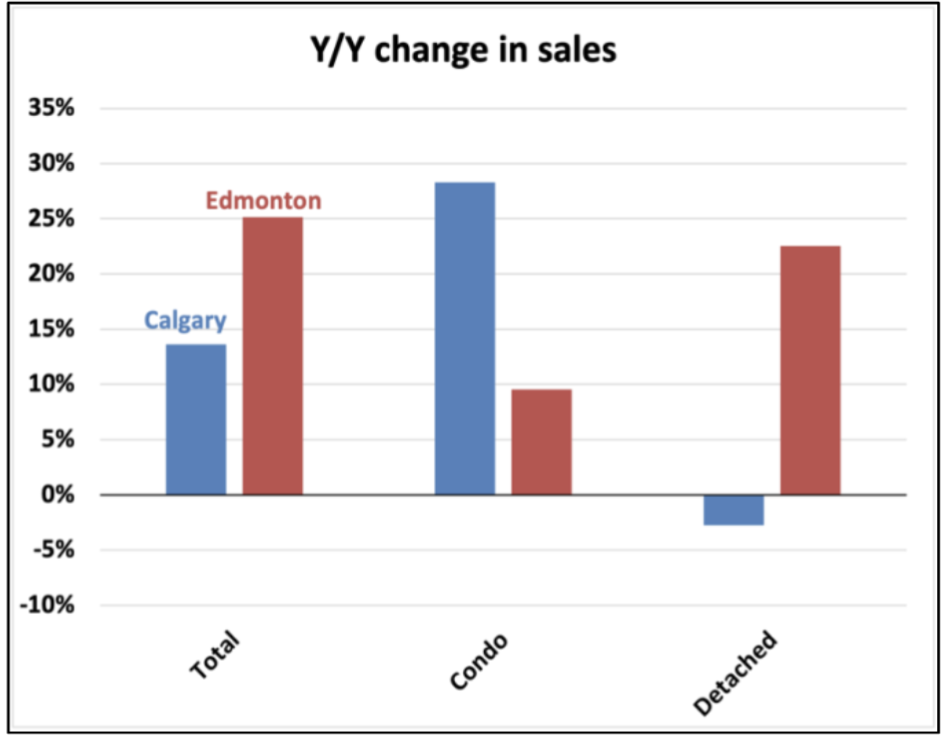

Demand in Alberta is very high for investors, specifically Calgary condos. These are sitting at over 25% more sales year over year. I expect Alberta to cool slightly in the upcoming year as other parts of Canada become more affordable. Historically, Alberta is not known for appreciation, however, I can see this changing as the cost of living continues to be a challenge in BC and Ontario.

Click to see more Anderson Reports.