Despite the two rate decreases announced in the last two consecutive Bank of Canada meetings, sales have decreased. In fact, this is quite the opposite of what people expected. The next Bank of Canada meeting is September 4th. A further rate decrease of 0.25% is expected to be announced.

We are reaching the point in the Fraser Valley real estate market – especially if there is a further rate cut in September – where we should start to see Buyers come back into the market. My open houses are busy, and I am getting consistent showing requests on my listings. However, when it comes to Buyers taking action and writing offers, very few actually are serious with their follow-through.

Bank of Canada Announcement Schedule and Results:

Fraser Valley Real Estate Market – New Listings Hit 10-Month Highs

Aside from low sales volumes in the Fraser Valley real estate market, we are seeing new listings increase. Consequently, this is causing active listings to rise. Seasonally adjusted new listings increased for the 4th consecutive month to hit 10-month highs in July. They rose 0.9% m/m and 6.5% year over year.

I expect we will see a high level of new listings right through the remainder of the year and into 2025. We are only now back to “normal” after 18 months of some of the lowest levels of new listings in the past 20 years. People who weren’t successful in selling their homes in the summer months usually try again in the Fall.

Sales

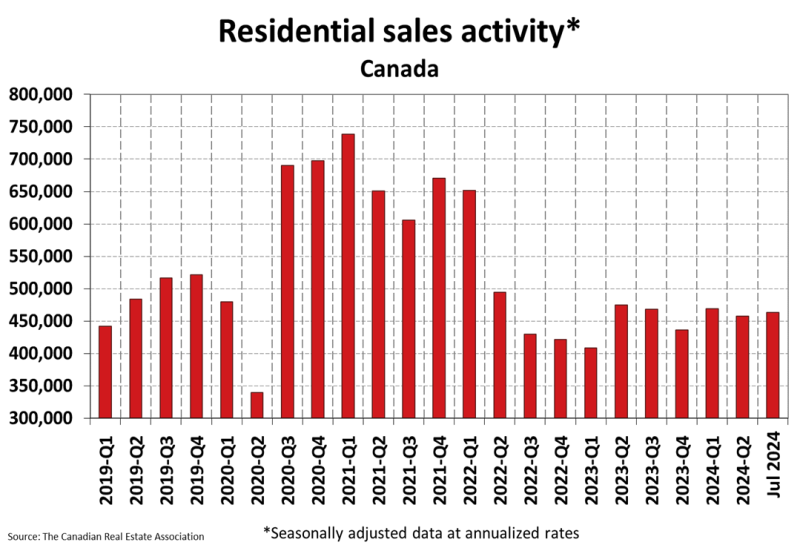

Overall, sales activity in the Fraser Valley real estate market, and all of Canada remain lower than historical trends and down from last year. National sales volume is still sitting below the 10 year trend.

Looking at the chart below, we can see that BC saw the biggest decrease in sales over the last year, followed by Ontario.

Balanced Market in the Fraser Valley Real Estate Market

Taking into consideration more new listings and fewer sales, it only makes sense that we are in a balanced market. Looking at the blue bars, we can see that months of inventory (MOI) is sitting at just over 4 months across Canada for all property types. This means that if no new listings came to market, it would take 4 months for everything to sell. 1-3 Months of inventory is a seller’s market, 4-6 is a balanced market and anything above 6 months is a buyers market. The red line measures the sales-to-active ratio which is another calculation on measuring absorption rates in the market. All property types in the Valley are sitting at 53%.

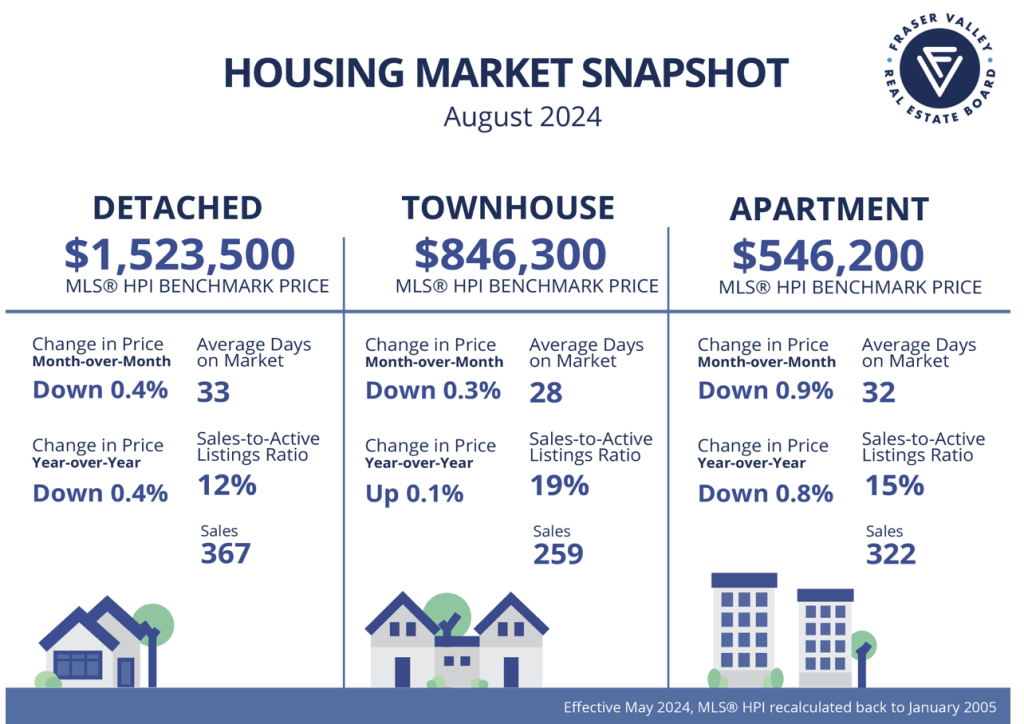

Housing Snapshot

Looking at the summary below, we can note that Townhomes are the hottest item right now, seeing a sales-to-active ratio of 19% indicating a balanced market (20% is a seller’s market). Fraser Valley detached homes are sitting at 12% sales-to-active listing ratio, which hovers on a balanced/buyers market. Condos are sitting in a balanced market.