What Should You Expect in 2025 for Canadian Real Estate?

Each year I write down my Canadian real estate predictions for the upcoming year. This is not financial advice. They are predictions, but each prediction has a lot of research behind them, they are very educated guesses backed by my 10 years of experience in the business.

Prediction 1 – Rates will Continue to Fall

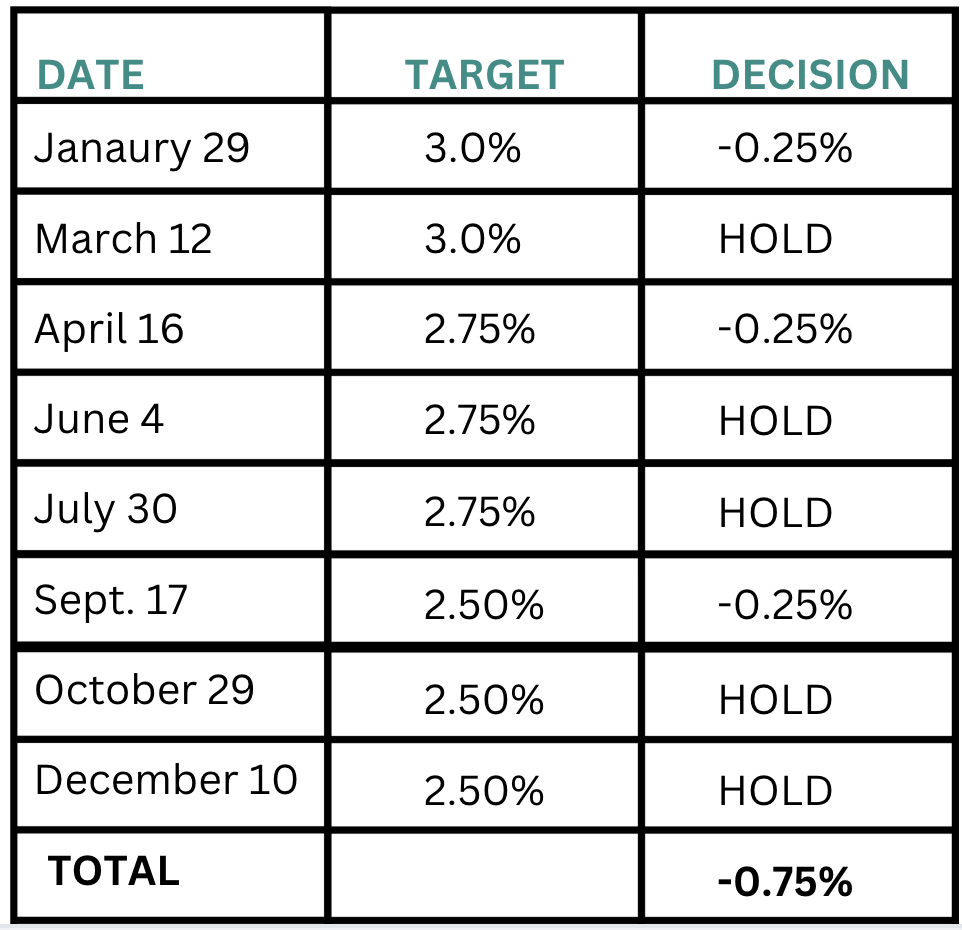

Despite the 5 consecutive rate decreases we saw over 2024, I believe rates will continue to fall throughout the year. Currently, the Bank of Canada overnight lending rate sits at 3.25% and I feel it will be at 2.5% by the end of 2025.

I don’t think they will make 50 basis point cuts like the two previous ones we saw in October and December 2024, however, I think we will see three, 25 basis point cuts throughout 2025. While rate cuts are good news, as they mean you will be paying less interest, they also mean our economy is not doing too great.

2025 BOC Rate Announcement Schedule and My Predictions

Prediction 2 – Sales to Increase

There are a few reasons why I believe we will see an increase in Canadian Real Estate sales over the next year.

Rates are expected to continue to fall. They will not fall as much as they did in 2024, but they will drop slightly. This should result in more buyers coming into the market due to affordability. According to the CMHC, roughly 85% of fixed-rate mortgages are coming due in 2025 that were contracted when the Bank of Canada rate was at or below 1%. This means there may be homeowners who have to offload their properties due to much higher monthly costs.

I believe we will see an increase in investors offloading their investment properties, specifically condos. I have personally noticed a lot of investors have listed their investment properties. Most of them bought when rates were low and are due to refinance soon, which will put them further in the red. Additionally, the government has implemented two new pieces of legislation that deter investors. The first is that any buyer who purchases an investment property must provide 3 full months’ notice to end the tenancy before they can move in. It can be challenging to find a buyer willing to wait this long before they get the keys. It also delays an investor from getting their money out if need be.

Government Change That will Impact Canadian Real Estate

Two new pieces of legislation have been introduced aimed at increasing buyers’ affordability. Which, in turn, will increase buyer demand and potentially lead to an increase in sales activity.

Effective December 15, 2024, the insurable mortgage threshold moving from 1M to 1.5M. This will allow some Canadians to get into a home while putting less down. Insurable mortgages require a minimum of 5% down on the first $500,000 and 10% thereafter. Uninsured mortgages require 20% down as a minimum.

Old Vs New Rules for Down Payment

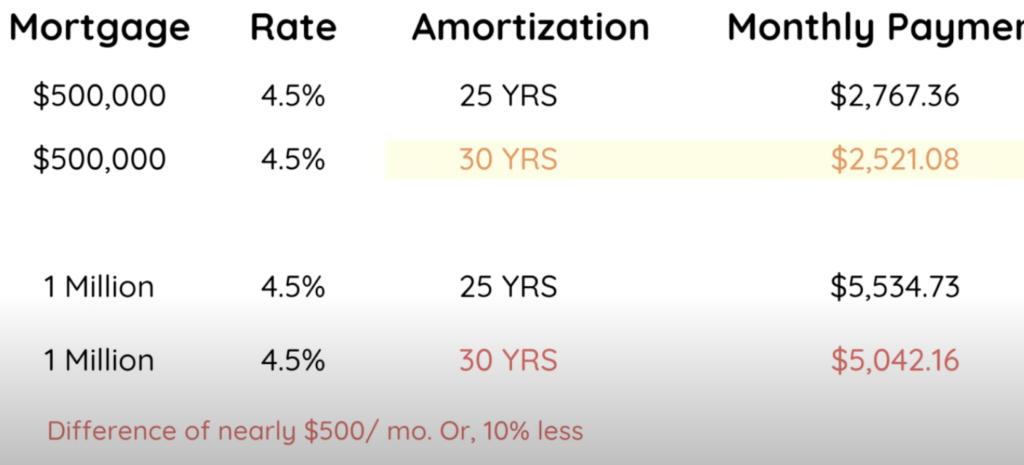

Also effective December 15, 2024, eligibility for 30-year mortgage amortizations to all first-time homebuyers and to all buyers of new builds has expanded. This will reduce the cost of monthly mortgage payments and help more citizens invest in Canadian real estate. Keep in mind, that it will also increase the total amount of interest paid overtime.

How the extra 5 years of amortization affects monthly mortgage payments

Micro and Macro Insight on Sales Volume

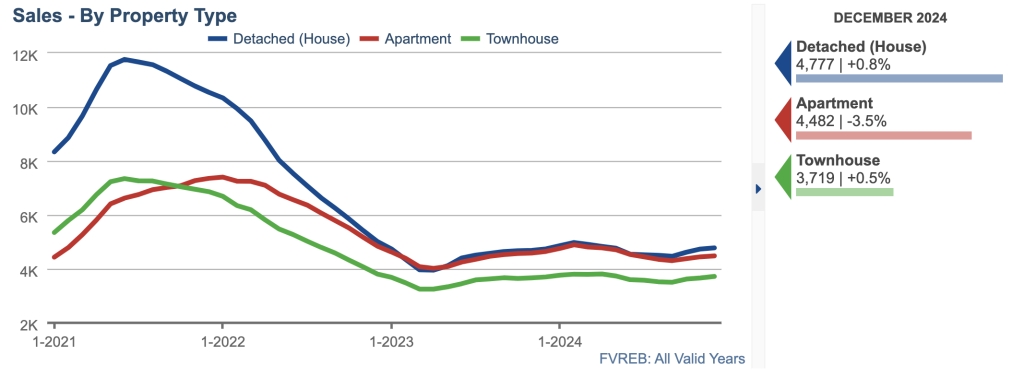

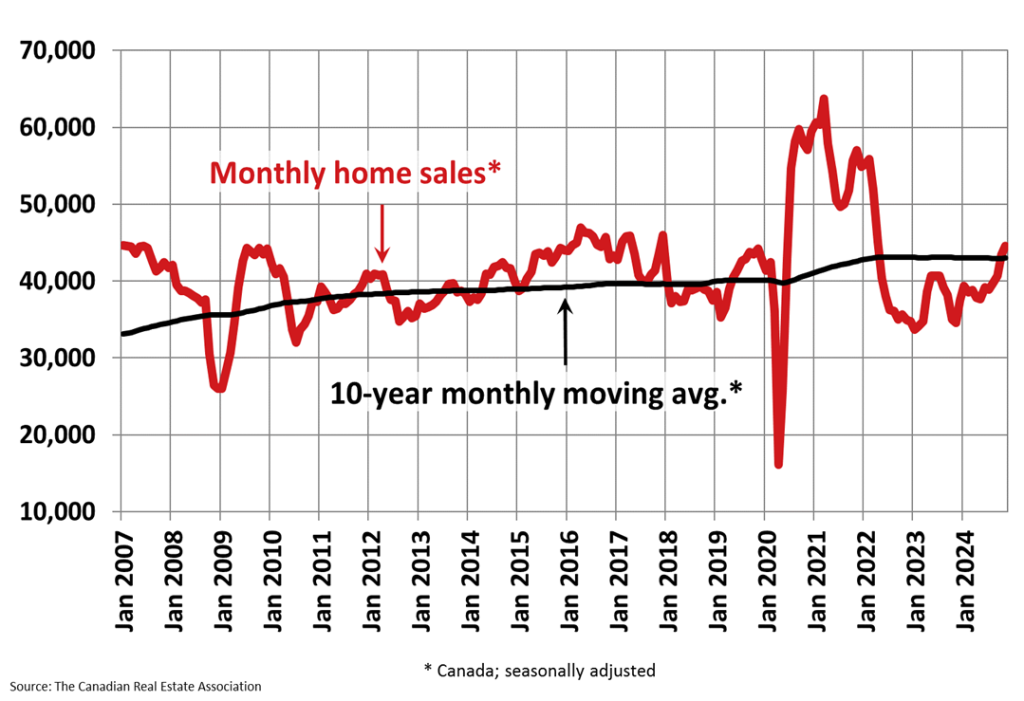

In 2022 and 2023, we saw a large decline in sales compared to the market’s peak in 2021. While 2021 Q1 of 2022 demonstrated exceptionally high sales, the decline that followed left the Canadian real estate market feeling sluggish. It has only been in recent months that we have started to see a recovery in sales volume.

Fraser Valley Real Estate Board Sales By Asset Class

Canada, 10-Year Sales Average For All Property Types

Prediction 3 – Benchmark and Median Sale Prices to Remain Stable, But Increase Slightly

There are quite a few property options in my marketplace of Langley BC and the Fraser Valley that are priced between 1M-1.5M. The new rule of increasing uninsured mortgages from 1M to 1.5M- lowering the down payment- will increase the buyer pool within that bracket, increasing prices slightly.

On the other hand, this will also increase the amount of Canadian debts :(. That said, even though the down payment is less, buyers still have to qualify for that mortgage in the first place and may have to put more down than the minimum requirements.

FVREB Sales for Detached, Apartments, Townhomes, and All Property Types Combined over the last 3 years

Prediction 4: Type of Market We are Seeing (Months of Supply)

Months of Inventory measures how fast homes are selling, and, ultimately provides insight on the overall health of the market. Since COVID, supply has been slowly building back up, which is a good thing. With an increase in active listings and a sluggish year for sales, months of inventory has increased. The highest levels of supply seen in September 2024.

1-3 MOI = Sellers Market

4-6 MOI = Balanced Market

6+ MOI = Buyers Market

I will try to get as specific as possible about where I think absorption rates will go throughout 2025.

- Detached – currently, in the Fraser Valley, detached homes are sitting at 5.2 MOI which is a balanced to buyers market. I think these will remain stable at the higher end of the balanced market, just below 6 months. I would say that detached would move into buyers market territory, however, homes with suites and those between the 1 -1.5M mark will do well this year due to the lower downpayment required to obtain one.

- Townhomes– at the end of the year were sitting at 3.2 MOI- just above a Seller’s market. I think this is the only asset class that will continue to see an improvement in absorption. I believe everything else will remain stable, and potentially increase slightly in supply. A townhome is a more affordable alternative to a detached home.

- Condos -the reality is that a lot of condos are owned by investors. I think investors are going to offload their condo investments over the next year due to the changes in the tenancy act announced this year. These new changes require providing 3 full months’ notice to end any tenancy. For some buyers, that is a long time to wait, making it more challenging to sell. Tenanted properties are challenging to show, and when they are shown, it’s not uncommon that they aren’t in “show ready” conditions.

- In addition to that, this past year, the government has increased the capital gains tax issued on successful sale from 55% to 66.7% of half of the profit over $250,000.

Prediction 5- Active listings to increase

Replenishing inventory since the later half of 2022 and I believe supply will continue to increase over 2025 as more people who have been waiting on the sidelines while rates drop, are ready to list their homes. When we do see rate cuts, it is interesting that it seems to be the sellers who get more excited than the buyers.

Active Listings by Property Type – 12-Month Rolling Average adjusted for seasonality

Want to talk more about Real Estate? Book a call with me here