Each year, I put forward my predictions for the upcoming real estate market. Reflecting back on 2025, it was a very challenging year for real estate. Sales were sluggish, and putting deals together was difficult- offers with subject to sale written in them were not uncommon. The Fraser Valley Real Estate Board recorded 12,224 sales in 2025, a decline of 16 per cent over 2024 and 33 per cent below the 10-year average. I anticipate this year to be stronger than 2025 in terms of the number of sales and overall consumer confidence.

Here are my predictions for the 2026 local real estate market:

1. Rates to Remain Stable

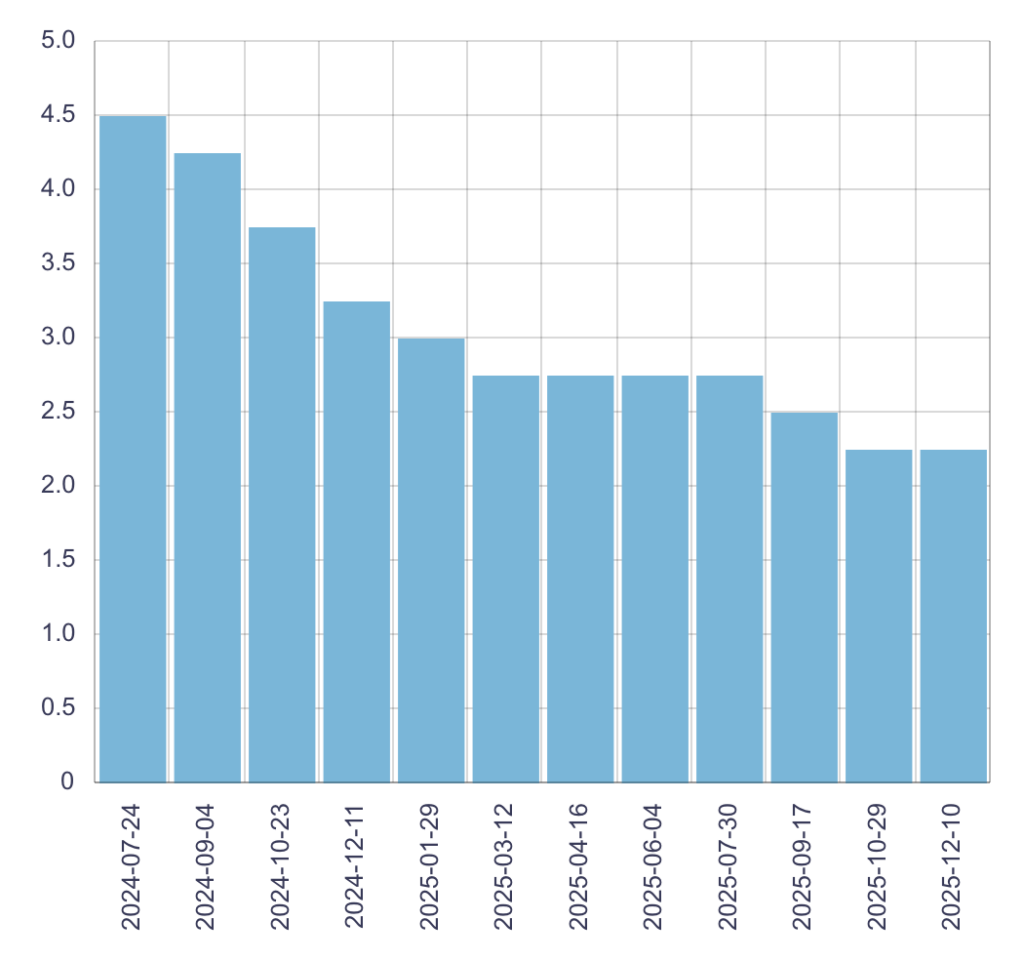

I think we can expect the overnight lending rate to remain stable. The BOC meets eight times/year, and in 2025, they reduced the rate four times, from 3.25% to 2.25% over the course of the year.

Variable rate is reflective of the overnight rate; therefore, I expect variable rates to hold. Currently, variable rates are sitting at just above 4%.

Fixed Rates

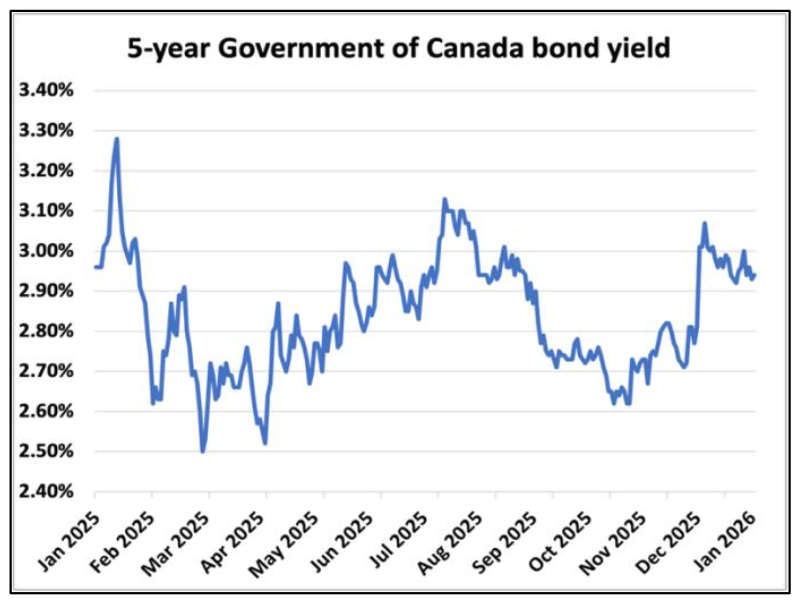

Canadian fixed mortgage rates are holding steady amidst bond volatility. Trade uncertainty continues to be a drag on economic growth.

Currently, fixed rates are sitting just below the 4% mark (depending on how many years you lock in for). I don’t think fixed rates will drop further; in fact, I think they may rise at the end of the year.

Fixed rates are tied to long-term bond-yields. Bond yields appear to have stabilized and even risen a bit recently, suggesting little downward pressure on fixed mortgage rates. So, if you are locked into a fixed rate, and the overnight lending rate changes, it will not affect your monthly mortgage payments. It will only affect you if you have a variable rate or if you are getting a pre-approval or refinance in place.

2. Sales Volume to Increase & Active Listings to Decline

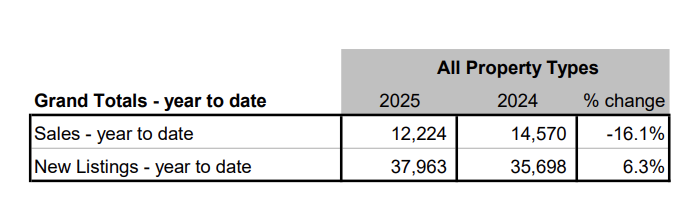

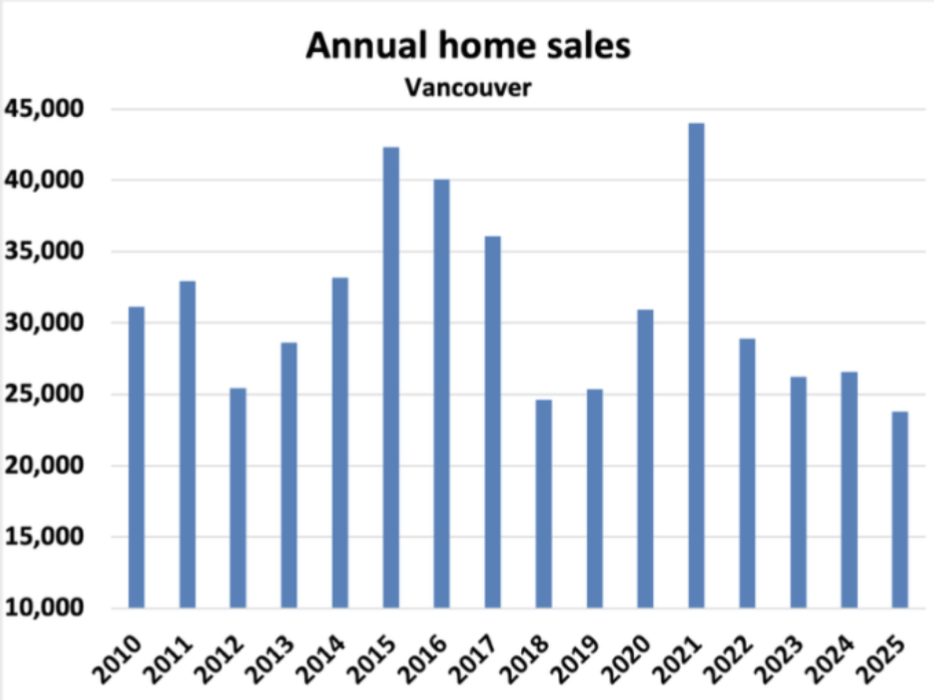

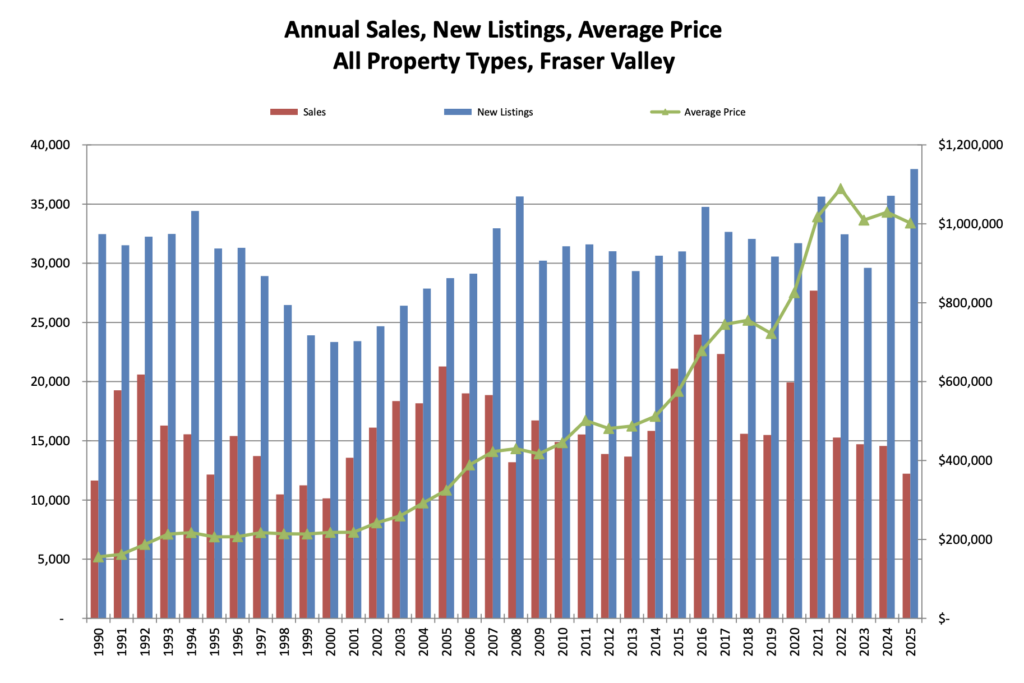

2025 saw 25-year lows for home sales in both the Fraser Valley and Vancouver real estate markets. In the Fraser Valley, sales volumes were down 16% year-over-year, while new listings increased by 6.3%.

I think the number of active listings on the market this year will decrease. More recently, I am seeing sellers get more realistic with their list prices, and the buyers who are out there have increased confidence and have been looking for a while to purchase.

Fraser Valley Sales and new listings for all property types:

Vancouver Homes Sales History

Canadian Homes Sales

Sales for all property types across the Country are currently sitting slightly below the 10 year moving average.

Slower sales volume paired with higher-than-usual amounts of inventory made for a slow-moving market. Buyers have more choices, and sellers must be competitive with their pricing in order to encourage offers.

I personally had several sellers take their homes off the market before the end of last year, and have decided to try again in the Spring, although I don’t anticipate sale prices to be higher than they are now come springtime.

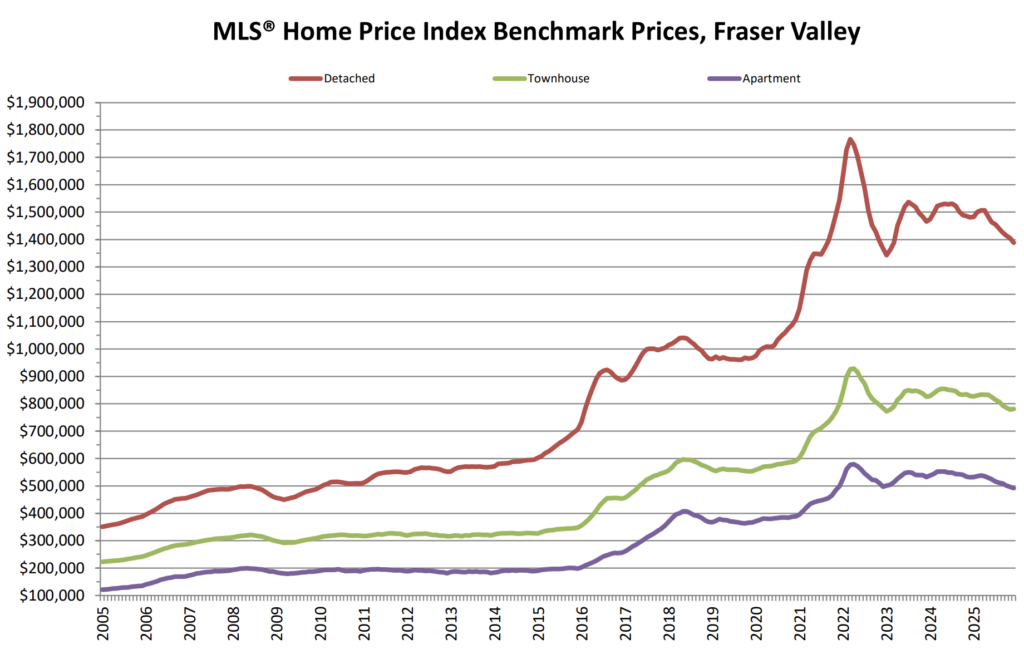

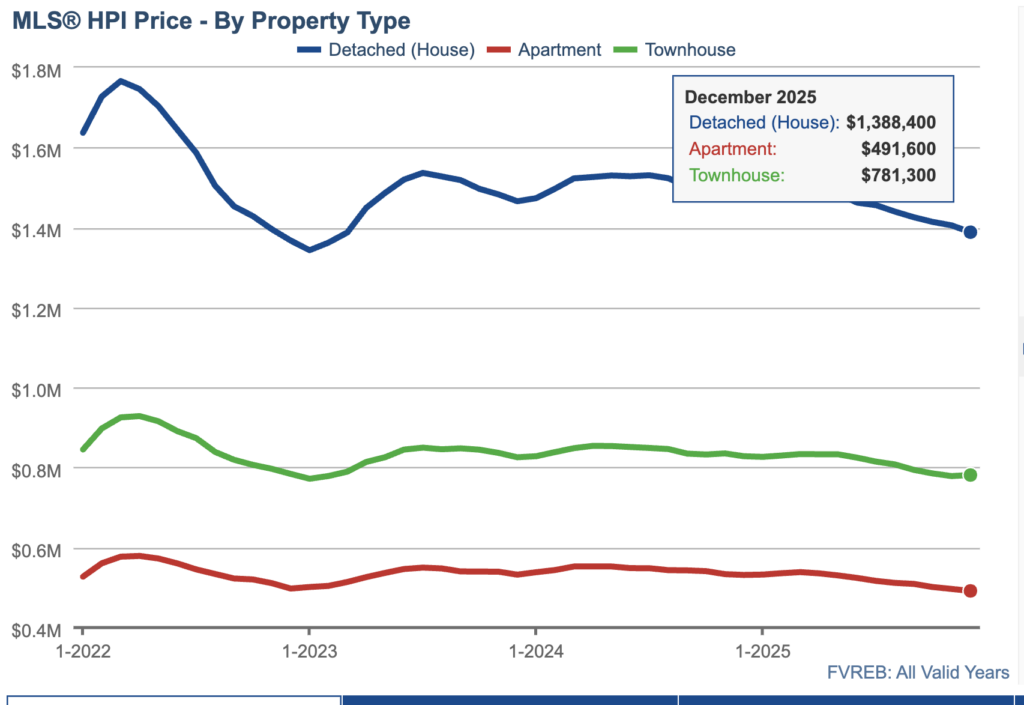

3. Sale Prices to Slightly Decline

I personally had several sellers take their homes off the market before the end of last year, and have decided to try again in the Spring, although I don’t anticipate sale prices to be higher than they are now come springtime.

Condos, especially 1-bedroom and studio layouts, have seen the biggest challenge over the last year. We have lost our investors, and it is hard for first-time home buyers to get into the market

Below shows the increased gap between new listings (blue) and sales (red). This is why we have seen sale prices decline over the past few years since the peak of the market in 2021.

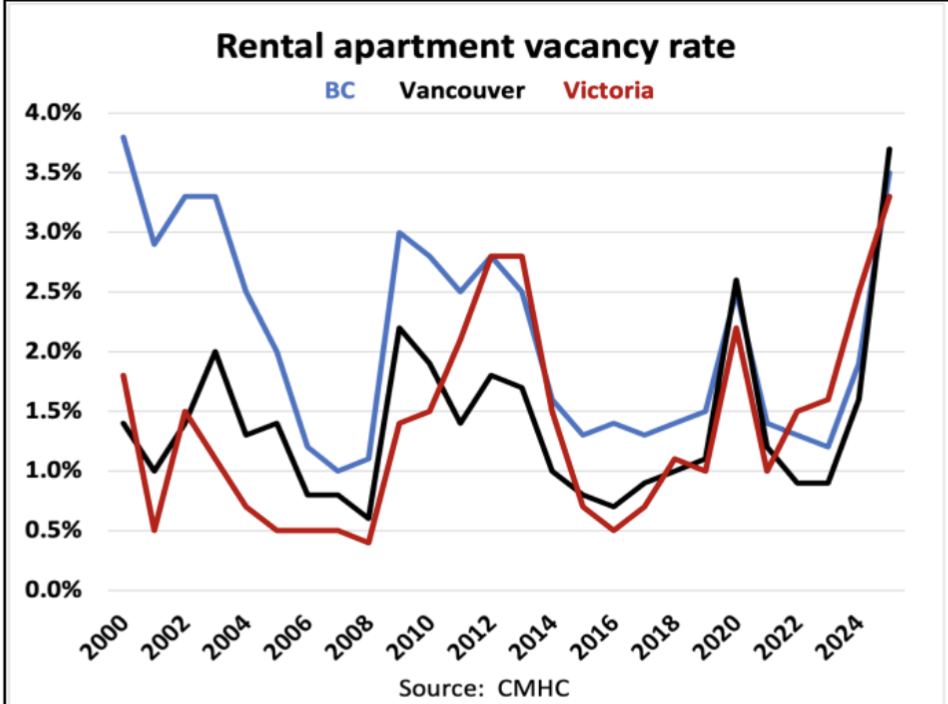

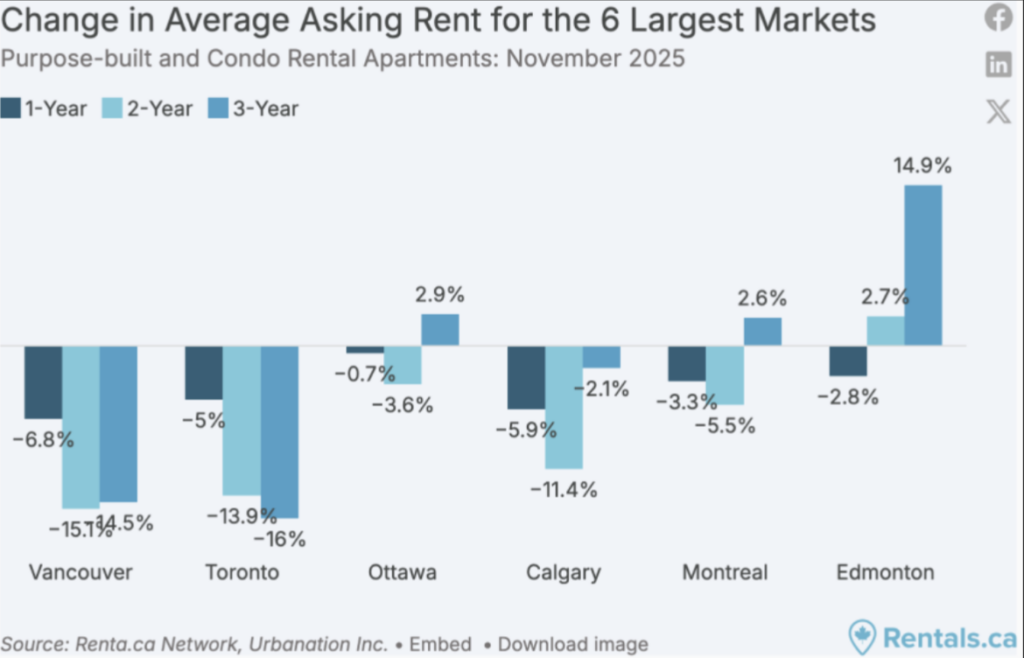

4. Rental Prices to Decline

Due to all the pre-sales we saw take place over the last year, we have seen rental prices fall and vacancy rates increase. I anticipate that will remain the case going into 2026. Our investors who purchased at the peak when rates were low want to sell as the numbers, when factoring in today’s interest rates, strata fees, taxes and the BC tenancy rules.

5. Market Conditions

Here are my thoughts on the market conditions for the following property types.

I am basing them on Months of inventory, which measures the absorption rate (active listings/number of sales in a given month). 1-3 Months of inventory is a seller’s market. 4-6 is a balanced market anf anything that is 6+ month sof inventory is a buyer’s market.

Detached: Will remain in a buyer’s market. I will share that there are cases where I am seeing certain types of detached homes in sought-after neighbourhoods getting good activity and offers within 2 weeks. For example, detached homes in Langley with a suite listed at 1.4M or less seem to get a good amount of activity. Hower moving into the 1.5M + range in the valley for a home without a suite, I believe, will remain a challenge to sell this year.

Townhomes: Will see a balanced market in 2026. I have been noticing that townhomes- although there are a lot out there- are still moving due to affordability. Especially if they are close to schools, transit and amenities. They really appeal to families as an alternative or stepping stone to a detached home.

Condos: Will remain in a Buyer’s Market. In the Fraser Valley and Greater Vancouver, apartment/condo sales have dropped while listings have climbed — meaning condos simply aren’t being absorbed by the market. We have seen a large influx of pre-sale condos hit the amrket which are a very tough sell right now. A large portion of condo purchasers are investors. Many of which have left the market. BC has very strict tenancy laws that boldly favour tenants, and the numbers, when factoring in strata fees, leave investors in the red every month.

Without strong investor interest — which was a major part of condo market demand in previous boom cycles — sales dry up.