There is no doubt that we are feeling the market shift. We are seeing sales decline and price points will follow. This is happening on both a local and national level.

The Bank of Canada has raised the interest rates twice so far in 2022. Once in March by 0.25% and again in April by 0.5%, brining the total overnight lending rate up to 1%. The Bank Of Canada meets again on June 1st and it is expected that the rates will be increased yet again – speculations of a 0.5% increase this time around. Currently, the BOC overnight rate is lower than it was pre-pandemic.

While these rate increases have been quite rapid, it needed to happen to curb inflation, which is at a 30 year high. This has had an impact on the real estate market throughout the country. Vancouver and Toronto are feeling the largest impacts being that they are the most expensive cities.

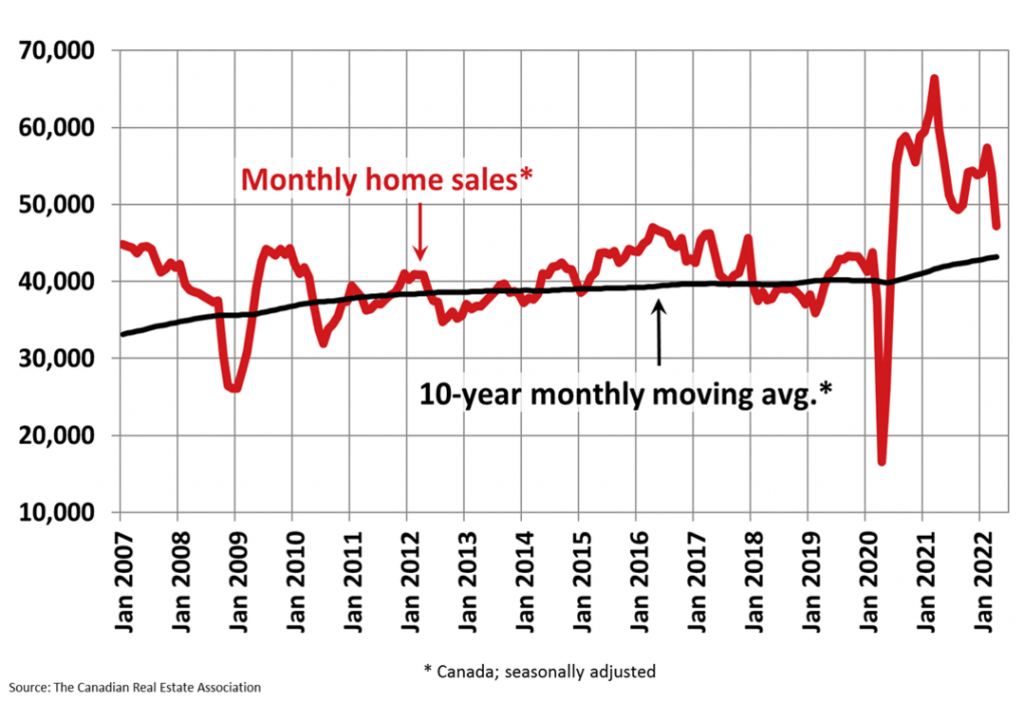

Canada is still above the 10 year average for number of sales, while the Fraser Valley has just dipped below the 10 year average for the first time in nearly two years.

Canadian 10 year Average Monthly Sales 👇

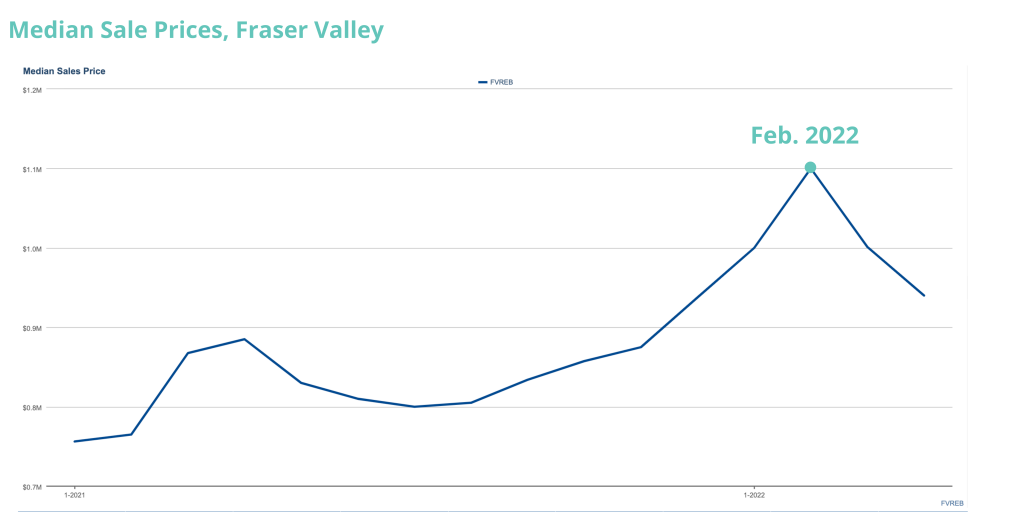

Some sellers who have their home on the market today, have already purchased back when the market was at its peak (February), when a subject to sale offer was out of the question. Now, these sellers are faced with a different type of market on their sale side and may be more incline to accept a lower priced offer in order to sell before they have to close on their purchase. This could also be a reason why we have seen prices dip over the past month. It will be interesting to see who is a true seller vs. which sellers are listing to try to get what their neighbours got back at the start of 2022.

Working with both Buyers and Sellers over the past few weeks, I have seen first hand the change in Buyer mentality. There is definitely uncertainty in the air. Buyers are wondering if prices are going to continue to rise, should they wait in order to get a lower sticker price?

That said, Buyers need to consider that when rates increase, their monthly payments will increase. So, if a Buyer is comfortable with their payments at the rate they are locked into today and they are planning to live there over the longer term, I wouldn’t throw the idea of buying today out the window. We do not know ow much rates will increase, and if they increase enough, it may push someone out of the type of property or neighbourhood they are wanting to purchase in.

Peak of the Fraser Valley Market👇

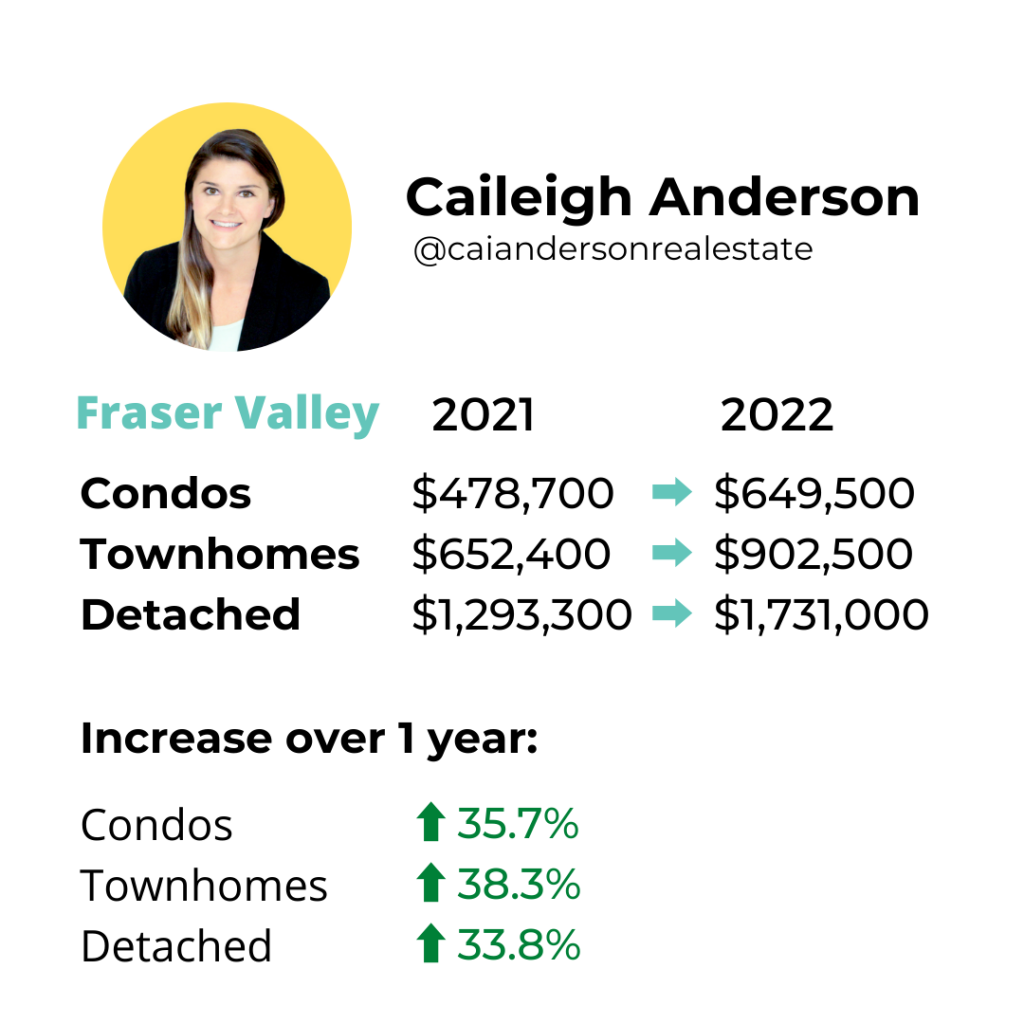

Crunchin’ The Numbers