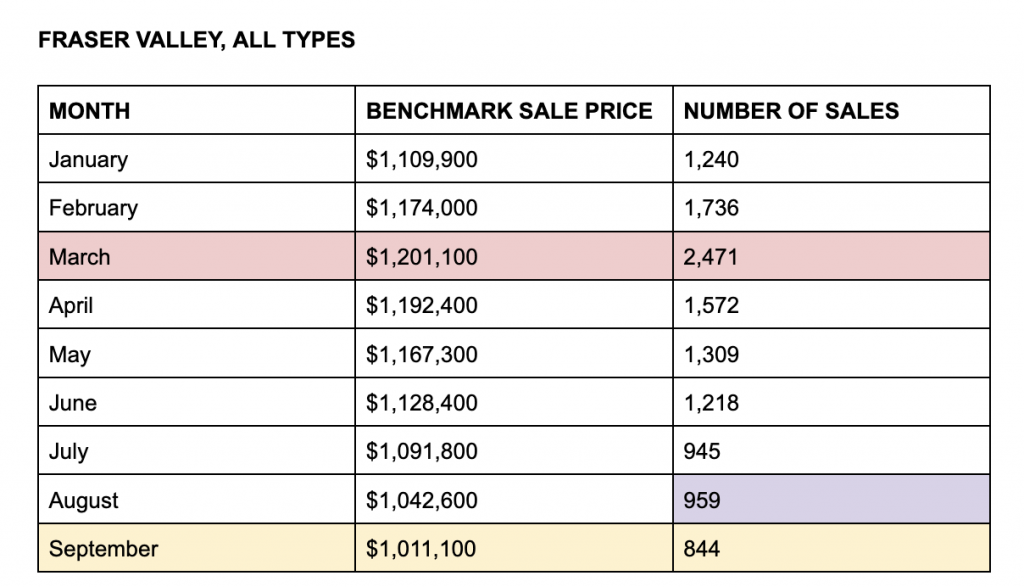

As the high interest rate environment continues to cast a shadow over real estate in Canada, national home prices saw yet another monthly decline. Prices have Fallen for the 7th straight month in a row. The number of sales have been on a constant decline from the peak of the market in March, with the exception of August.

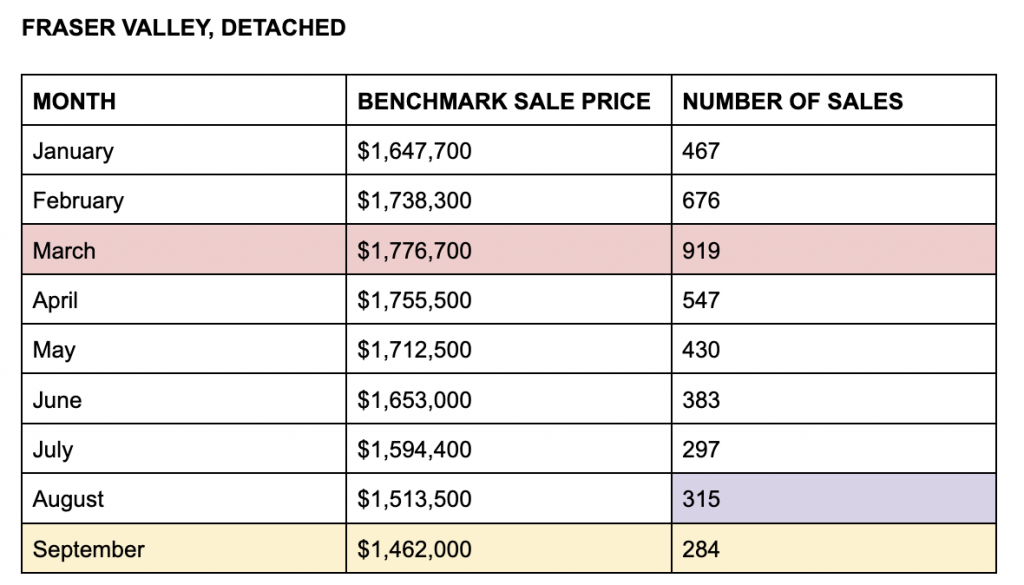

I have outlined below the Benchmark sales prices, & the number of months to show you how much both categories have come down since interest rates began increasing (March, 2022).

All Types of Homes, Fraser Valley:

Detached Homes Only, Fraser Valley:

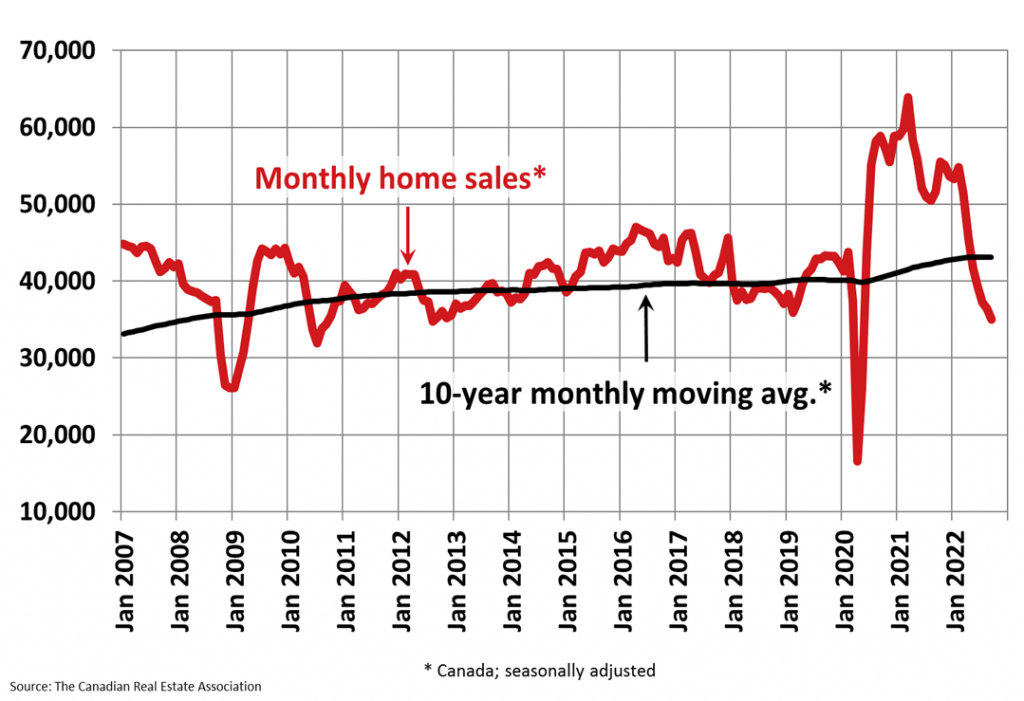

September was another month of lower sales activity, although, with many sellers also opting to play the waiting game, the market remains on the tighter side of balanced market territory. It hasn’t been since mid 2020 that we have been below the 10 year sales average and I expect this to continue to fall off.

The number of sales is down across the nation. Vancouver buyers remain under tremendous pressure at this point. Higher interest rates hits them especially hard given the (still) sky-high property values they face in the area.

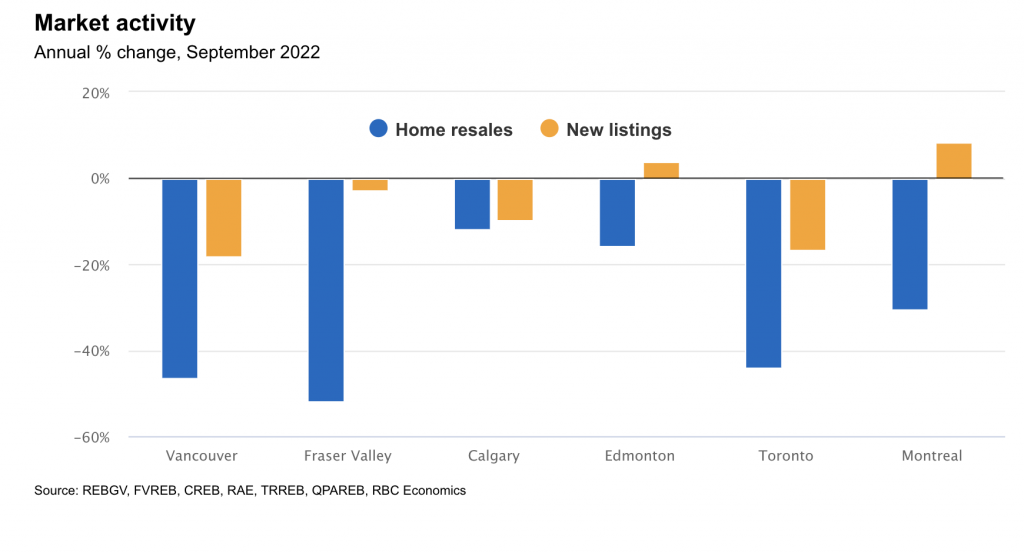

Market Activity, Annual % Change, Sept. 2022

Looking at the annual change in both the number of sales and new listings, we can see that Vancouver & The Fraser Valley have seen drastic changes over one year’s time. New sales are down the most in the Valley which, all things considering is not too much of a shock. Since the pandemic, there just aren’t as many people looking to buy in the Valley compared to the high buyer demand we saw over the past 2 years.

The number of new listings is down as well. Firstly, I believe this is due to sellers adjusting their expectations and realizing their homes are not worth what they were at the beginning of the year. Secondly, if a seller cannot get the sale price they need for them to make sense to move, they will cancel the listing & take their home off the market. Lastly, most sellers eventually become buyers. If I am a seller right now, I really would like to know what rate I am getting when it comes time to buy after I sell. That could be the difference of me wanting to sell or not, especially in an upsize situation.

The Alberta market remains constant. Home resale activity is holding far above pre-pandemic levels and close to the previous all-time peak. The increase in housing affordability in Calgary and Edmonton means interest rates have less of an effect on buying and selling.

The softening in prices in time will help, but so far it’s done little to ease severe affordability issues. When we look at mortgage payments on a monthly basis at todays prices and todays rates, they have not changed drastically compared to the peak; when although prices were much higher, rates were low.